Will Powell’s Rate Cut Hint Trigger the Next ADA Rally?

When Federal Reserve Chair Jerome Powell took the stage at Jackson Hole on August 22, markets were looking for clarity on where monetary policy is heading. What they got was a clear dovish tilt. Powell signaled that rate cuts are on the table as early as September, citing a softer labor market and reduced inflation pressures. That single shift in tone sent equities higher, weakened the U.S. dollar, and reignited momentum across crypto. For Cardano (ADA) , which had been consolidating after a strong July rally, Powell’s remarks may have just provided the spark for its next move.

Cardano Price Prediction: Why Powell’s Speech Matters for Crypto and ADA?

Powell’s speech was not just about interest rates. It marked a shift in the Fed’s stance after years of battling post-pandemic inflation. By acknowledging downside risks to jobs and signaling rate cuts, Powell effectively loosened financial conditions in advance. For crypto, this matters because:

- A weaker dollar often boosts digital assets priced in USD.

- Lower rates make risk assets more attractive relative to bonds.

- Market psychology shifts toward growth and liquidity plays like ADA.

The context was also political. Trump’s tariffs and immigration policies are feeding economic uncertainty, but Powell stuck to data rather than politics. That gave investors confidence the Fed is still in control. ADA price, like other altcoins, thrives when investors are comfortable taking risk, and Powell’s speech reinforced that environment.

Market Reaction to the Speech

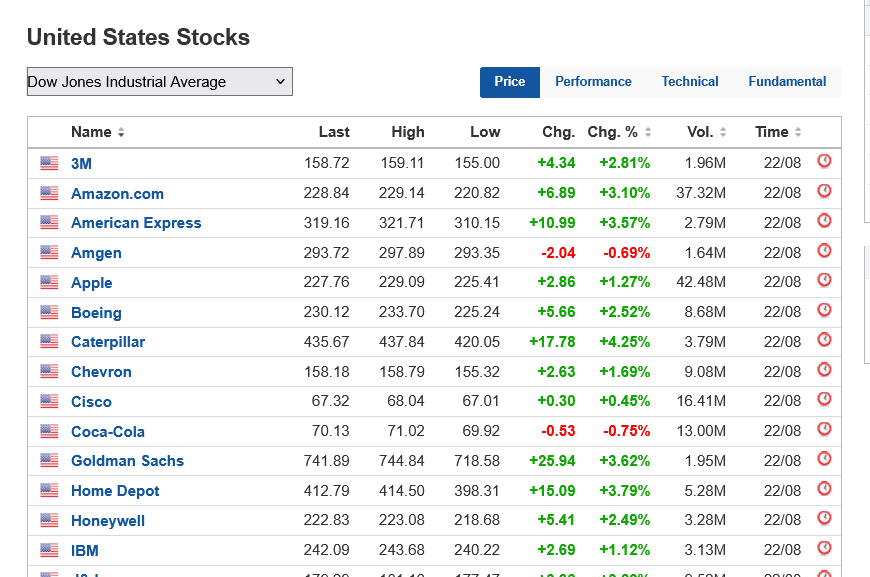

US Stocks: Image Source:

US Stocks: Image Source: Markets moved immediately. The dollar dropped, U.S. stocks climbed, and crypto followed . Probability of a September rate cut jumped to 89%, up from 75% before Powell spoke. For ADA specifically, th e timing aligned with a 3.5% daily gain, lifting it to 0.92. This shows that ADA is directly tied to macro cues and not moving in isolation. Powell’s dovish stance turned into instant support for ADA bulls.

Cardano Price Prediction: ADA Daily Chart Signals

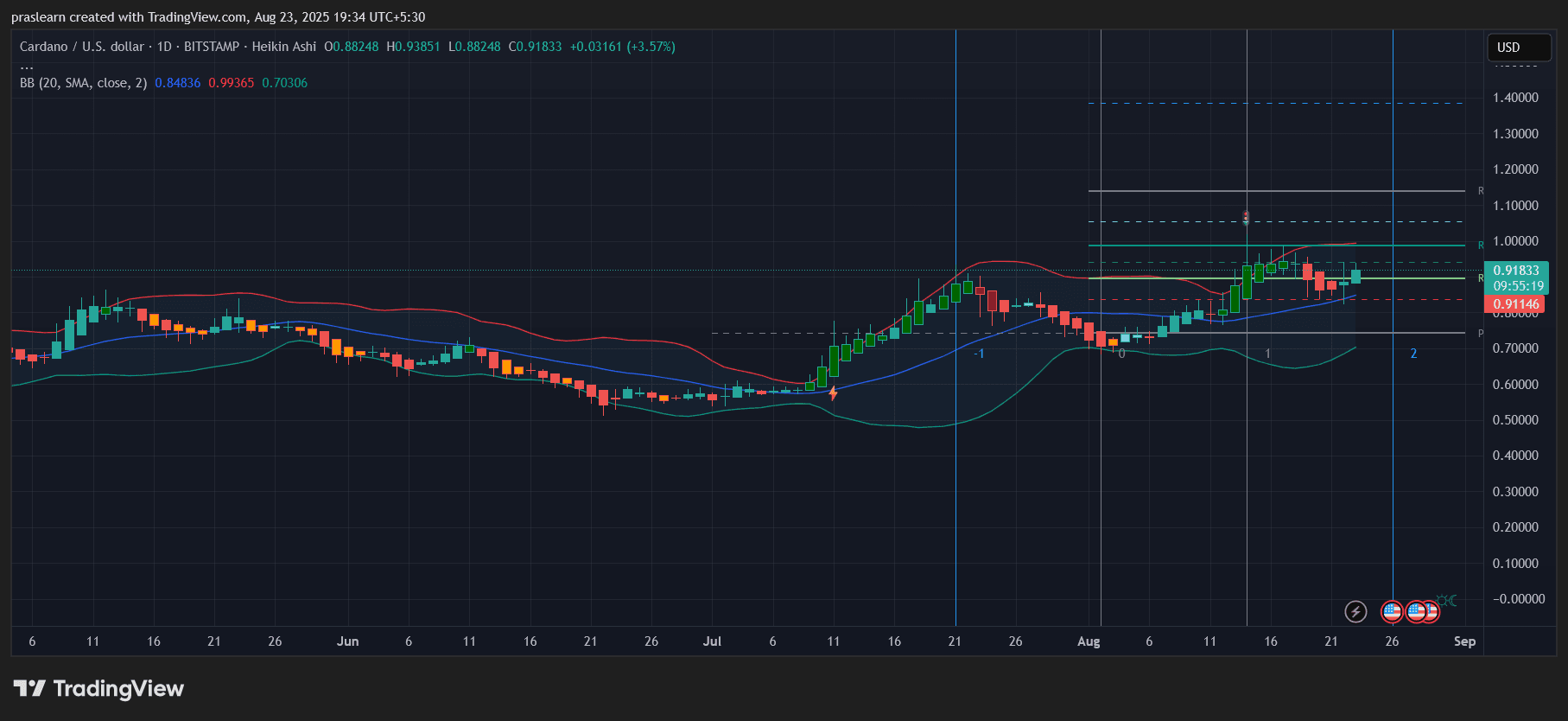

ADA/USD Daily Chart-

ADA/USD Daily Chart- The daily ADA price chart shows price holding above 0.85 support and testing the 1.00 resistance zone. Heikin Ashi candles have turned green, signaling a shift in momentum.

- Key support: 0.85, aligned with the Bollinger Band midpoint.

- Immediate resistance: 1.00, both psychological and Fibonacci-based.

- Next upside target: 1.12–1.15 if bulls break through.

- Downside risk: losing 0.85 could reopen 0.70 as a target.

The Bollinger Bands are tightening, often a precursor to a strong directional move. Powell’s speech may have been the catalyst to set that move in motion.

What Powell’s Message Means for Cardano Price Next 30 Days?

- Bullish case: If Powell’s words translate into a September rate cut, ADA could push through 1.00 and run toward 1.12, with potential to stretch higher if broader crypto strength continues.

Neutral case: If markets tread water until the actual Fed decision, ADA may stay range-bound between 0.85 and 1.00, waiting for confirmation.

Bearish case: If the Fed walks back its dovish tone or economic shocks hit risk assets, ADA could drop below 0.85 and test 0.70 again.

Catalysts Beyond Powell

- September FOMC meeting: confirmation of a rate cut would be the biggest trigger.

- U.S. dollar index trends: continued weakness strengthens $Cardano case.

- Cardano network updates: while macro dominates near term, any positive adoption news could amplify upside moves.

Powell’s Jackson Hole speech may prove to be the turning point for ADA in August. By signaling a readiness to cut rates, Powell opened the door for renewed liquidity flows into risk assets. $ADA now sits right below 1.00, a level that could unlock a fresh rally if broken. Until the September Fed meeting, ADA traders will be hanging on every macro headline, but the bias has clearly shifted in ADA’s favor.