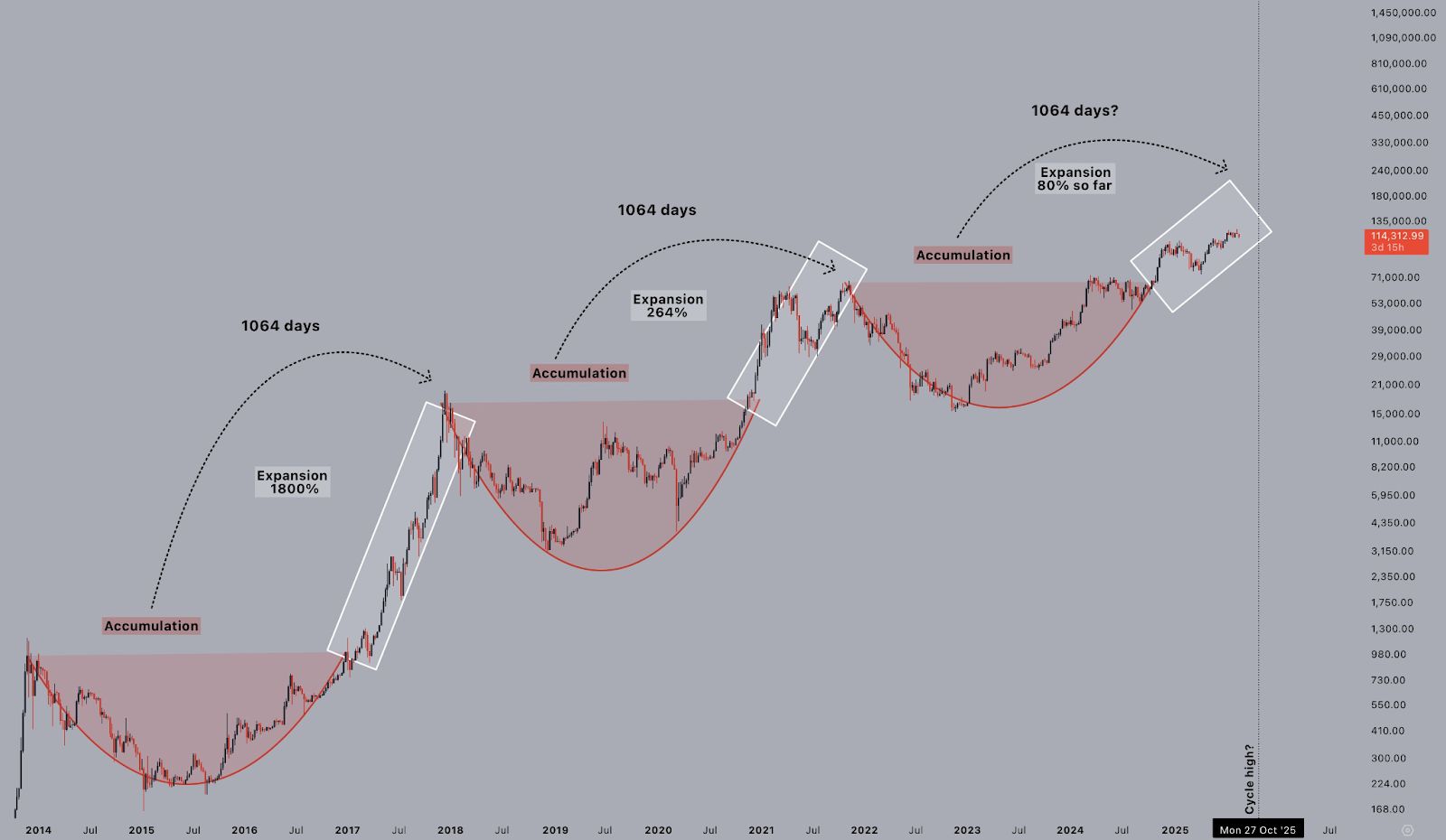

Bitcoin’s 1064-day cycle indicates the market is entering a final bull phase: institutional accumulation and a tightening breakout window point to a high-probability rally toward an October peak, with key support near $112,000 and resistance at $114,755–$116,813.

-

Bitcoin 1064-day cycle nearing final expansion window — October 27, 2025 flagged as potential peak.

-

Institutions and whales are accumulating; on-chain flows and a reported large $118M purchase add tangible demand.

-

Technical structure: key support ~$112,000, resistance at $114,755 and $116,813; momentum indicators signal consolidation before potential breakout.

Meta description: Bitcoin 1064-day cycle signals final bull phase — institutions accumulate, breakout window in October 2025. Read analysis and key takeaways now.

Bitcoin’s final bull phase is entering a decisive stretch as the 1064-day cycle approaches its expansion window. Institutional accumulation and significant whale buys intensify the breakout narrative while technical levels define risk and reward ahead of a possible October peak.

What is the Bitcoin 1064-day cycle and is the final bull phase underway?

The Bitcoin 1064-day cycle is a recurring macro structure of roughly 1064 days of accumulation followed by an expansion period. Historical patterns show the steepest gains in the final stretch, and current on-chain flows and institutional interest suggest the cycle is entering that expansion phase now.

How have past 1064-day cycles behaved and what did they produce?

Past cycles (2014–2017, 2018–2021, 2022–2025) display a rounded accumulation followed by large price expansions. The 2014–2017 cycle produced ~1800% gains; the 2018–2021 cycle delivered ~264% from its breakout; the current cycle has shown an 80% move since the breakout point, per available market data.

Source: CryptoJelleNL via X

Source: CryptoJelleNL via X How are institutions and whales affecting Bitcoin’s current structure?

Institutional demand has accelerated. Industry reporting and on-chain analytics indicate increased long-term inflows to custody and OTC desks. Public statements attributed to U.S. lawmakers and a reported purchase of approximately $118,000,000 in Bitcoin by a single entity are consistent with measurable accumulation pressure.

When will the breakout window likely peak?

Chart analysis marks a breakout box with a possible top around October 27, 2025. Traders should monitor daily closes above resistance zones ($114,755 and $116,813) and validate momentum with volume expansion and RSI moving above 60 for conviction.

Frequently Asked Questions

How should traders size positions ahead of the October window?

Use tiered position sizing: allocate smaller initial exposure near support ($112,000), add on confirmed breaks above $114,755 with volume confirmation, and apply stop-losses below the lower support to manage downside risk.

Is the current move confirmed as a sustained bull market?

Confirmation requires persistent higher highs on weekly charts, rising on-chain net flows to exchanges’ custody providers, and sustained institutional accumulation over multiple weeks. Short-term rallies can occur inside longer consolidations, so use multiple timeframes for confirmation.

What official data supports the institutional accumulation claim?

Support includes on-chain custody inflows reported by analytics firms, public statements from policymakers indicating potential large-scale purchases, and aggregated wallet transfer records showing increased whale deposits into long-term custody addresses (sources: on-chain analytics firms and public legislative reports—plain text references).

Key Takeaways

- Cycle signal: The 1064-day structure suggests the market is in the final expansion phase — monitor the October window.

- Institutional demand: Large purchases and reported legislative support add credible demand signals.

- Technical levels: Support ~$112,000; resistance $114,755 and $116,813 — use volume and RSI for breakout confirmation.

Conclusion

Bitcoin’s 1064-day cycle and recent on-chain activity indicate a high-probability final bull phase as the October breakout window approaches. Traders should combine multi-timeframe technicals with verified custody flow data and manage risk through disciplined position sizing. COINOTAG will continue monitoring developments and publishing evidence-based updates.