BRC20, the first token standard built directly on Bitcoin’s base layer and indexers, has officially upgraded to “BRC2.0” at Bitcoin block height 912690. The upgrade has opened the door to decentralized apps and DeFi on Bitcoin.

The BRC2.0 upgrade was developed by Best In Slot, a major infrastructure player in the Ordinals ecosystem, together with BRC20’s pseudonymous creator Domo and the Layer 1 Foundation, the governance body overseeing the protocol.

Technically, the upgrade adds Ethereum Virtual Machine(EVM) functionality directly into the BRC-20 core indexer. It brings Ethereum-like composability and programmability while leveraging its security.

Developers can use Ethereum-style smart contracts on Bitcoin

Now developers will be able to use Ethereum-style smart contracts on Bitcoin, while still being able to use Ethereum tools. There are no bridges, no wrapped assets, just the capacity to combine things already there.

Eril Binari Ezerel, CEO of Best In Slot, said, “Bitcoin meta-protocols like Ordinals, Runes, and BRC20 run on indexers, which function like simple calculators […] We upgraded this ‘calculator-style’ indexer with EVM—making BRC20 Turing complete.”

On the other hand, Domo, the creator of BRC20, said, “The holy grail is combining the two gold standards: Bitcoin as the most decentralized and secure network, and the EVM as the most proven virtual machine […] The aim is to give users the Ethereum experience of composability and programmability, but secured by Bitcoin.”

Meanwhile, the new smart contract functionality expands what’s possible for Bitcoin-native assets. The programmability and DeFi are expected to spark renewed interest, with profits likely rotating into inscriptions, potentially driving another bull run for Bitcoin assets.

The number of programmable Bitcoin layers spikes

Over $3 billion worth of assets have been exchanged on BRC-20 since it started in early 2023. The goal has been reached without getting any institutional assistance or venture financing.

Although activity slowed down in 2025, BRC-20 volumes stayed high, with 5,636 BTC in on-chain volume over the last six months. This is more than double the number of Runes and over five times the number of old Ordinals inscriptions.

These tokens have mostly been used for meme coins and speculative trading until recently, because Bitcoin isn’t very programmable.

Ezerel said, “Adoption of Bitcoin native assets has been stifled because there are no dApps on Bitcoin; it’s just memes[…] One of the main goals of BRC2.0 is to bring Ethereum’s more diverse application ecosystem onto Bitcoin.”

BRC2.0 joins an increasing number of programmable Bitcoin layers, such as the WASM-based Alkanes standard.

The standard introduced trustless smart contract functionality to the base layer, without relying on bridges or external execution layers. It also allows developers to build apps and launch tokens natively on Bitcoin, expanding the functionality of the original blockchain. It recently rose to make up over a third of all meta-protocol transactions in Q3.

ETH NFTs dominate the crypto market

Even though NFT sales aren’t as hot as they used to be, the NFT market has nevertheless made $71.55 billion in sales since 2017. Of that, $46.35 billion is from NFTs based on Ethereum. That translates to 64.78%. Ethereum actually had a total volume of $80.95 billion, but $34.59 billion of that was wash trading NFTs.

Solana has made $7.02 billion in sales, but $588 million of that has been marked as fake wash deals. That means Solana, the second-place candidate, has $6.43 billion in real NFT revenues. Bitcoin comes in third with $5.69 billion in total sales, of which $123 million were wash trades.

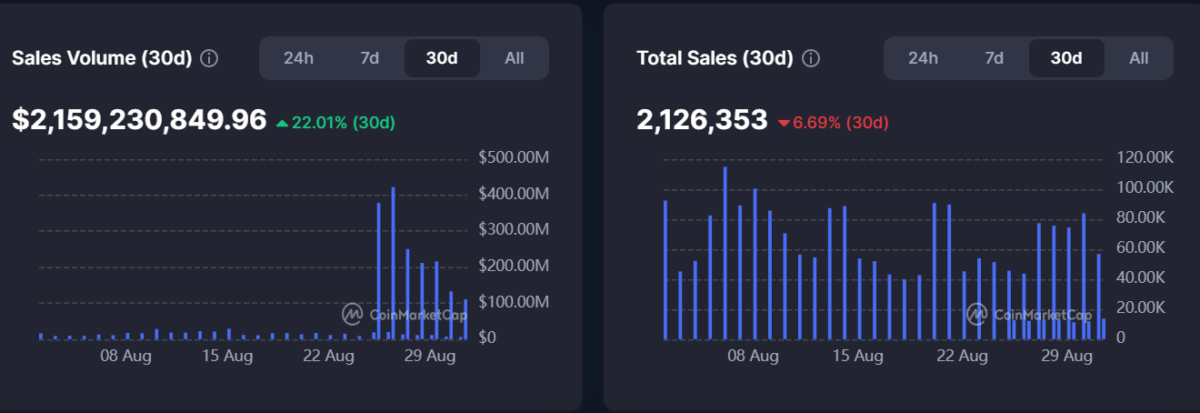

NFT sales and sales volume. Source: Coinmarketcap

NFT sales and sales volume. Source: Coinmarketcap Meanwhile, the total amount of NFT sales volume in the last 30 days is $2.1 billion, which is a 22% surge.

KEY Difference Wire helps crypto brands break through and dominate headlines fast