XRP Max Pain Levels Show Both Bulls and Bears in Trouble

The XRP price continues to look more like a roller coaster than a $178.36 billion asset. Amid this mess of a price action, the most logical question that makes crypto traders scratch their heads is at what point the XRP market will bring the maximum pain.

Thanks to fresh liquidation data from CoinGlass, the answer becomes much less prosaic.

So, right now XRP is trading just around $3, while the so-called “max pain” levels for both longs and shorts are sitting almost within arm’s reach.

The short-side pain line is calculated at $3.387, where more than $17.9 million in contracts would be at risk if the price were to push higher. For context, that level is only about 13% away from spot, while Bitcoin and Ethereum show far broader cushions before short bets face liquidation pressure.

On the other end, XRP’s long-side pain is marked at $2.953, which is essentially right beneath the current level, just a few cents away. That means any slip lower immediately drags leveraged longs into danger equivalent to $11.35 million in liquidations.

XRP on thin ice

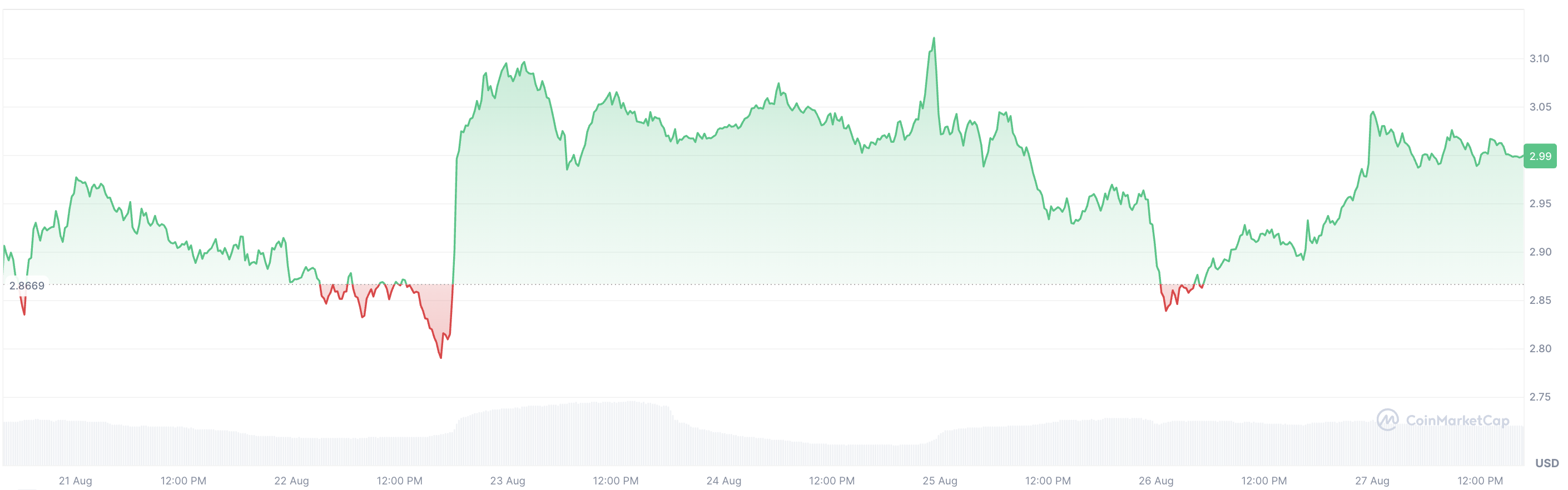

What makes this setup more tense is how it lines up with the recent price action of the third biggest cryptocurrency. Since its run to $3.60 earlier in August, XRP has cooled into a range between $2.80 and $3.20, and those same levels now overlap with the on-chain liquidation map.

The band is so narrow that even routine intraday shifts can trigger forced exits, keeping volatility alive even when the chart looks flat at first glance.

In short, XRP is caught in a pocket where both sides are exposed, and the margin for error is thin. Whether price breaks lower toward $2.80 or tests the $3.30 ceiling again, the data suggests liquidations will be amassing quickly, making the coming weeks especially sensitive for anyone losing their heads going heavy on leverage.