Bitcoin price trades near $114,000, holding $112,000 as critical support while analysts monitor a possible $133K–$145K distribution zone and cycle-top targets between $161K and $207K in 2025, based on MVRV bands, regression models, and Wyckoff distribution signals.

-

Bitcoin holds near $114K with $112K as crucial support

-

Cycle models project BTC tops between $161K and $207K, aligning with historical oscillator-driven peaks

-

Macro distribution may form in the $133K–$145K range before multi-level retests; realized price remains near $52,164

Bitcoin price near $114K, defending $112K support; read on for levels, MVRV insights, distribution signals, and analyst targets—stay informed with COINOTAG coverage.

What is the current Bitcoin price outlook?

Bitcoin price is trading near $114,000, defending the $112,000 support level while on-chain and technical indicators point to possible distribution in the $133K–$145K zone and cycle-top targets between $161K and $207K for 2025. Short-term risk includes retests to $96K, $76K, or lower.

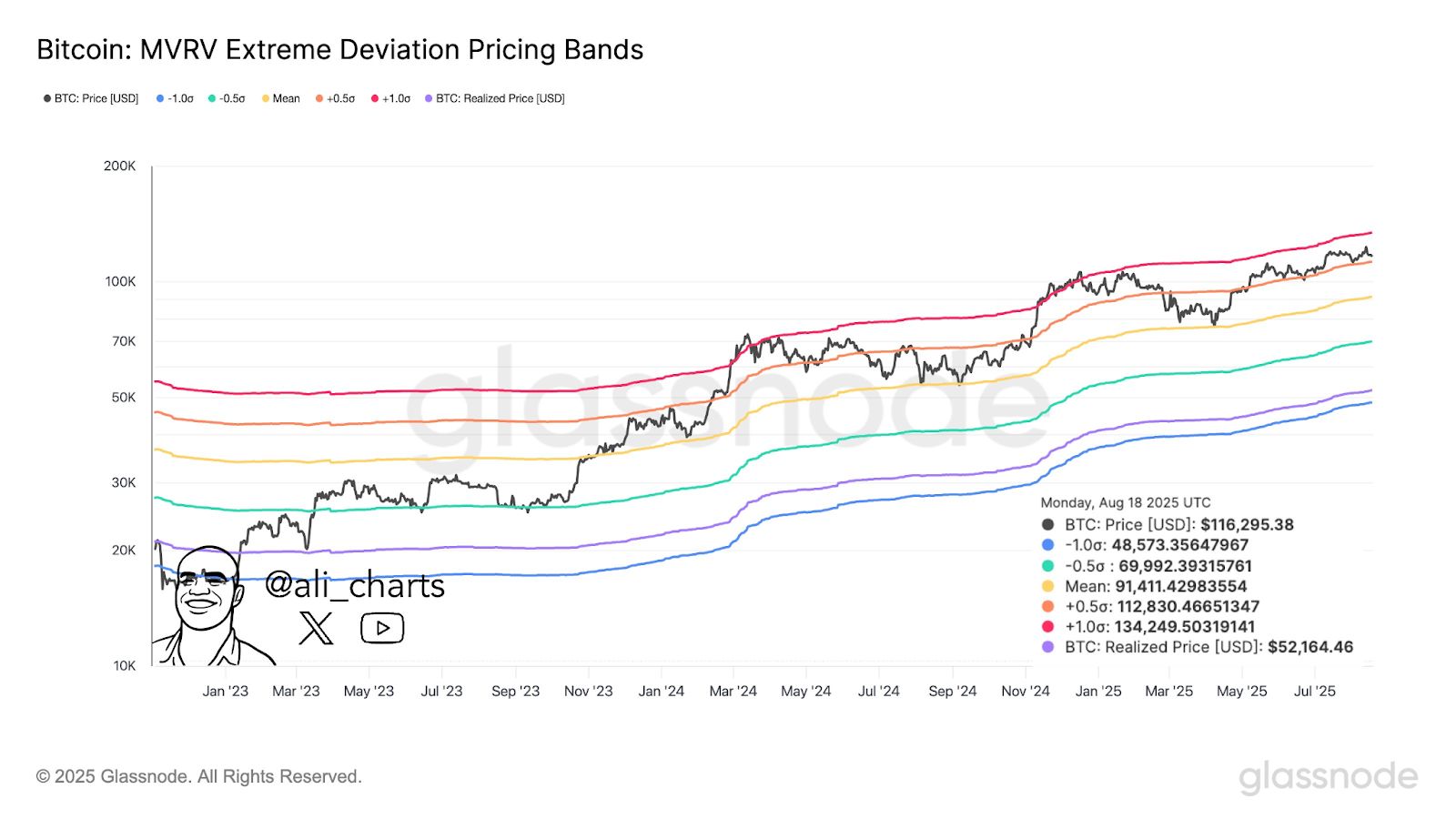

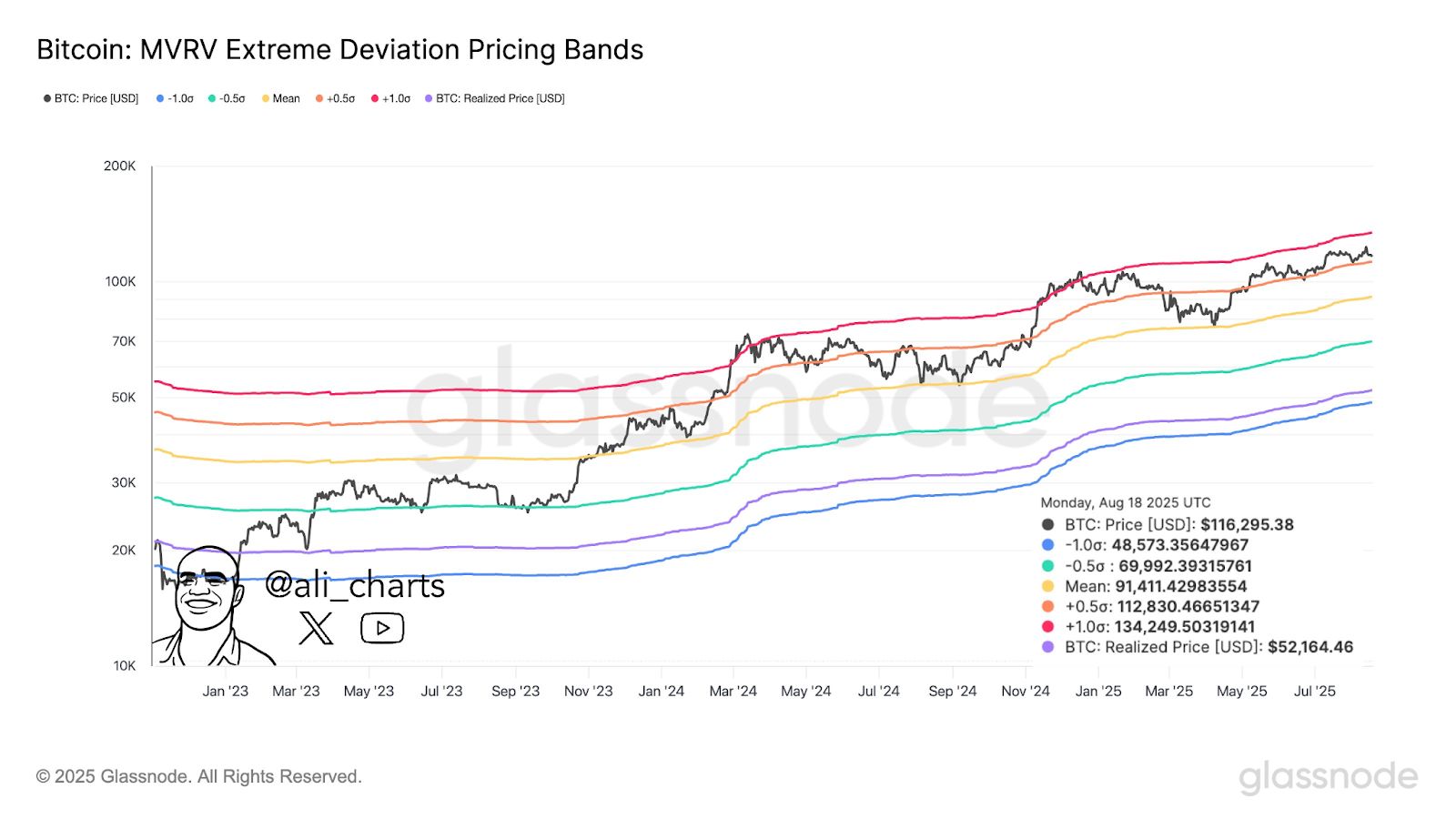

How do MVRV bands signal key levels?

On-chain MVRV deviation bands show Bitcoin holding above critical support buckets. Current measured supports include $112,800, $91,400, and $70,000. These bands compare realized price to market price and historically mark turning points that attract buyers and profit-takers.

Realized price remains anchored near $52,164, keeping most holders in profit. That structure implies market strength but increases vulnerability if short-term supports fail.

How do cycle models and regressions set targets?

Regression-based cycle models project peaks between $161,000 and $207,000. Linear regression caps the upper band around $199,106, while nonlinear models extend beyond $207,000. Historical cycles (2013, 2017, 2021) peaked with oscillator readings near 100% followed by sharp corrections.

Analysts tracking halving-driven rallies view 2025 as the likeliest window for the next cycle top, but all projections carry high volatility risk and depend on macro liquidity and market participation.

Why is a distribution phase important now?

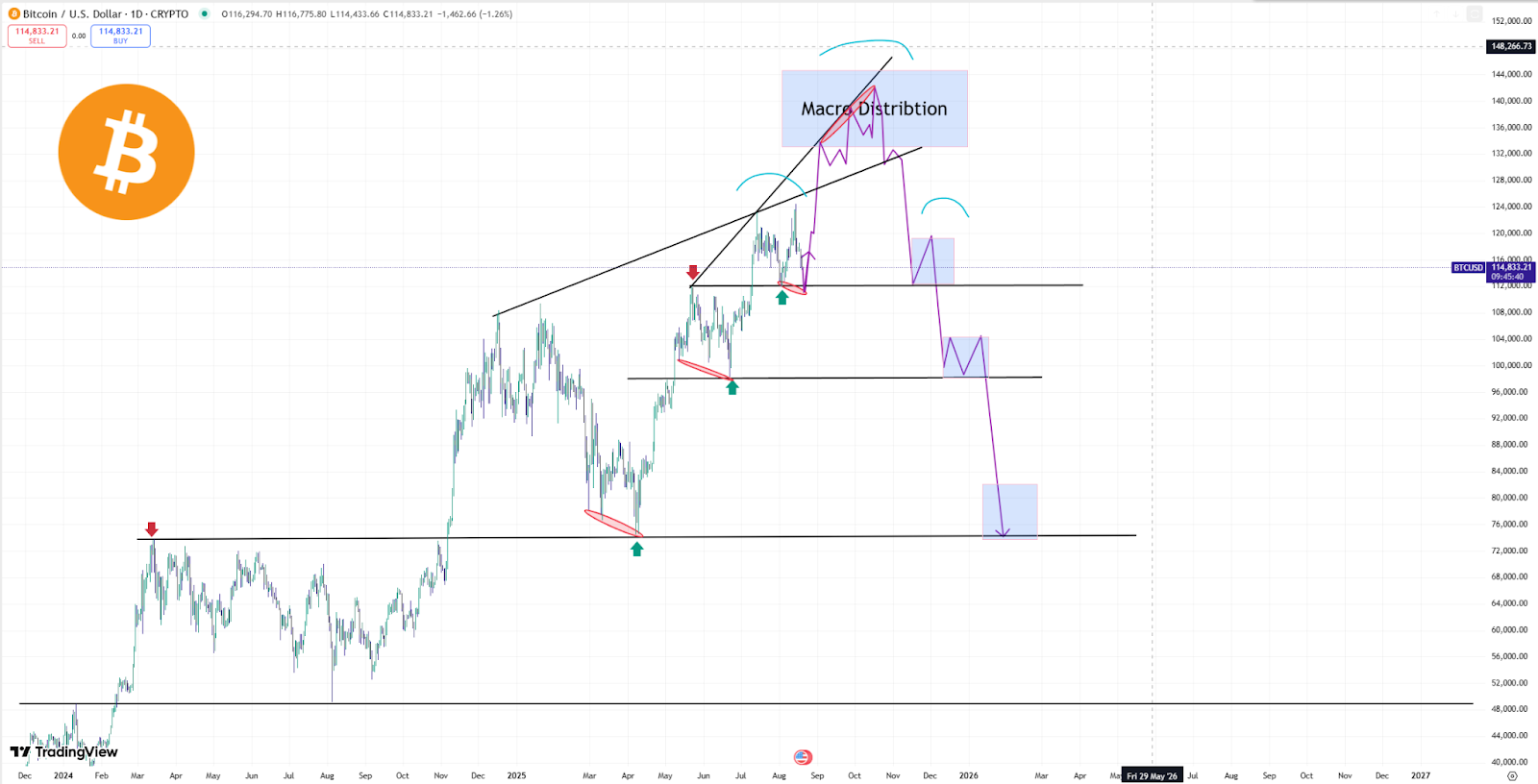

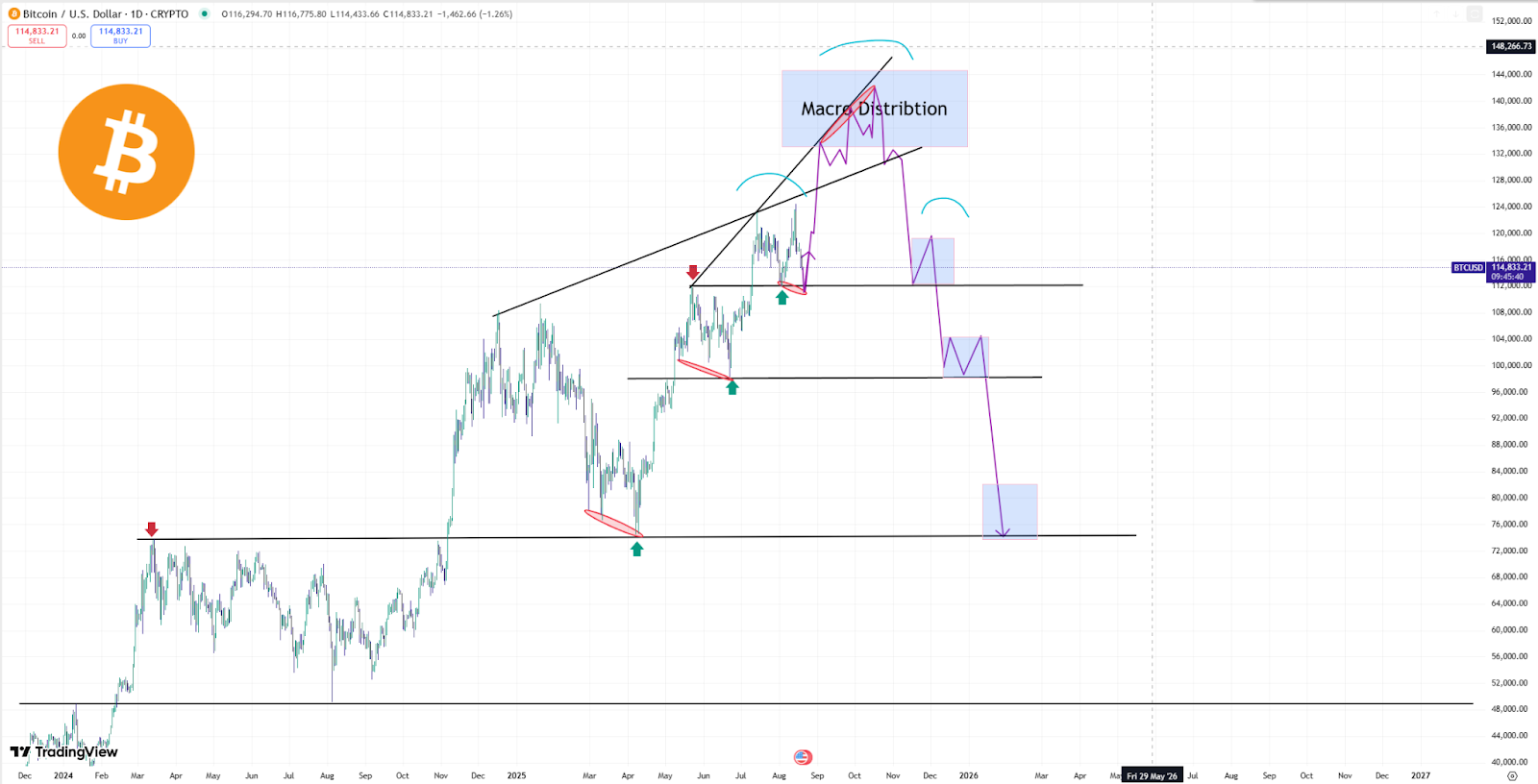

Technical structure and Wyckoff mappings point to an emerging distribution phase. BTC trades slightly below the EMA50 (~$114.9K). Short-term support sits at $111,880, with breakdown risk toward $108,000 and lower retest levels at $112K, $96K, $76K, and potentially $48K if a deep correction unfolds.

Market participants note institutions often induce fear-driven sell-offs to reaccumulate positions. This dynamic can create volatile compressions before extended recoveries or new highs.

Source: Ali Charts via X

Source: Ali Charts via X When could key levels break and what are the scenarios?

Immediate scenario: maintain $112K support and test $133K–$145K distribution zone, where topping could occur near $148,266 before retracements. Bear scenario: failure of $112K increases odds of multi-level retests to $96K, $76K, and deeper levels around $48K in a severe correction.

Bull scenario: a clean break above distribution bands and sustained liquidity could push toward regression targets in the $161K–$207K range, though volatility will remain elevated.

Source: The Wyckoff Architect via X

Source: The Wyckoff Architect via X Frequently Asked Questions

What are the immediate support and resistance levels for Bitcoin?

Immediate support rests at $112,000 and $111,880 with extended supports at $96K and $76K. Resistance and potential distribution band sits between $133K–$145K, with a possible topping zone near $148,266.

How reliable are cycle top projections for 2025?

Cycle projections use regression and oscillator-based models. They offer probabilistic ranges (e.g., $161K–$207K) but are not certainties. Historical cycles show similar parabolic tops followed by corrections, so risk management is essential.

Key Takeaways

- Support to watch: $112K is critical — failure increases downside risk.

- Distribution zone: $133K–$145K may act as a macro distribution range before major corrections.

- Cycle targets: Regression and nonlinear models project $161K–$207K as possible 2025 tops; volatility expected.

Conclusion

Bitcoin price remains near $114K, with on-chain MVRV bands and cycle regressions providing a framework for potential upside to $161K–$207K and downside retests to $96K or lower. Readers should monitor $112K support and the $133K–$145K distribution band; apply risk management and follow COINOTAG coverage for updates.

Bitcoin trades at $114K, defending $112K support. Analysts eye $145K distribution and $207K cycle top targets in 2025.

- Bitcoin holds near $114K with $112K as crucial support while traders watch for a potential breakout.

- Cycle models project BTC tops between $161K and $207K, aligning with historical oscillator-driven peaks.

- Macro distribution may form in the $133K–$145K range before deeper multi-level support retests unfold

Bitcoin trades near $114K, defending crucial support levels as analysts map out possible cycle peaks and macro distribution phases. The market remains active with strong participation, yet technical signals reveal tightening ranges and building pressure.

MVRV Bands Signal Key Levels

On-chain data shows Bitcoin holding above critical MVRV deviation levels. Current supports stand at $112,800, $91,400, and $70,000. These ranges have guided market behavior for over a year, reflecting how traders value realized price against market price.

Source: Ali Charts via X

Source: Ali Charts via X Since mid-2024, Bitcoin has built a clear trend of higher lows. The realized price remains anchored near $52,164, keeping most holders in profit. This structure indicates strength, but it also leaves Bitcoin vulnerable if short-term supports fail.

Bitcoin’s recent price is between the +0.5σ and +1.0σ MVRV bands. In the past these levels have acted as turning points, drawing in both eager buyers and profit-takers.

Cycle Models Point Higher

Regression-based models now project cycle peaks between $161,000 and $207,000. Linear regression caps the upper band near $199,106, while nonlinear projections stretch beyond $207,000.

Historical cycles in 2013, 2017, and 2021 all show similar behavior. Each cycle topped with oscillator readings near 100%, followed by steep corrections. Analysts now track 2025 as the most likely period for this cycle’s top, aligning with prior halving-driven rallies.

These projections highlight potential upside, but also the volatility that follows parabolic growth.

Distribution Phase Taking Shape

Technical charts place Bitcoin in a developing distribution phase. BTC trades near $114K, slightly below the EMA50 at $114.9K. Short-term support rests at $111,880, with breakdown risks toward $108,000 if sellers gain momentum.

Source: The Wyckoff Architect via X

Source: The Wyckoff Architect via X The Wyckoff framework maps a possible final push higher toward the $133K–$145K range. Above this, a topping structure may form near $148,266 before sharp retracements unfold.

Planned retests stretch across multiple levels: $112K, $96K, $76K, and potentially $48K if deeper corrections emerge. This step-by-step pattern reflects previous macro distributions, where rallies transitioned into prolonged consolidations.

Market voices add further perspective. Analysts emphasize how institutions often create fear-driven sell-offs before reaccumulating positions. This tactic has historically fueled sharp recoveries and, eventually, new highs. Some expect late 2025 to deliver another all-time high if patterns hold.