Solana price trades near $200 after a week of heavy activity; the Alpenglow upgrade cuts finality to ~150ms, enhancing throughput and supporting renewed bullish momentum for SOL with analysts eyeing $400+ midterm targets.

-

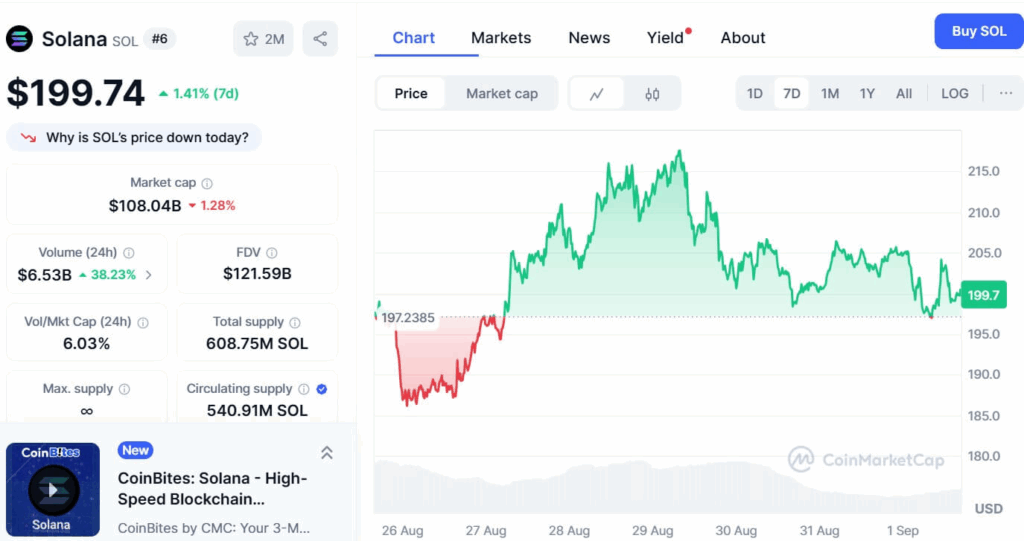

Solana price near $200 with $6.53B 24h volume — active market participation.

-

Alpenglow upgrade reduces finality to 150ms, boosting scalability and app potential.

-

Market cap ~$108B, circulating supply ~540.91M SOL; analysts cite midterm $400+ targets.

Solana price nears $200 amid Alpenglow upgrade and $6.53B volume — read analysis, key metrics, and outlook for traders and investors.

Solana trades near $200 with $6.53B volume, Alpenglow upgrade boosts speed to 150ms, and analysts eye $400+ targets ahead.

- Solana climbed from $20 in 2023 to $200 in 2025, with projections aiming toward $2,000.

- Weekly trading near $200 saw $6.53B in volume, marking a 38% rise in market activity.

- Alpenglow upgrade cuts finality to 150ms, boosting Solana’s speed and application potential.

Solana has recorded strong growth over the last three years, moving from double digits in 2023 to triple digits in 2024. By 2025, trading levels show stability near $200 with projections indicating much higher ranges. Analysts now track Solana’s progress with expectations of continued expansion into 2026.

What is driving Solana price strength now?

Solana price strength is driven by higher trading volume, improved network finality from the Alpenglow upgrade, and continued demand from DeFi, NFT markets, and institutional buyers. These factors combine with technical momentum to keep SOL trading near $200 while analysts model higher midterm targets.

How did Solana move from double digits to triple digits so quickly?

Between September 2023 and early 2024, Solana recorded outsized returns as ecosystem activity revived. Analysis by market observers shows gains driven by renewed developer activity, scaling upgrades, and wider market liquidity. These elements supported a move from under $20 to above $200, setting the stage for further rallies.

$SOL

SOLANA SEPTEMBER:

🔹2023 — $20 ➡️ $200

🔹2024 — $100 ➡️ $300

🔹2025 — $200 ➡️ $2,000 #SOLANA ⚡️ pic.twitter.com/ZGiDL5Munp

— curb.sol (CryptoCurb) — August 31, 2025

During the week ending September 1, 2025, Solana traded at $199.74 with a 1.41% weekly increase. Market capitalization stood near $108.04 billion and fully diluted valuation at $121.59 billion. Circulating supply is ~540.91 million SOL, and total supply ~608.75 million SOL.

Source: CoinMarketCap

Source: CoinMarketCap Trading activity was strong, with $6.53 billion recorded in 24-hour volume, a 38.23% increase versus the prior period. The ratio of volume to market capitalization was 6.03%, indicating elevated exchange participation. Prices oscillated between $185 and $215 during the week, with the close near $200.

How does the Alpenglow upgrade affect network performance?

The Alpenglow upgrade reduces finality from around 12.8 seconds to approximately 150 milliseconds, materially lowering confirmation times and improving throughput. Validators approved the protocol change, which strengthens Solana’s suitability for latency-sensitive applications and high-frequency DeFi operations.

Source: Dusxbt (X)

Source: Dusxbt (X) DeFi activity, NFT trading, and institutional interest remain consistent drivers for SOL demand. Technical setups show reclaimed bullish structures on weekly charts, with resistance near $250 identified as a key level. If SOL holds support between $176 and $185, analysts view the bullish structure as intact.

What are the key technical signals and market metrics to watch?

Key signals include weekly reclaim patterns, the 200-week moving average as support, resistance at $250, and volume-to-market-cap ratios. Current metrics: market cap ~$108B, FDV ~$121.6B, 24h volume $6.53B, circulating supply ~540.91M SOL. These inputs guide midterm targets and risk levels.

Frequently Asked Questions

What is Solana’s short-term price outlook?

Short-term outlook is cautiously bullish if volume and support hold. Weekly momentum and the Alpenglow upgrade improve fundamentals; traders watch $176–$185 support and $250 resistance for confirmation.

How fast will transactions be after Alpenglow?

Alpenglow aims to reduce finality to roughly 150 milliseconds, massively improving confirmation times versus prior finality metrics and enabling faster application experiences.

Key Takeaways

- Price and volume: SOL trades near $200 with $6.53B 24h volume, indicating high market activity.

- Network upgrade: Alpenglow reduces finality to ~150ms, improving throughput and application potential.

- Technical outlook: Support $176–$185, resistance $250; a break above $250 could target $400+.

Conclusion

Solana price momentum near $200 combines strong trading volume and the Alpenglow upgrade’s technical benefits. These elements support a constructive outlook for SOL, with analysts watching key technical levels and ecosystem demand. Follow on-chain metrics and weekly charts to track potential moves into 2026, and consult COINOTAG for continuing coverage and updates.

More Questions

Who authored this report?

This piece is published by COINOTAG and reflects data compiled from market metrics, CoinMarketCap-style aggregates, and on-chain upgrade confirmations reported in September 2025.