3 Altcoins Poised to Benefit from Investor Interest in World Liberty Financial (WLFI)

Investor attention is turning toward World Liberty Financial after its powering token, WLFI, debuted for trading, and its flagship stablecoin USD1 surged to a $2.64 billion supply in just six months.

Amidst the rising adoption, speculation is wild on which altcoins stand to benefit the most. According to analysts, BNB coin, Chainlink (LINK), and Bonk (BONK) may be the likely contenders.

Why BNB, LINK, and BONK Could Benefit from WLFI Adoption

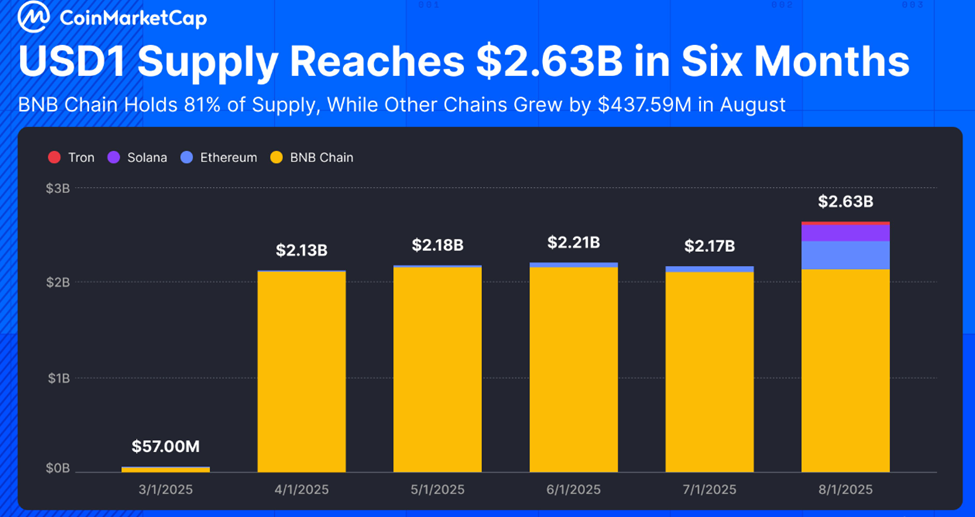

The BNB Chain has quickly become the backbone of USD1’s expansion. According to CoinMarketCap, 81% of the USD1 supply is currently held on BNB Chain, making it the dominant network for WLFI’s stablecoin.

While the USD1 stablecoin supply on other chains grew by $437.59 million in August, BNB Chain remains far ahead.

USD1 Supply on BNB Chain. Source: CoinMarketCap

USD1 Supply on BNB Chain. Source: CoinMarketCap This concentration suggests BNB’s central role in WLFI’s ecosystem. As USD1 issuance continues to climb, demand for BNB Chain block space and liquidity provisioning is likely to follow.

For BNB holders, the network effect could translate into sustained utility and increased transaction volumes. This could bode well for the BNB price.

Chainlink (LINK) is the second potential beneficiary, whose Cross-Chain Interoperability Protocol (CCIP) has become a critical infrastructure layer for WLFI’s operations.

Zach Rynes, Chainlink’s community liaison, revealed that CCIP processed over $130 million in cross-chain transfer volume in a single day. Of this, $106 million, or 81.5%, is reportedly tied directly to WLFI transfers.

Chainlink CCIP processed $130M+ in cross-chain transfer volume today

— Zach Rynes | CLG (@ChainLinkGod) September 2, 2025$106M+ came from $WLFI transfers, which adopted the Cross-Chain Token (CCT) standard for seamless interoperability

WLFI has also adopted Chainlink’s Cross-Chain Token (CCT) standard, making LINK’s oracle and interoperability services indispensable to its expansion strategy.

With more than 80% of CCIP volume linked to WLFI, the partnership places LINK at the heart of a growing multi-chain ecosystem.

Rising WLFI activity could therefore translate into stronger fundamentals for the LINK price.

Chainlink (LINK) Price Performance. Source: BeInCrypto

Chainlink (LINK) Price Performance. Source: BeInCrypto A third but no less promising altcoin is Bonk (BONK), Solana’s leading meme token. WLFI recently tapped Bonk.fun as the official launchpad for USD1 on Solana, a move hailed as transformative for both ecosystems.

“We’re proud to announce that we’ve partnered with World Liberty Financial to become the official USD1 launchpad on Solana… bringing the next wave of users onto Solana,” Bonk.fun announced.

Analysts like Unipcs argue that the deal could unlock a surge in liquidity for the Bonk ecosystem. They point out that USD1 drove $30 billion in trading volume to BNB Chain in its first month alone.

many continue to take for granted how big of a deal the $WLFI partnership with BonkFun isUSD1 drove $30 billion in volume to BNB chain the first month it went live on the chainthat's several times more volume than we see in the trenches on Solana monthly, despite Solana being…

— Unipcs (aka 'Bonk Guy')(@theunipcs) September 2, 2025

As WLFI replicates its success on Solana, BONK and its associated ecosystem could see significant inflows of liquidity and attention.

Short-Term Headwinds, Long-Term Opportunity for WLFI Ecosystem

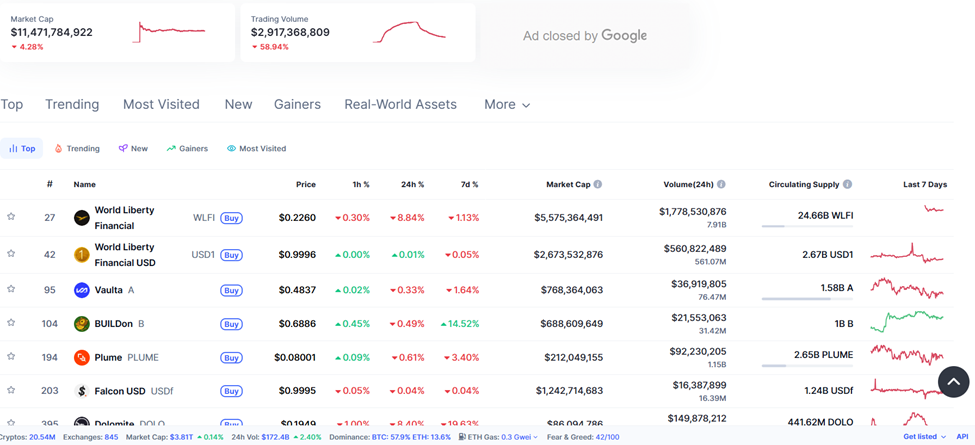

Despite these bullish signals, the broader WLFI sector faces short-term headwinds. CoinMarketCap data shows the ecosystem’s market cap fell 4.28% to $11.47 billion, while trading volume has dropped nearly 60%.

Top WLFI Ecosystem Tokens by Market Capitalization. Source: CoinMarketCap

Top WLFI Ecosystem Tokens by Market Capitalization. Source: CoinMarketCap Analysts suggest early exits may weigh WLFI’s price action, though sentiment could shift as new partnerships like Bonk.fun’s go live.

Ultimately, BNB, LINK, and BONK stand out as the top altcoins poised to benefit from WLFI’s expanding footprint.

These projects could be the forefront of the next wave of liquidity, interoperability, and stablecoin-driven growth across the crypto markets. However, this is contingent on WLFI adoption accelerating.