Metaplanet Bitcoin fundraising is under pressure after the Tokyo-listed firm’s stock plunged 54% since mid‑June, hurting its share-based “flywheel.” Metaplanet is pursuing an overseas public offering and a preferred-share issuance to restore liquidity and sustain Bitcoin accumulation.

-

Stock down 54% since mid‑June puts Metaplanet’s Bitcoin fundraising at risk.

-

Company plans ~130.3 billion yen overseas offer and up to 555 million preferred shares to raise capital.

-

Holds 18,991 BTC (seventh-largest public treasury); target: 100,000 BTC by 2026, 210,000 BTC by 2027.

Metaplanet Bitcoin fundraising: Tokyo-listed Metaplanet faces a 54% share plunge and moves to raise capital via an $880M overseas offering and preferred shares—read what’s next.

Metaplanet’s stock has plunged 54% since mid‑June, forcing the Tokyo‑listed firm to seek alternative fundraising as its share‑based “flywheel” falters.

What is Metaplanet’s Bitcoin fundraising strategy?

Metaplanet Bitcoin fundraising relied on a share‑price “flywheel”: rising equity unlocked funding through warrants and share issuance to buy Bitcoin. Falling share prices have reduced warrant exercise incentives, squeezing liquidity and slowing BTC purchases while the company shifts to overseas offerings and preferred shares.

How did the stock decline disrupt the flywheel?

Shares dropped 54% since mid‑June while Bitcoin rose ~2% in the same period. With a lower share price, Evo Fund is unlikely to exercise MS warrants, removing a key capital source. Bloomberg reported that suspended warrant exercises (Sept. 3–30) and the shrinking Bitcoin premium—from >8x to ~2x—have increased dilution risk.

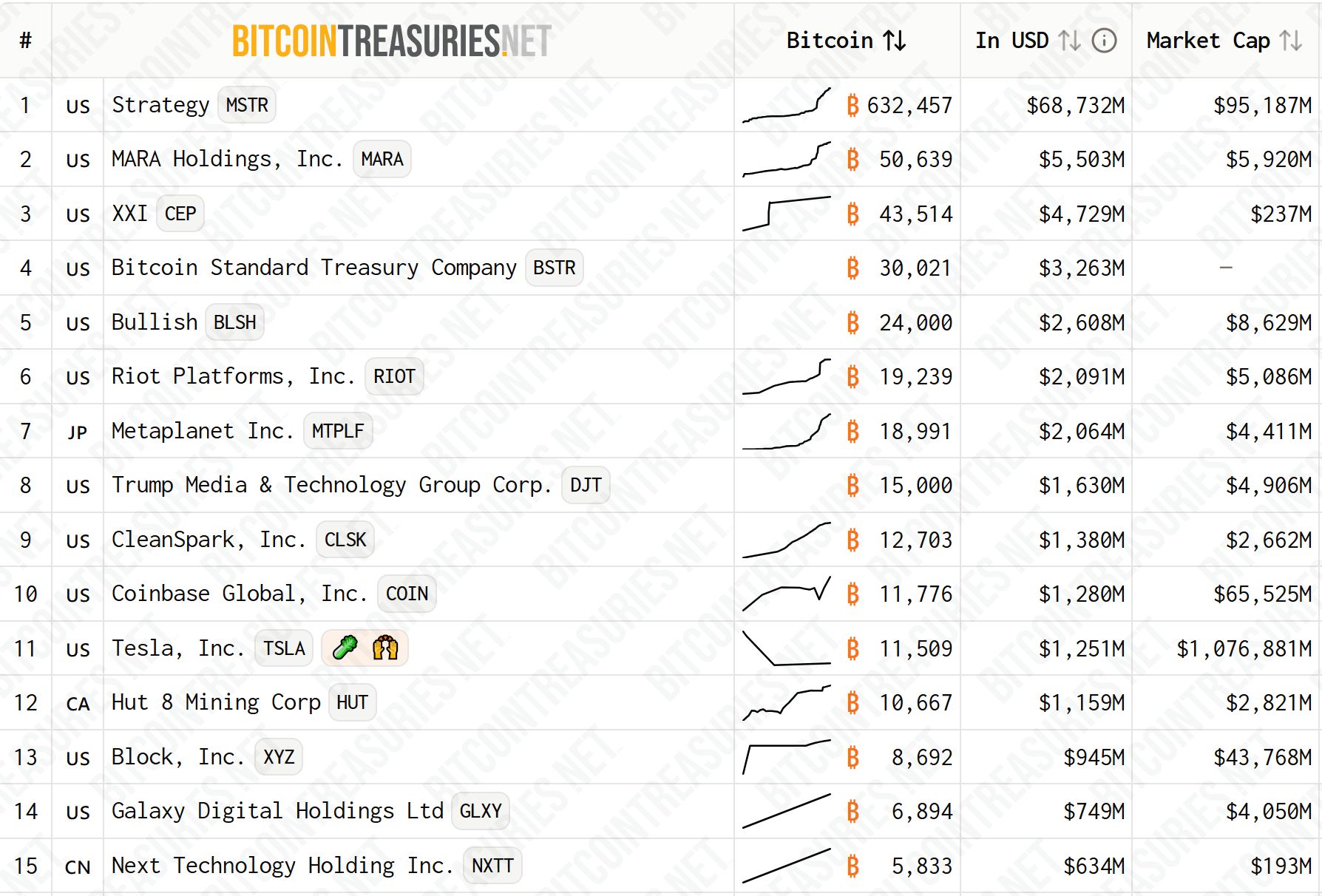

Metaplanet currently holds 18,991 BTC, ranking it among the largest public holders (source: BitcoinTreasuries.NET, plain text). Management targets 100,000 BTC by end‑2026 and 210,000 BTC by 2027, goals now contingent on new funding.

Top 15 Bitcoin treasury companies. Source: BitcoinTreasuries.NET

Why is Metaplanet turning to overseas markets?

With the domestic share‑based mechanism impaired, CEO Simon Gerovich announced a planned overseas public offering to raise ~130.3 billion yen (~$880M) and a shareholder vote on issuing up to 555 million preferred shares that could raise up to 555 billion yen (~$3.7B).

The preferred shares are presented as a defensive capital tool: they may pay up to 6% dividends and initially be capped at 25% of the firm’s Bitcoin holdings, offering yield to investors while aiming to limit dilution of common equity if the stock falls further.

What do analysts say about the premium and risks?

Analysts caution that the “Bitcoin premium”—the gap between market cap and BTC value—will determine strategy success. “The Bitcoin premium is what will determine the success of the entire strategy,” said Eric Benoit of Natixis. A lower premium increases dilution risk and the need for larger equity issuance to fund BTC buys.

Frequently Asked Questions

How much Bitcoin does Metaplanet hold?

Metaplanet holds 18,991 BTC, making it one of the top public corporate holders. Management publicly targets 100,000 BTC by 2026 and 210,000 BTC by 2027.

What fundraising steps is Metaplanet taking now?

Metaplanet announced a ~130.3 billion yen overseas share offering and proposed up to 555 million preferred shares to raise capital, aiming to restore liquidity and resume Bitcoin purchases.

Key Takeaways

- Immediate impact: Share decline (‑54%) has stalled Metaplanet’s share‑based funding flywheel.

- Planned response: Overseas offering (~130.3B yen) and up to 555M preferred shares aim to restore liquidity.

- Outlook: Success depends on restoring the Bitcoin premium and investor appetite for preferred yield; targets remain ambitious.

Conclusion

Metaplanet Bitcoin fundraising now hinges on new capital routes after a steep share price decline undermined its original strategy. Management’s overseas offering and preferred‑share proposal aim to stabilize funding, preserve the Bitcoin acquisition program, and meet public treasury targets. Watch premium metrics and shareholder votes for the next directional signals.