ETH poised to set tempo for the rest of the bull run

This is a segment from the Empire newsletter. To read full editions, subscribe .

Whether you’re bullish, bearish, or channeling some other animal spirit, you’re forgiven for feeling the pressure right now.

It’s been two weeks since bitcoin’s last all-time high and only four days since ether set a new price after almost three years.

Bitcoin could trend sideways and even downward for all anyone would care.

ETH sets the tempo for the foreseeable future. Scary stuff.

Before we zoom in on ETH, let’s see the momentum it’s inherited from bitcoin.

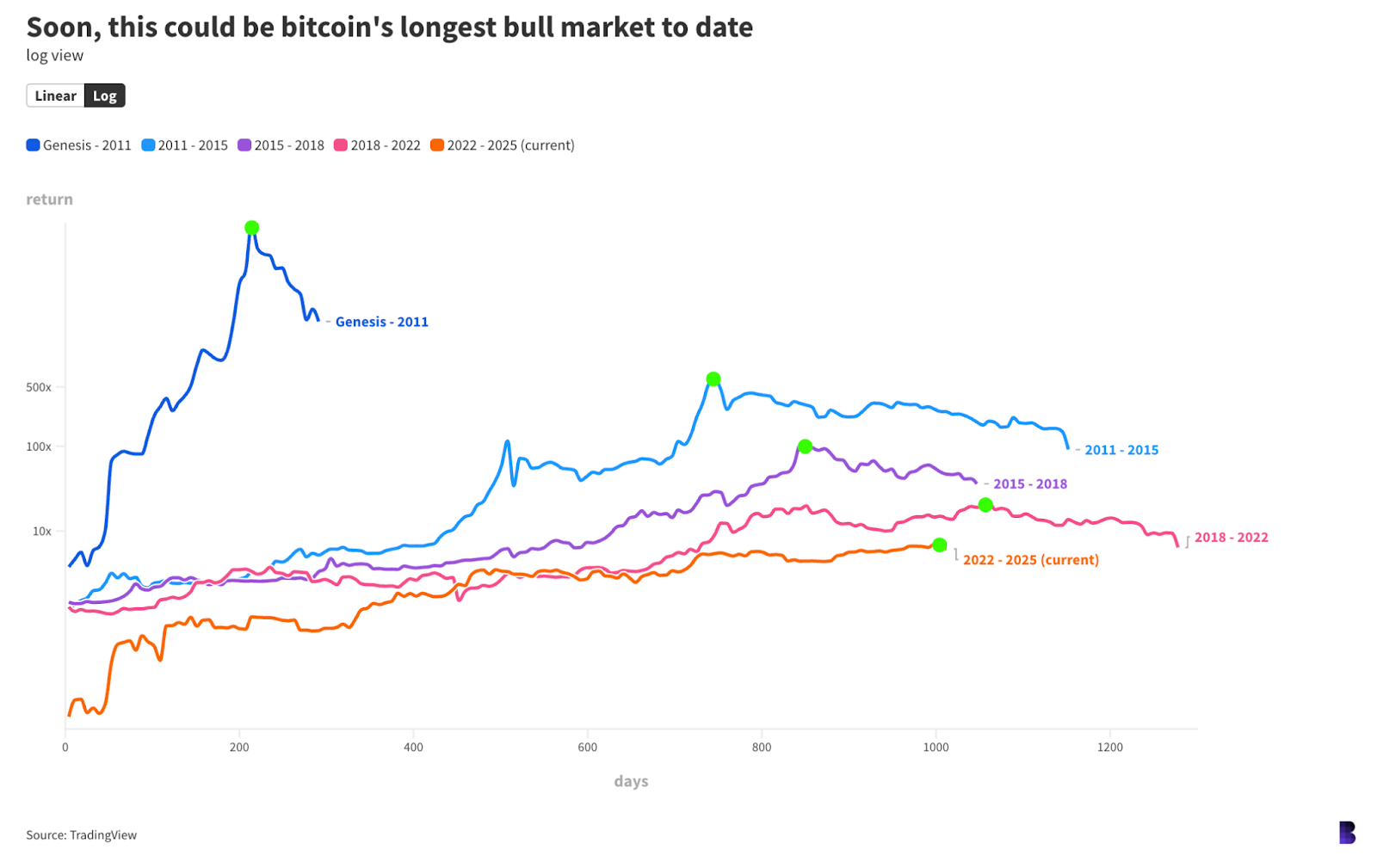

The chart below plots every bitcoin bull market together, as if they all started on the same day. Green dots point to cycle peaks, and each bull phase starts at the previous bear market’s lowest price.

By these (very basic) rules, bitcoin has now been on a bull market for 1,023 days — 2.8 years.

If the bitcoin top is not yet in, then bitcoin is on track to soon enter its longest bull market on record. It took another 40 days or so from here for bitcoin to reach its November 2021 peak.

Returns so far are about what you would expect, considering how large the market cap of bitcoin has grown.

At this point in the past two cycles, bitcoin had posted up to 100x and around 21x, respectively.

Two weeks ago, when bitcoin hit $124,100, that was the equivalent of about a 7x from the late 2022 bottom.

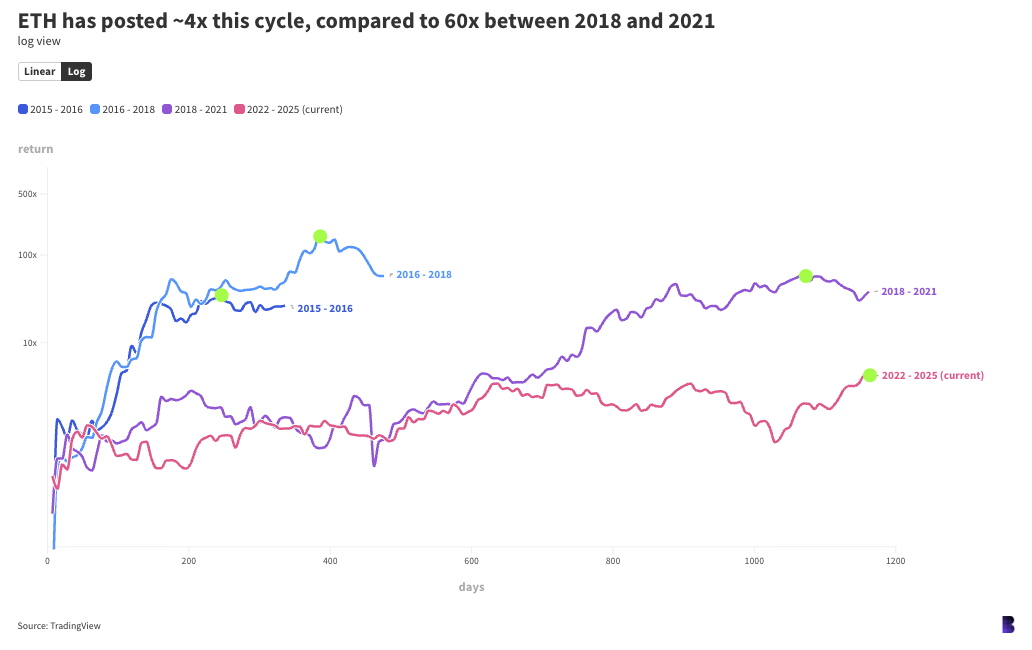

Here’s the same chart, but for ETH.

It’s similar. But technically, ETH has now entered its longest bull market on record — or in other words, this all-time high took longer than ever before

What’s glaring is that ETH’s cycle returns are tracking far below the previous bull market.

Perhaps Solana has something to do with that, considering bitcoin has no analogous direct rival.

But if it’s true that ETH is the thermometer for where crypto is headed for the next year, year and a half, then the pink line will need to catch up to the purple line, fast.

Updated 8/28/2025 at 10:07 a.m. ET: ETH’s cycle returns and length have been corrected.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown : Decoding crypto and the markets. Daily.

- 0xResearch : Alpha in your inbox. Think like an analyst.

- Empire : Crypto news and analysis to start your day.

- Forward Guidance : The intersection of crypto, macro and policy.

- The Drop : Apps, games, memes and more.

- Lightspeed : All things Solana.

- Supply Shock : Bitcoin, bitcoin, bitcoin.