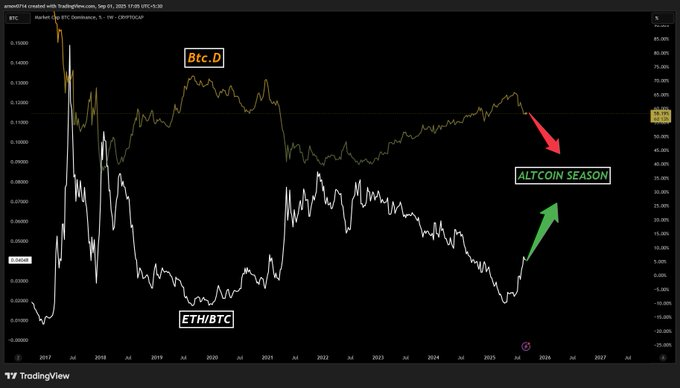

BTC dominance is showing two consecutive monthly red candles on the 1M chart, signaling a likely decline that may prompt capital rotation into altcoins. Watch resistance rejection near 65% and potential support zones at 54.55%, 51.20% and 48%; recent Ethereum whale buying strengthens the altcoin case.

-

BTC.D printed two large red monthly candles, indicating a structural rollover and increased odds of altcoin rotation.

-

Target support zones: 54.55%, 51.20%, 48% and long-term rising support near ~43%.

-

On-chain signals include a reported $46.5M Ethereum purchase, suggesting institutional interest in altcoins.

BTC dominance shows two red monthly candles and altcoin rotation risk; monitor 54.55%, 51.20% ETH whale activity for actionable signals. Read analysis.

BTC dominance prints two red monthly candles, signaling decline while capital may rotate to altcoins, driving potential market growth.

- BTC.D hits long-term resistance with two large red candles, suggesting downward momentum may drive investors to altcoins for growth.

- Historical trends show BTC dominance declines often precede altcoin market strength, reflecting capital rotation and renewed interest in Ethereum and other assets.

- Whale activity includes a $46.5 million Ethereum purchase, signaling institutional interest in altcoins alongside BTC dominance rolling over.

Bitcoin dominance (BTC.D) is showing strong signals of a structural shift as two consecutive monthly red candles appeared on the 1M chart. Analysts observe that the trend may accelerate downward, creating potential opportunities for altcoins.

What is BTC dominance showing on the 1M chart?

BTC dominance has printed two fat red monthly candles after rejecting a long-term descending resistance near the ~65% zone. This pattern historically precedes multi-month declines in dominance and often coincides with periods of renewed altcoin performance.

How has BTC dominance reacted to long-term resistance historically?

The BTC Dominance 1M chart shows a descending resistance trendline active since 2017. Each major test produced sharp rejections and a sequence of lower highs. The latest rejection near 65% follows that pattern and increases the probability of continuation toward the 54.55%, 51.20% and 48% mid-level zones before testing long-term rising support near ~43%.

Industry analysts including CryptoBullet (commentary from social X posts converted to plain text) have noted, “Two fat red monthly candles indicate a clear trend change. BTC.D is about to accelerate to the downside.” Bitcoinsensus also flagged risk of rolling dominance and suggested ETH/BTC strength off macro support.

$BTC.D 1M chart — Two fat red monthly candles. Clear trend change. BTC has one last higher high left to make and $BTC.D is about to accelerate to the downside. That implies upside for Alts. — CryptoBullet (post dated September 1, 2025)

Historical data indicates BTC dominance often peaks at long-term resistance before a downshift. With two strong monthly bearish closes, market structure favors lower dominance levels and increased altcoin liquidity over coming months.

How could altcoin rotation unfold and what levels matter?

As BTC.D rolls over, capital typically reallocates into altcoins. Potential rotation path targets include 54.55%, 51.20% and 48%, with a deeper test toward long-term rising support near ~43% if selling persists. These zones align with prior cyclical rotations that preceded altcoin rallies.

Market commentators on X and on-chain reports note a reported $46,500,000 Ethereum purchase by a whale (reported by market observers), which can be an early indicator of institutional interest. When combined with declining BTC dominance, such accumulation often precedes relative ETH and altcoin strength.

Source: Bitcoinsensus (plain text reference)

What does whale activity suggest about market direction?

Large purchases such as the reported $46.5M ETH acquisition indicate strategic positioning by big holders. Whale accumulation can precede price appreciation in targeted assets, especially when BTC dominance is weakening and liquidity seeks higher risk/reward altcoins.

Market observers like Ted and on-chain analytics reports point to coordinated accumulation as an important signal. These moves do not guarantee short-term gains but increase the probability of altcoin strength during dominance declines.

Frequently Asked Questions

Will altcoins outperform Bitcoin if BTC dominance drops?

Historically, periods of falling BTC dominance often coincide with altcoin outperformance relative to Bitcoin, but performance depends on macro liquidity, market sentiment and on-chain fundamentals.

How quickly can BTC dominance move between target zones?

Movement timing varies; declines from resistance to mid-levels can take weeks to months depending on macro catalysts and liquidity. Use monthly confirmations and exchange flow data to time entries.

Should traders buy altcoins immediately after BTC.D red candles?

Traders should scale into positions, monitor key BTC.D support zones and validate with on-chain and price action signals rather than entering solely on monthly candles.

Key Takeaways

- Structural rollover: Two monthly red candles at long-term resistance increase odds of extended BTC.D decline.

- Altcoin rotation levels: Watch 54.55%, 51.20%, 48% and long-term support around 43% for rotation progression.

- Whale signals: A reported $46.5M ETH purchase supports the thesis of institutional interest in altcoins.

Conclusion

BTC dominance has shown clear bearish monthly confirmation, raising the probability of capital rotating into altcoins. Traders and investors should monitor the identified BTC.D zones, on-chain whale activity and relative ETH strength. COINOTAG will continue to track developments and publish updates as market structure evolves. Consider staged allocation and risk management while preparing for potential altcoin season.