Saros (SAROS) Faces 70% Crash: What Caused the Sudden Price Drop?

The cryptocurrency Saros (SAROS) experienced a dramatic 70% price drop on August 24, plummeting to its lowest level since April 2025.

The steep decline, which briefly erased months of gains, has sparked widespread concern among investors. Some market watchers have even drawn parallels to the troubled trajectory of MANTRA (OM).

Why Did SAROS Token’s Price Crash?

For context, Saros is a decentralized finance (DeFi) platform built on the Solana (SOL) blockchain. It combines a wide range of services into a single ecosystem, including trading, staking, yield farming, launchpad participation, and more.

Its native utility token, SAROS, powers governance, staking, liquidity incentives, and more. The token is deployed on both Solana and Viction.

The altcoin, which has a market cap of $922 million, has been on a predominantly upward trend for months and reached an all-time high (ATH) on August 04.

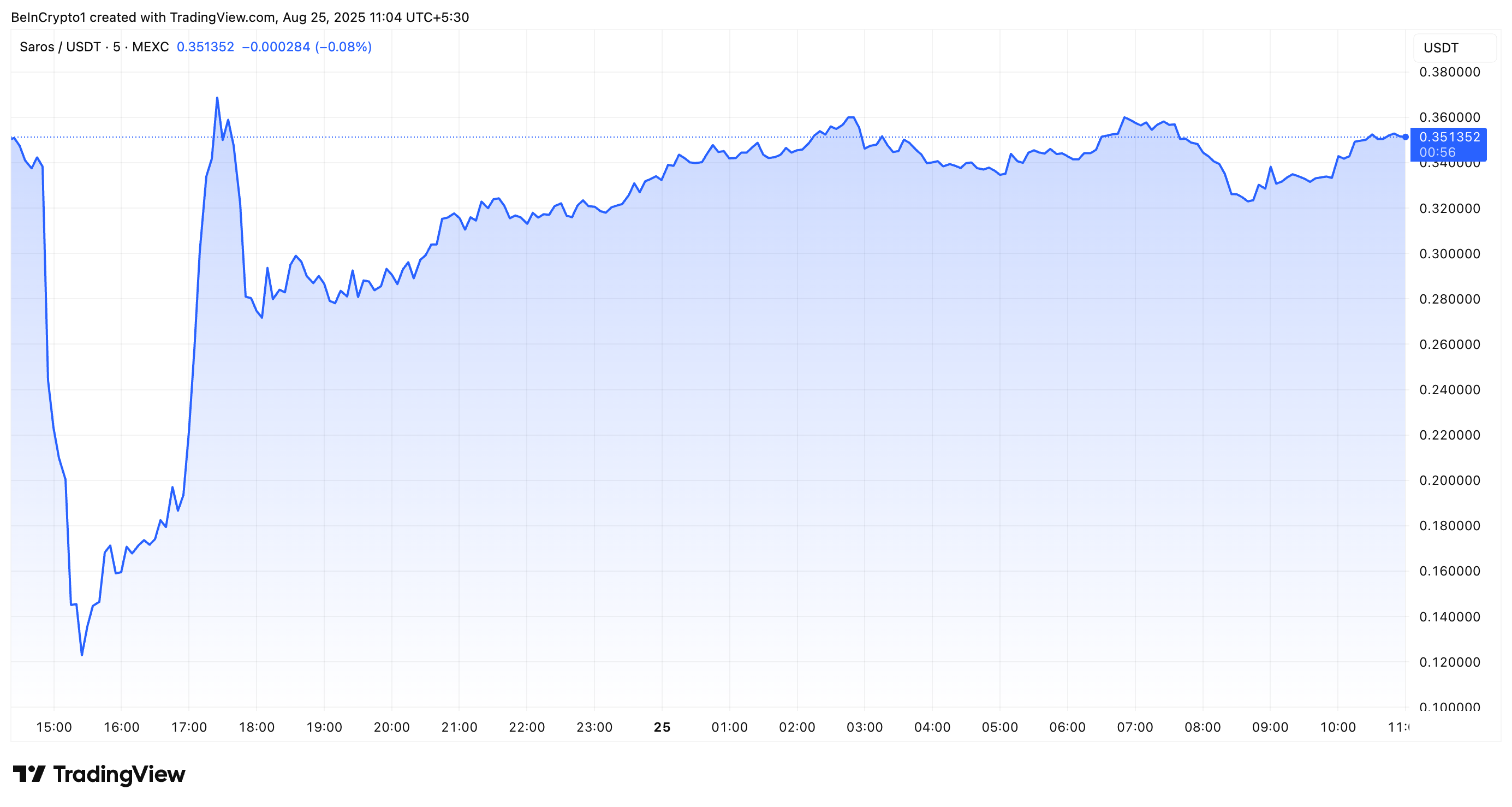

However, yesterday’s 70% crash hindered this upward trajectory, pulling the price shortly back to four-month lows. Market data showed that SAROS’ price dipped to $0.109, a level last seen in April.

SAROS Price Crash. Source: TradingView

SAROS Price Crash. Source: TradingView Nonetheless, the dip was brief. SAROS bounced back and reversed its losses. At the time of writing, it was trading at $0.35, down 5.3% over the past day.

Thanh Le, founder of Saros, addressed recent price volatility. He explained that the sharp moves in SAROS resulted from leveraged traders reducing their positions on centralized exchanges, which caused open interest to fall sharply.

“Based on our ongoing investigations and available data, we believe this is a market-driven adjustment, potentially involving a large, highly-leveraged position reducing its exposure on centralized exchanges (CEX). Prior to the movement, open interest was approximately 90M SAROS, according to exchange data, and it has since decreased to around 20M SAROS,” he said.

He stressed that neither the team nor long-term investors sold their holdings.

“Market cycles come and go, but our focus stays the same: building Saros into the liquidity backbone of Solana. Your trust and support are what drive us, and we’ll continue to keep you informed every step of the way,” Le added.

Despite this, the major crash caused many traders to lose money and shook the market sentiment. CoinGecko data showed that over 50% of the community is bearish on SAROS.

Welcome to crypto Never trade without a Stop-Loss! No matter how much profit you’re sitting on, one sudden move can wipe it all out.Just look at #SAROS — 142 days of gains erased in a single day dump.

— Crypto Tigers (@Crypto_Tigers1) August 24, 2025Risk management > Hype.

The volatility has reignited comparisons to OM, which experienced a 90% crash in April and has yet to recover completely.

“It’s going to keep falling for at least 1-2 years now…Whatever I said about OM before came true, and now whatever we said about Saros came true too,” an analyst remarked.

Surprise surprise$SAROS

— VIKTOR (@thedefivillain) August 24, 2025

Thus, this incident highlights the broader risks within the altcoin market. While SAROS has shown some recovery, the price drop has left many questioning the market’s stability. Now, the community will watch closely to see how Saros navigates this setback.