Hedera Slides 12%: Investors Abandon Ship as HBAR Weakens Further

Hedera Hashgraph’s native token HBAR has extended its bearish streak, losing 12% of its value over the past 30 days.

As September begins, both on-chain and technical indicators point to further weakness, with little sign of recovery on the horizon. The question now is whether the altcoin can withstand growing bearish pressure or if a deeper decline is imminent.

Retail Disinterest Meets Smart Money Retreat

According to Santiment, HBAR’s social dominance has plummeted steadily over the past month, indicating the limited interest in the altcoin. It currently stands at 0.74%, noting a 55% dip in the past 30 days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Social Dominance. Source: Santiment

HBAR Social Dominance. Source: Santiment The social dominance metric measures how frequently an asset is mentioned across social platforms, forums, and news outlets relative to the rest of the market. When it climbs, it signals that the token is attracting greater attention and discussion.

Spikes like this usually precede rallies as more chatter around an asset tends to draw in new buyers and fuel upward momentum.

Conversely, when it drops, the asset is fading from the broader market conversation. This decline reflects disinterest from retail traders, which can translate into lower demand for HBAR and reduced price support.

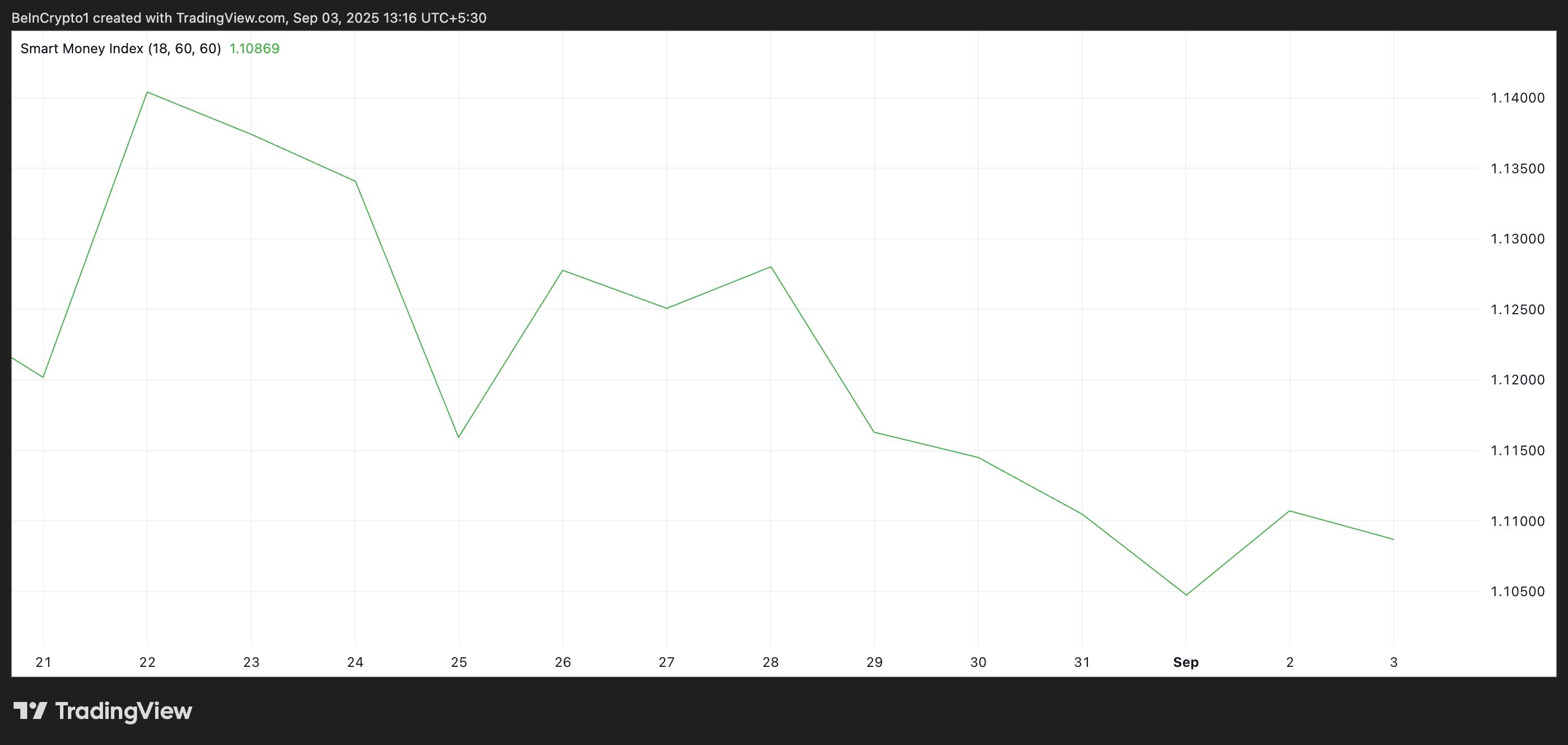

Meanwhile, HBAR’s Smart Money Index (MSI) is also trending downward, indicating that key holders are reducing their exposure to the altcoin. At press time, this is at 1.108.

HBAR SMI. Source: TradingView

HBAR SMI. Source: TradingView An asset’s SMI measures the activity of experienced or institutional investors by analyzing market behavior during the first and last hours of trading.

When the indicator rises, it indicates increased buying activity by these investors, signaling growing confidence in the asset.

On the other hand, when it drops, it signals reduced confidence from these investors, as they distribute their holdings. This points to bearish sentiment or expectations of price declines from HBAR’s key holders, further stalling any near-term rebound.

HBAR Bears Eye $0.1885, But One Breakout Could Send It Above $0.26

The above indicators point to reduced investor interest, fading social presence, and dwindling support from key players. If this trend continues, HBAR’s price could extend its decline and fall to $0.1885.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingView However, an uptick in new demand for the altcoin would invalidate this bearish outlook. HBAR could reverse its decline, break above $0.2212, and rally toward $0.2636 in that scenario.