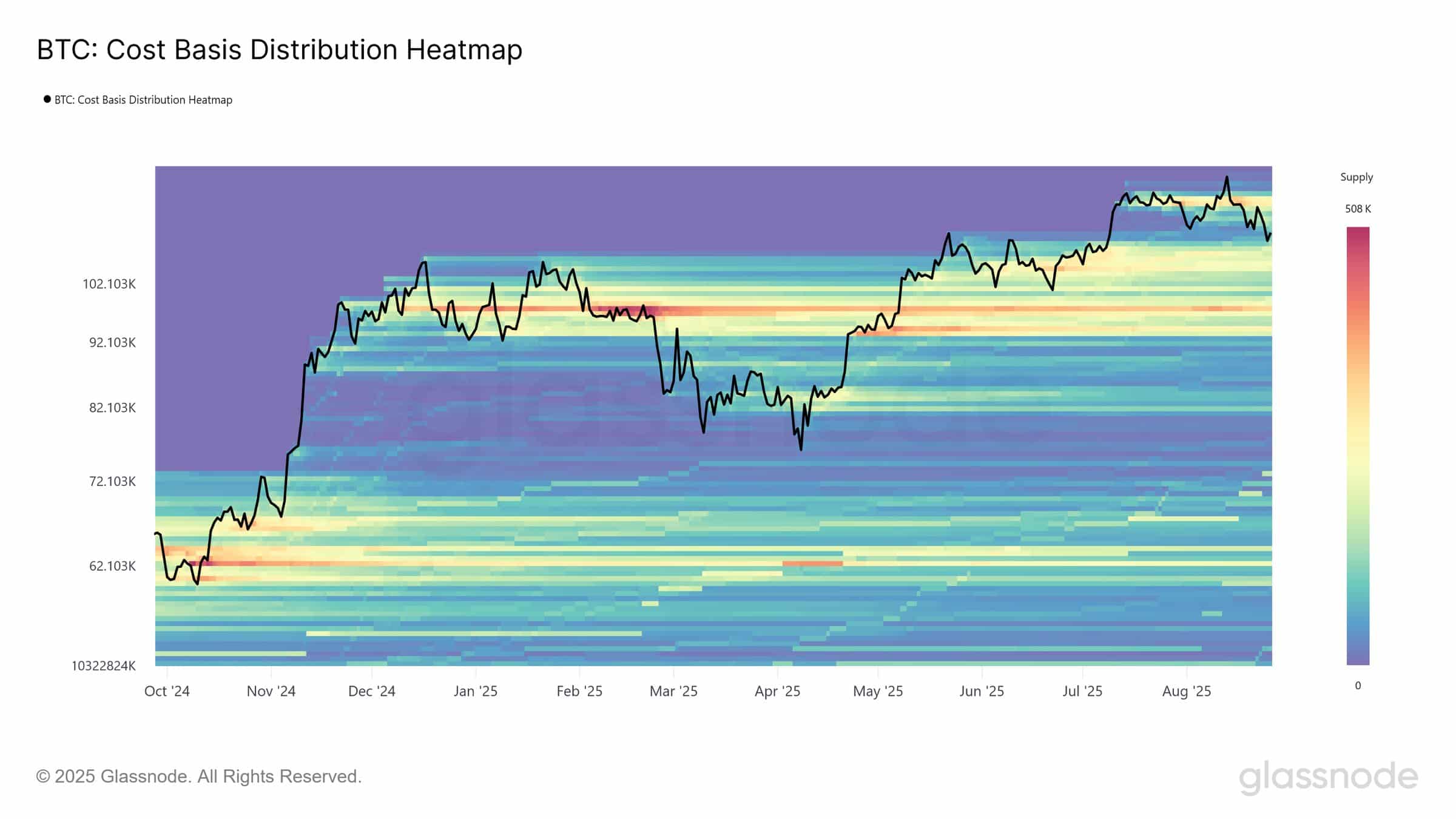

Bitcoin price is holding inside a dense $93,000–$110,000 supply cluster, with holders remaining firm and the NVT golden cross sliding toward oversold readings; this combination suggests a potential rebound if buying resumes, though a breakdown below the cluster would risk a deeper test of support.

-

Bitcoin price range: $93,000–$110,000 acting as supply cluster and possible accumulation zone

-

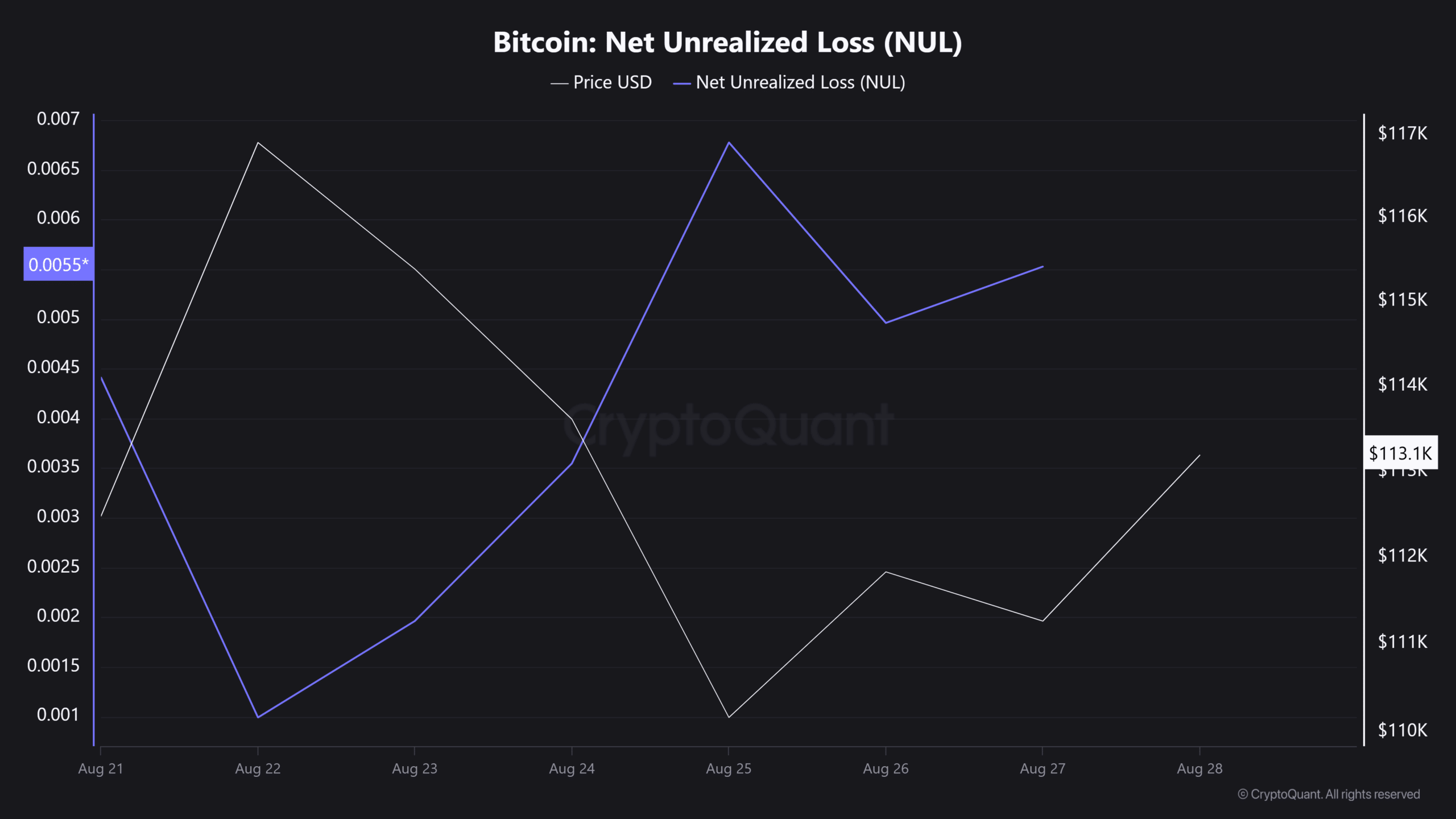

Net unrealized losses have risen, yet holders show limited panic selling—on-chain metrics indicate conviction.

-

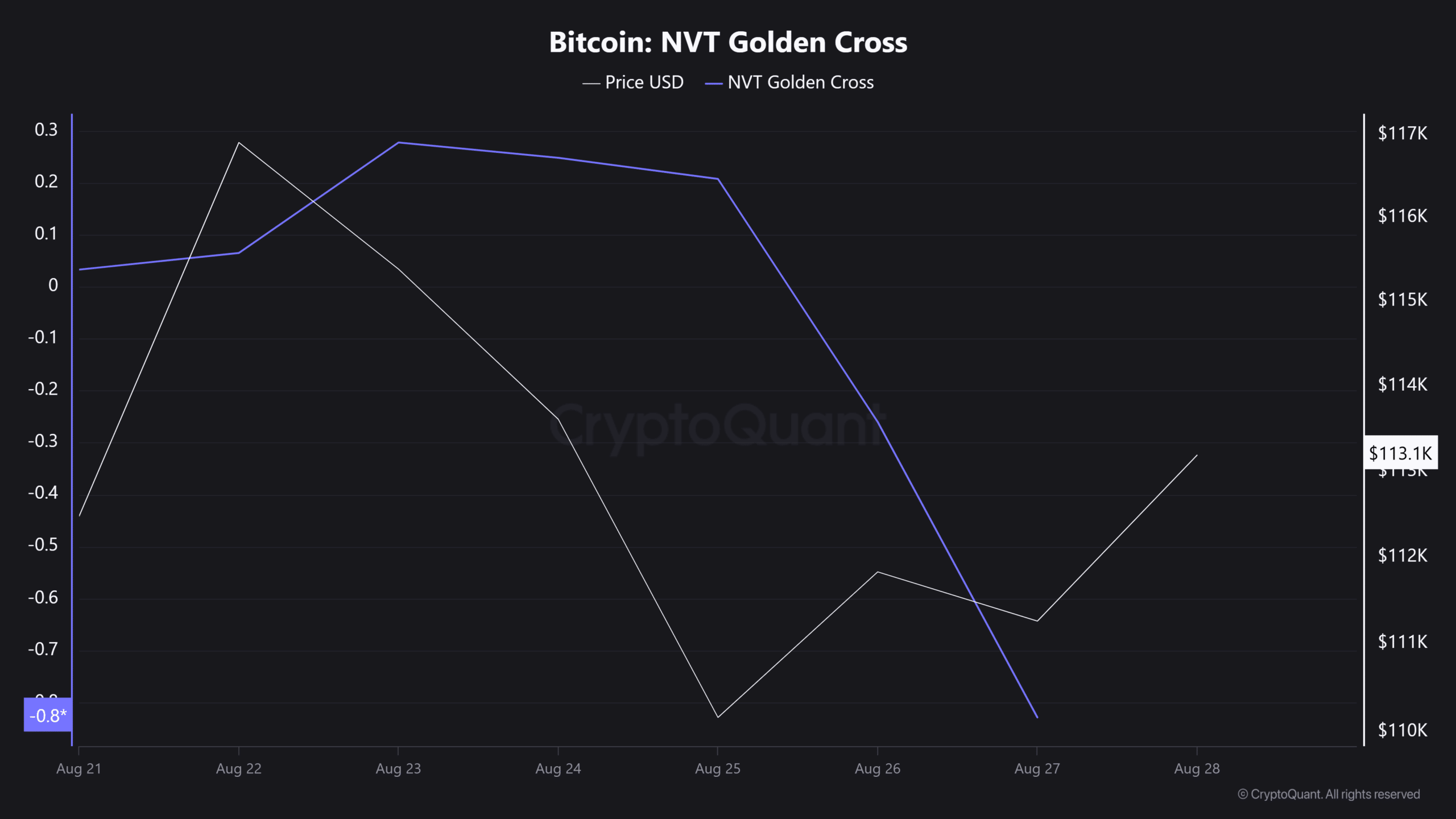

NVT golden cross near oversold historically aligns with relief rallies; monitor demand vs. supply for confirmation.

Bitcoin price holds in $93k–$110k supply cluster; NVT nearing oversold — read on-chain signals, trader cues and next steps. Learn what to watch now.

What is driving Bitcoin’s price inside the $93k–$110k supply cluster?

Bitcoin price is trading inside a dense supply cluster between $93,000 and $110,000 where accumulation and distribution have overlapped since late 2024. On-chain data shows rising net unrealized losses, but limited selling pressure, indicating holders are largely absorbing the drawdown.

How severe are holders’ unrealized losses and what do they mean?

Net unrealized losses have climbed in this band based on on-chain metrics from providers such as CryptoQuant and Glassnode (source names referenced as plain text). Increased losses typically signal potential capitulation, but the absence of mass liquidations suggests resilience among long-term holders.

Historically, such conditions often precede a relief rally rather than a sustained breakdown when demand remains steady.

Why are holders not backing away despite mounting losses?

On-chain analysis by COINOTAG referencing CryptoQuant shows holders maintaining positions rather than exiting. That suggests conviction: many participants appear content to ride short-term drawdowns, treating the current price band as an accumulation opportunity.

When selling pressure is muted while unrealized losses rise, the market can form a durable base if demand steadily absorbs supply.

How does the NVT golden cross affect outlook for Bitcoin?

The NVT golden cross — which measures valuation against on-chain transaction activity — has been sliding toward oversold territory. When NVT readings fall relative to historical norms, price can be stretched low versus network utility, often preceding relief rallies in prior cycles.

This indicator is a signal, not a guarantee; traders should watch for improving transaction activity and renewed demand to confirm a rebound.

What should Bitcoin traders expect next?

If selling pressure accelerates, Bitcoin could break below the $93k–$110k cluster and test lower supports. Conversely, if demand continues to match or exceed supply, the band could act as a springboard for renewed upside.

Traders should monitor on-chain demand signals, transaction volume, and NVT behavior for early confirmation of either scenario.

Frequently Asked Questions

Is the $93k–$110k range a confirmed bottom for Bitcoin?

Not confirmed. The range is a strong supply cluster and accumulation zone, but a confirmed bottom requires sustained demand and improving on-chain metrics such as transaction activity and declining net unrealized losses.

How should traders use the NVT golden cross signal?

Use NVT as a supplementary indicator: falling NVT toward oversold can signal stretched valuation versus usage, but trade confirmation should include rising transaction activity and volume to validate a rebound.

Key Takeaways

- Range focus: $93k–$110k is a dense supply cluster that could be a floor if buyers persist.

- Holder resilience: Rising unrealized losses have not triggered large-scale selling, pointing to conviction.

- NVT signal: The NVT golden cross moving toward oversold historically lines up with relief rallies; wait for demand confirmation.

Conclusion

Bitcoin price remains inside a decisive $93,000–$110,000 cluster, with holders showing resilience and the NVT golden cross nearing oversold levels. These signals favor a potential rebound if demand returns. Traders should watch transaction activity, on-chain demand metrics, and supply absorption for confirmation and manage risk accordingly.