Pantera Capital Bets $300M on Crypto Treasury Firms, Predicting Higher Yields Than ETFs

Pantera Capital has committed $300 million to companies holding large crypto treasuries, arguing that their performance could outpace traditional crypto exchange-traded funds (ETFs).

In a Tuesday note , general partner Cosmo Jiang and head of content Erik Lowe described digital asset treasuries (DATs) as vehicles capable of generating yield that grows net asset value (NAV) per share over time — a structure they say can result in more underlying token ownership than simply holding spot assets.

Source: Pantera

Source: Pantera The venture capital firm has deployed capital across treasury-focused companies in the United States, the United Kingdom, and Israel, with holdings spanning Bitcoin, Ether, Solana, and other altcoins. According to Jiang and Lowe, these firms use unique strategies to boost token reserves in an “accretive” manner, including staking, DeFi yields, and structured financing tools.

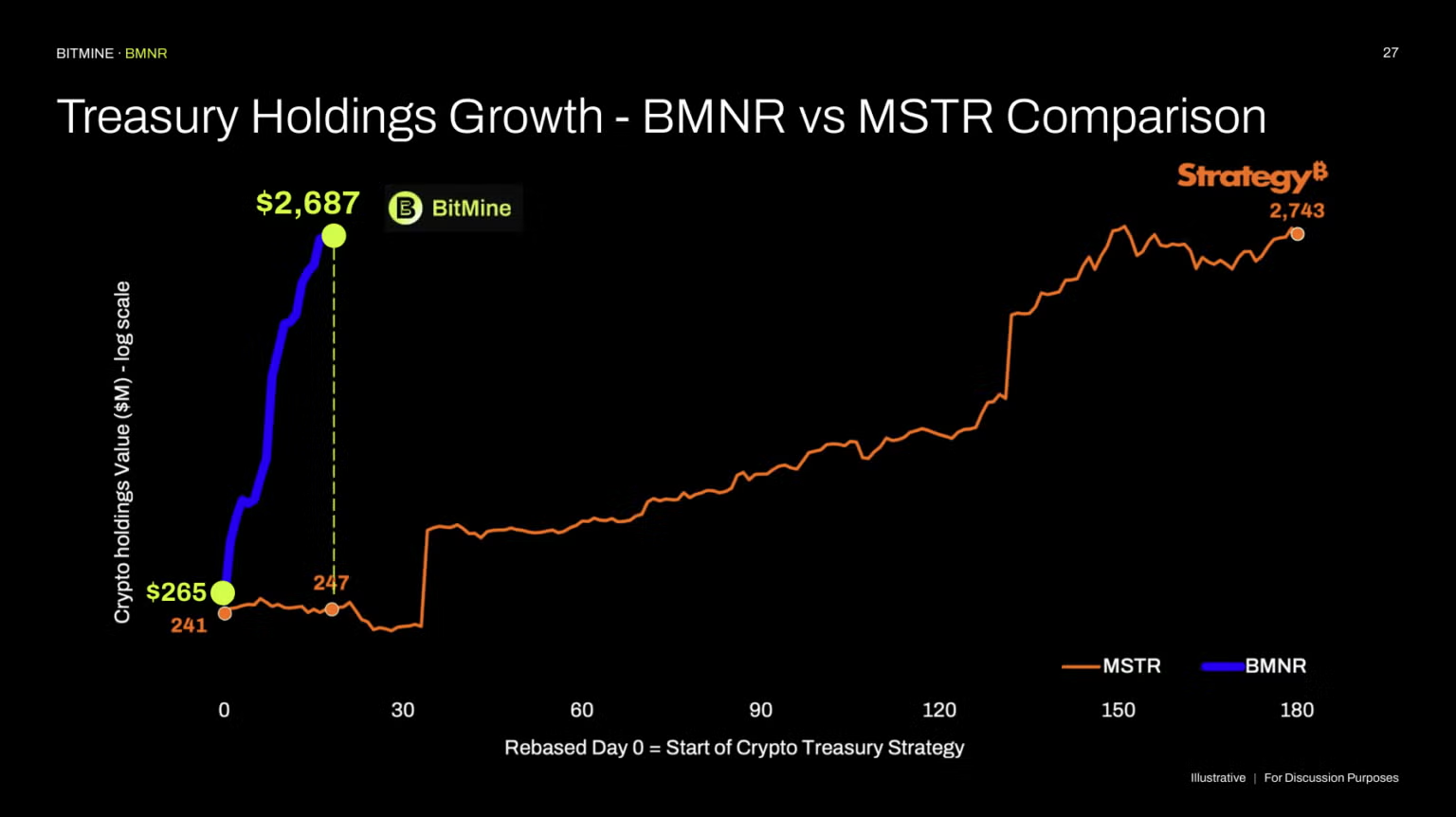

Pantera’s first investment from its DAT Fund went to BitMine Immersion Technologies — chaired by Wall Street veteran Tom Lee — which has quickly risen to become the largest Ether treasury and the third-largest crypto holder among public companies worldwide. BitMine now controls nearly 1.2 million ETH, valued at about $5.3 billion, and aims to accumulate 5% of Ether’s total supply.

The model has already drawn heavyweight backers such as Stan Druckenmiller, Bill Miller, and ARK Invest. Since launching its ETH accumulation strategy in late June, BitMine’s shares have surged more than 1,300%, compared with Ether’s roughly 90% rise over the same period.

Pantera believes the “highest quality” DATs will gain broader recognition among institutional investors, mirroring the adoption trajectory of other crypto investment strategies. Still, the sector faces warnings from both industry insiders and analysts.

Ethereum co-founder Vitalik Buterin recently cautioned that excessive leverage could sink treasury firms if poorly managed. Framework Ventures’ Vance Spencer added that most ETH acquired by treasuries is likely to flow into on-chain lending markets for leveraged farming.

Despite the risks, Jiang and Lowe maintain that the top-tier DATs are positioned for sustained growth, even in a competitive and potentially overcrowded market.