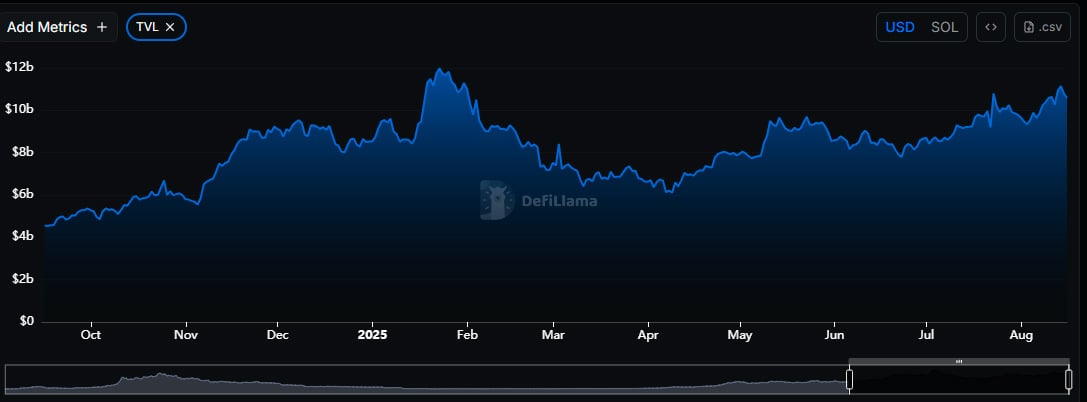

Solana hits new TVL record despite falling volume

- Solana's TVL exceeds $31 billion

- Circle accounts for 28% of the blocked value

- Trading volume down 84% since January

Following Ethereum's recent all-time high, Solana also reached a significant milestone. Data from Token Terminal indicates that Solana's total value locked (TVL) surpassed $31 billion on August 14, surpassing the previous record of $30,8 billion set in January. This growth occurs even though the SOL cryptocurrency is trading at $186—about 37% below its all-time high of $293.

The current growth of the Solana ecosystem isn't tied to the memecoin frenzy, as it was at the beginning of the year, but rather to a more consolidated foundation. Circle, responsible for issuing USDC, is the main participant in this growth, with $8,7 billion allocated to the network, representing 28% of the total TVL. Protocols like Kamino (lending), Jupiter (DEX aggregator), and Jito (liquid staking) have a combined $10,7 billion in locked value, sustaining liquidity on the blockchain.

Despite the decline in retail interest in memecoins, institutional capital and real-world usage in DeFi protocols are keeping the ecosystem healthy. The numbers reinforce this shift: Solana's weekly trading volume fell from $103 billion in January to $16,9 billion today—an 84% drop. Cumulative fees also followed suit, falling from $530 million to $72,3 million in the same period.

Even with declining trading and revenue, funds continue to flow into decentralized applications, indicating a maturing ecosystem. The new TVL record suggests that Solana may be less dependent on speculative cycles and more anchored in real utility.

With the strengthening of established protocols and increasing liquidity, Solana now exhibits more consistent fundamentals for a potential bullish resumption. This continued growth could occur even in environments of less euphoria in the cryptocurrency market.