BIG Breaking News: Powell Hints at Rate Cuts – Will Bitcoin Crash or Soar?

Jerome Powell’s Jackson Hole speech nudged the door open to future rate cuts, but he kept it clear that decisions stay data-driven and independent. He acknowledged rising downside risks for jobs and a nontrivial chance that tariffs keep prices sticky. Policy remains restrictive, yet the balance of risks may justify an adjustment. Markets heard relief, not panic. That matters for Bitcoin price because liquidity shocks usually drive the sharpest selloffs. This speech reduced the odds of a fresh policy shock and shifted attention back to levels on the chart.

Why Powell’s message matters for BTC?

A tepid nod to possible cuts supports risk assets without promising a rapid easing cycle. If inflation from tariffs proves short lived, the Fed can back away from restrictive settings in measured steps. That path cools the left-tail scenario where Bitcoin dumps on a surprise hawkish turn. It also warns against runaway euphoria. BTC price now trades in an environment where macro is less threatening in the near term, and price has to earn upside through technical confirmation.

Immediate market read-through

Equities popped and front-end yields slipped after the remarks, a classic relief move. For BTC, that translated into a fast topside break out of a tight hourly range. The reaction tells you positioning was leaning cautious into the event. Shorts covered first, momentum funds chased next, then price paused under nearby supply. That is textbook when policy risk narrows but the Fed does not wave through easy money.

Bitcoin Price Prediction: Hourly chart diagnosis

BTC/USD 1 Hr Chart- TradingView

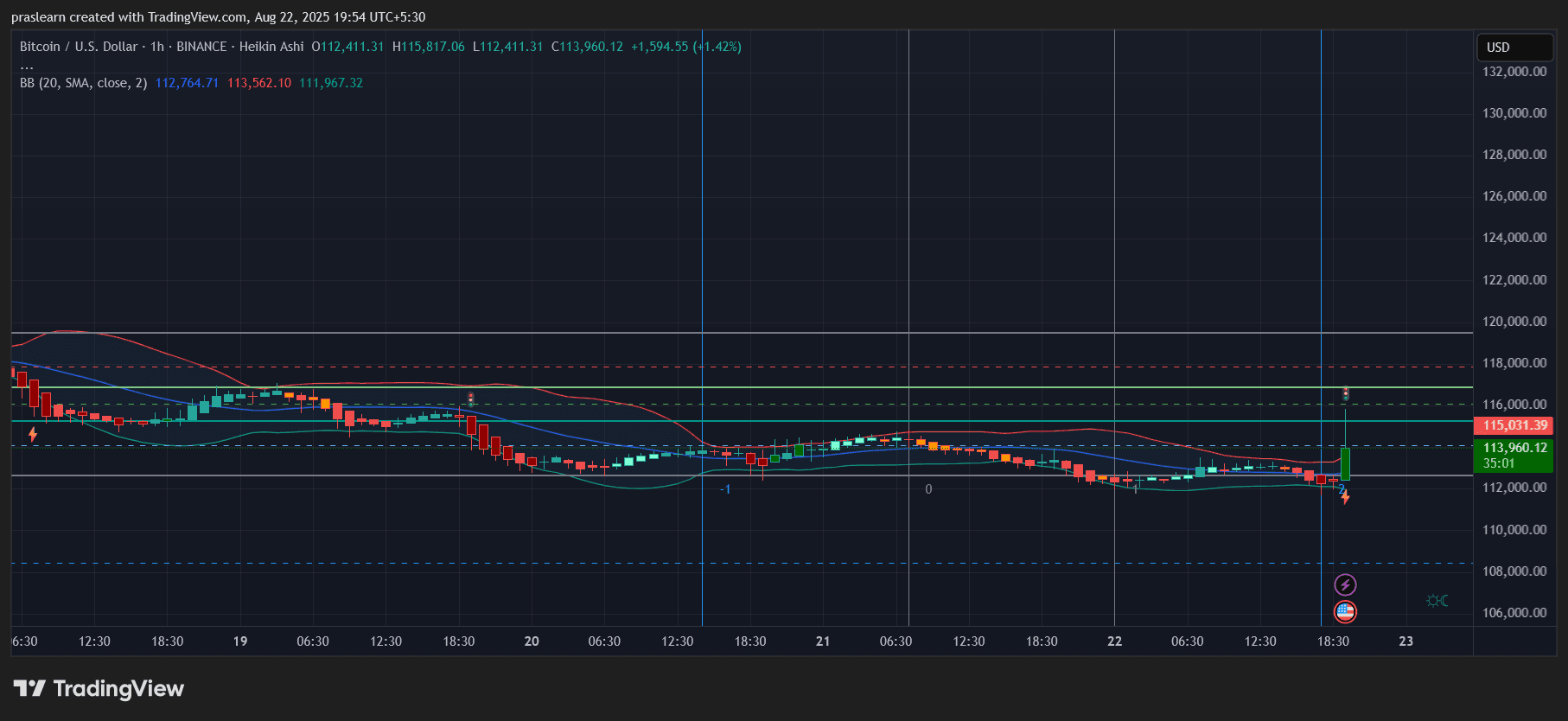

BTC/USD 1 Hr Chart- TradingView The 1-hour chart with Heikin Ashi and Bollinger Bands shows a multi-day squeeze that resolved up on the speech. The band statistics on the candle you shared were roughly upper 113,562, basis 112,765, lower 111,967. Price spiked to about 115,817, then settled around 113,960.

The breakout expanded the bands and flipped Heikin Ashi momentum positive after a slow grind down. The tall upper wick near 115,800 marks fresh supply and the first decision zone. If buyers can keep closes in the upper half of the envelope, the next push tends to follow. Sink back below the basis and the move becomes a one-off squeeze.

Support now sits at 113,400, then the band basis near 112,765. Lose 111,900 on a closing basis and the structure breaks, opening 110,800 and 109,000 where your chart shows prior liquidity. Resistance is stacked at 115,000 to 115,800. Acceptance above 116,000 would target the next pocket around 117,500. Until that happens, expect attempts higher to meet supply at 115s.

Jerome Powell Speech: Macro to micro bridge

Jerome Powell speech cut the probability of a sudden hawkish surprise in the next few sessions. That aligns with a topside range break rather than a liquidation cascade. The Fed’s insistence on independence also dampens the chance of political pressure forcing an abrupt pivot. Net effect on a 1-hour tape is fewer headline rug pulls and more respect for technicals. Buyers get room to try higher, but they must convert resistance cleanly because easy policy is not promised.

Bitcoin Price Prediction: Will BTC price crash?

Near-term crash risk is low while 111,900 holds. The speech removed the immediate policy shock that usually sets off deep drawdowns. A crash would need either a decisive loss of that support or incoming data that push the Fed back toward tightening. The chart is not signaling that right now. Instead, it shows a breakout from compression with expanding volatility bands, which typically favors follow-through or at least a higher range.

Scenarios for the next 24 to 72 hours

Continuation higher is the base case. Hold 113,400 to 112,700 on dips, then re-attack 115,000 to 115,800. An hourly close through 116,000 unlocks 117,500, where first profit taking likely appears.

Range reversion is the second case. Slip back to the basis near 112,765, tag the lower band around 111,967, then rebuild inside the prior range while the market waits for fresh data.

Failure and flush is the tail. Break and close below 111,900 with momentum, then slide to 110,800 and possibly 109,000. Only here do crash dynamics re-emerge.

Constructive bias while above 113,400. Dips into 113,400 to 112,700 are buyable only if price keeps closing in the upper half of the bands. Momentum validation is an hourly close over 116,000 that sticks. Invalidation for the bullish skew is an hourly close under 111,900 that holds on retest. If that happens, stop buying dips and look to sell bounces back toward 112,700.

A hot inflation print that forces markets to price out cuts and price in renewed hikes. On the chart you would see rejection from 115 to 116, a lower high, then a firm close through 111,900. Absent that combination, the path of least resistance is sideways to up.

Jerome Powell Speech: Final take

Jerome Powell speech eased policy-shock fears without promising fast easing. Bitcoin responded with a clean breakout from a squeeze, not a breakdown. As long as 111,900 remains intact, BTC is more likely to probe 115 to 117k than to crater. The ceiling still matters because liquidity is not about to flood in, but the floor looks sturdier after Jackson Hole.

$BTC, $Bitcoin