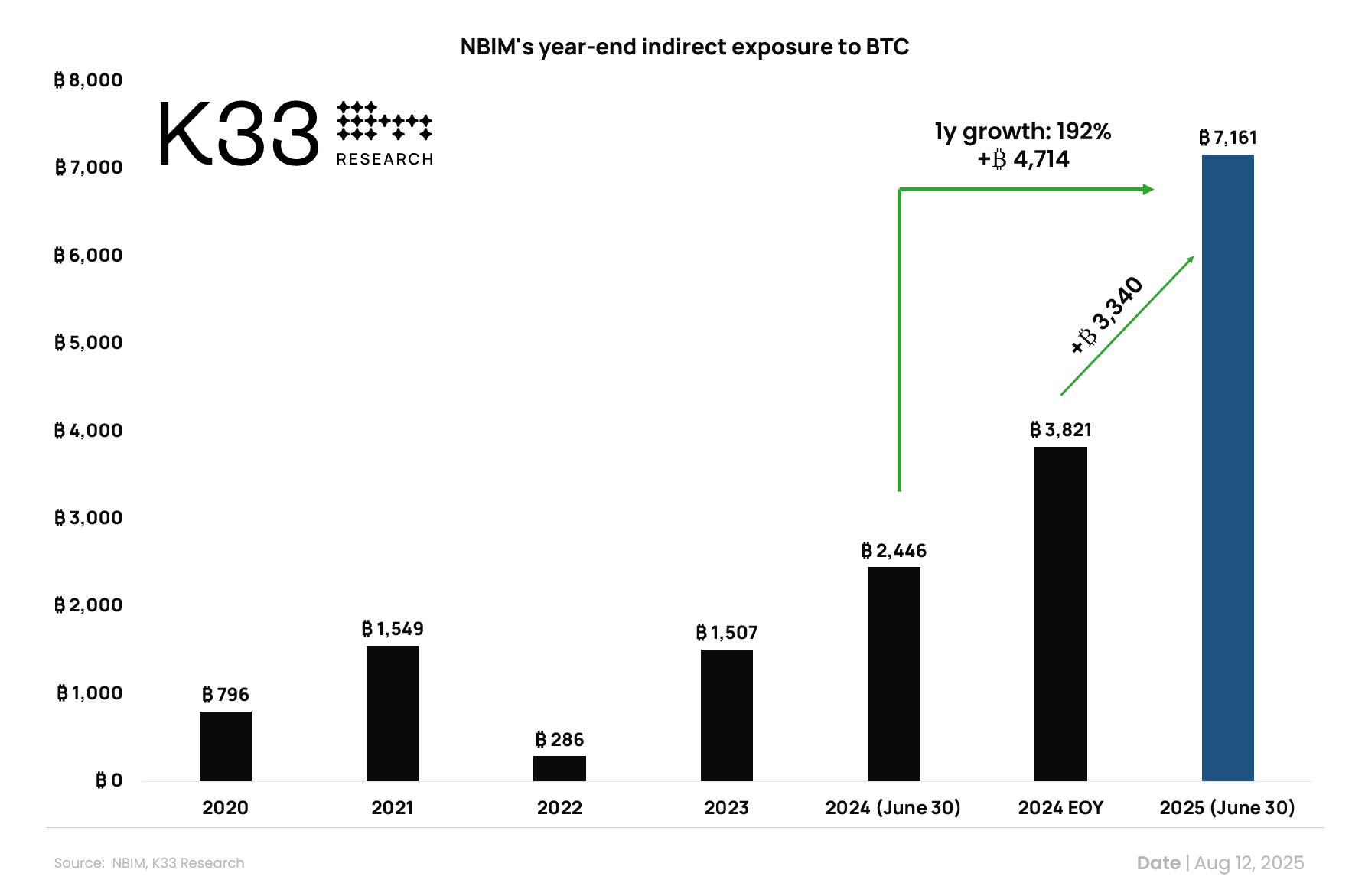

Norway’s sovereign wealth fund has increased its indirect Bitcoin exposure by 192% over the past year, holding the equivalent of 7,161 BTC through investments in crypto companies like Strategy and Coinbase.

-

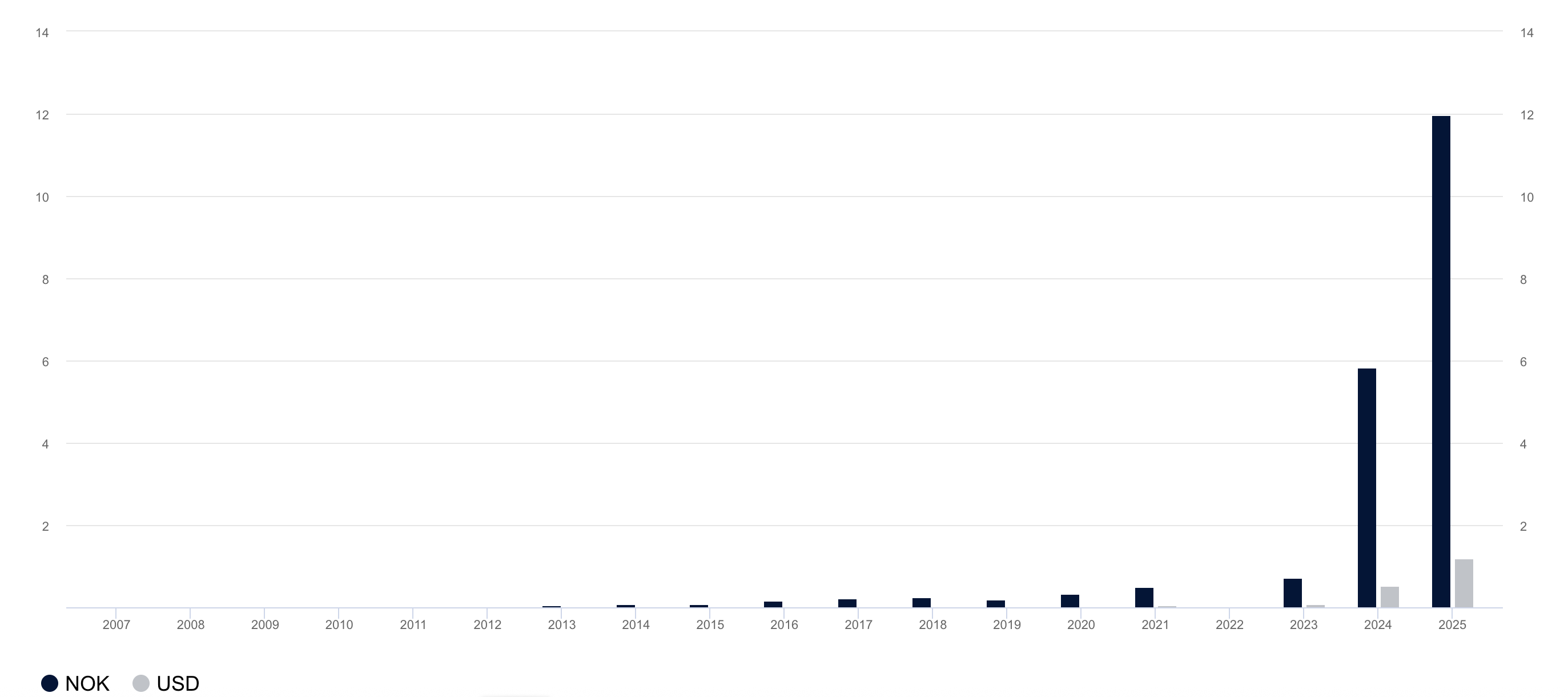

Norway’s fund now holds over $1.2 billion in Strategy’s stock, a 133% increase from 2024.

-

The fund’s Coinbase holdings have surged by over 96% since 2024.

-

Global sovereign wealth funds are increasingly gaining indirect exposure to Bitcoin through investment vehicles.

Norway’s sovereign wealth fund has significantly increased its Bitcoin exposure, reflecting a growing trend among state funds to invest in cryptocurrencies. Learn more about this shift.

What is Norway’s Sovereign Wealth Fund’s Bitcoin Exposure?

Norway’s sovereign wealth fund, the largest in the world, has increased its indirect Bitcoin exposure by 192% over the last year. This exposure, equivalent to 7,161 BTC, comes through investments in companies like Strategy and Coinbase.

How Are Sovereign Wealth Funds Investing in Bitcoin?

Sovereign wealth and state pension funds often face legal mandates that restrict them to specific asset classes. To invest in Bitcoin, they typically gain indirect exposure through vehicles like exchange-traded funds (ETFs) or corporate proxies. For instance, the State of Wisconsin State Investment Board disclosed a $164 million investment in BTC ETFs, which nearly doubled to over $321 million.

Frequently Asked Questions

What is the current value of Norway’s Bitcoin holdings?

Norway’s sovereign wealth fund has indirect Bitcoin holdings valued at approximately $1.2 billion, reflecting its strategic investments in crypto companies.

Why are sovereign wealth funds investing in Bitcoin?

Sovereign wealth funds are investing in Bitcoin to diversify their portfolios and gain exposure to the growing cryptocurrency market, often through indirect means.

Key Takeaways

- Significant Growth: Norway’s fund increased its indirect Bitcoin exposure by 192% in one year.

- Investment Vehicles: Funds often use ETFs or corporate proxies to invest in cryptocurrencies.

- Global Trend: Many sovereign wealth funds are exploring crypto to enhance returns.

Conclusion

Norway’s sovereign wealth fund’s substantial increase in Bitcoin exposure highlights a significant trend among global sovereign wealth funds. As these funds adapt to the evolving financial landscape, their strategies may increasingly incorporate cryptocurrencies, paving the way for broader acceptance and integration of Bitcoin into traditional finance.

Norway’s sovereign wealth fund continues to increase its Bitcoin and crypto exposure. Source: Vetle Lunde

Norway’s sovereign wealth fund continues to increase its Bitcoin and crypto exposure. Source: Vetle Lunde  The Norwegian sovereign wealth fund also increased exposure to BTC holding company Strategy in 2025. Source: Norges Bank Investment Management

The Norwegian sovereign wealth fund also increased exposure to BTC holding company Strategy in 2025. Source: Norges Bank Investment Management