New Month, Same Solana Story? Price Bounce Faces Profit-Taking Risk

Solana (SOL) is currently trading a notch above $210, up 3.09% today and nearly 30% higher month-on-month. Yet, despite the strong percentage gains, traders might not have felt the rally in full. Pullbacks have been sharp, and the Solana price has struggled to sustain momentum, flattening out within the $205–$215 range.

As a new month begins, the familiar Solana story could repeat: another local high facing the risk of profit-taking.

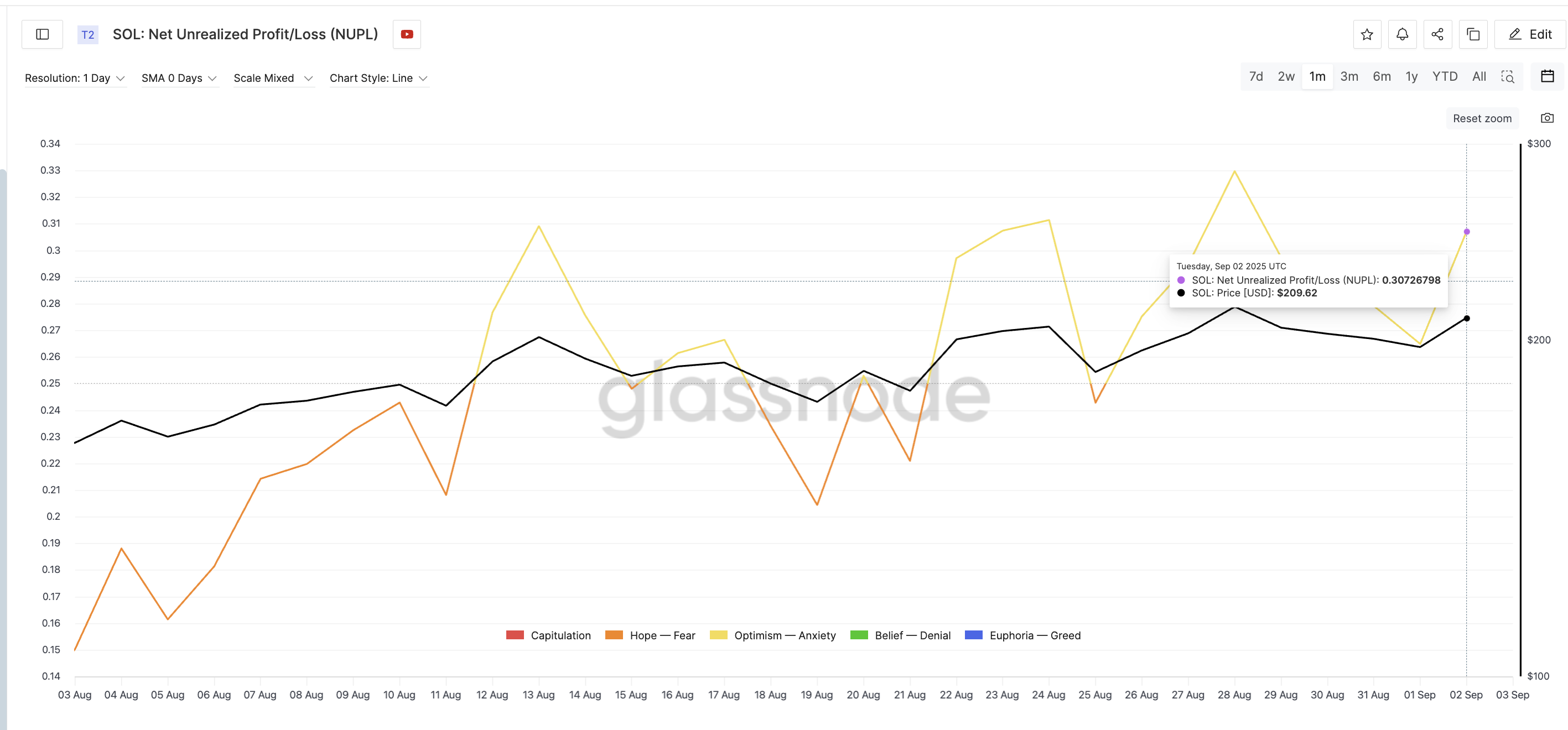

NUPL Signals Profit-Taking Risk

The Net Unrealized Profit/Loss (NUPL) metric measures the overall profitability of the market by comparing current prices to the cost basis of coins. Rising NUPL indicates more holders are in profit, which often coincides with periods of profit-taking.

Solana Traders Sitting On Profits:

Solana Traders Sitting On Profits: Over the past day, Solana’s NUPL has climbed about 15.4%, moving from 0.26 to 0.30 and forming another local peak. Previous peaks have consistently aligned with corrections. On August 28, when NUPL topped out, Solana slipped from $214 to $205 — a drop of 4.2%. Earlier, on August 13, NUPL reached 0.30, and prices corrected by almost 8%.

Now, with NUPL once again approaching a local high, and Solana’s price hovering near $210, the setup suggests another wave of profit-taking could emerge. But what if we told you that cashing out has already begun?

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Hodler Net Position Change Turns Negative

The Hodler Net Position Change tracks whether long-term holders — wallets that typically accumulate for months — are adding or reducing positions. A positive reading signals accumulation, while a negative one indicates long-term holders are cashing out.

Long-Term Solana Investors Are Cashing Out:

Long-Term Solana Investors Are Cashing Out: At present, Solana’s Hodler Net Position Change has dropped sharply into the red, crossing below –1.5 million SOL. This shows long-term investors are reducing exposure even as prices trend higher — a bearish divergence.

History reinforces this risk. In June 2025, a similar dip into negative territory coincided with Solana’s price correction. Only when the metric flipped back to positive did the rally resume. That pattern suggests the current red reading could deepen Solana’s pullback unless hodler conviction returns.

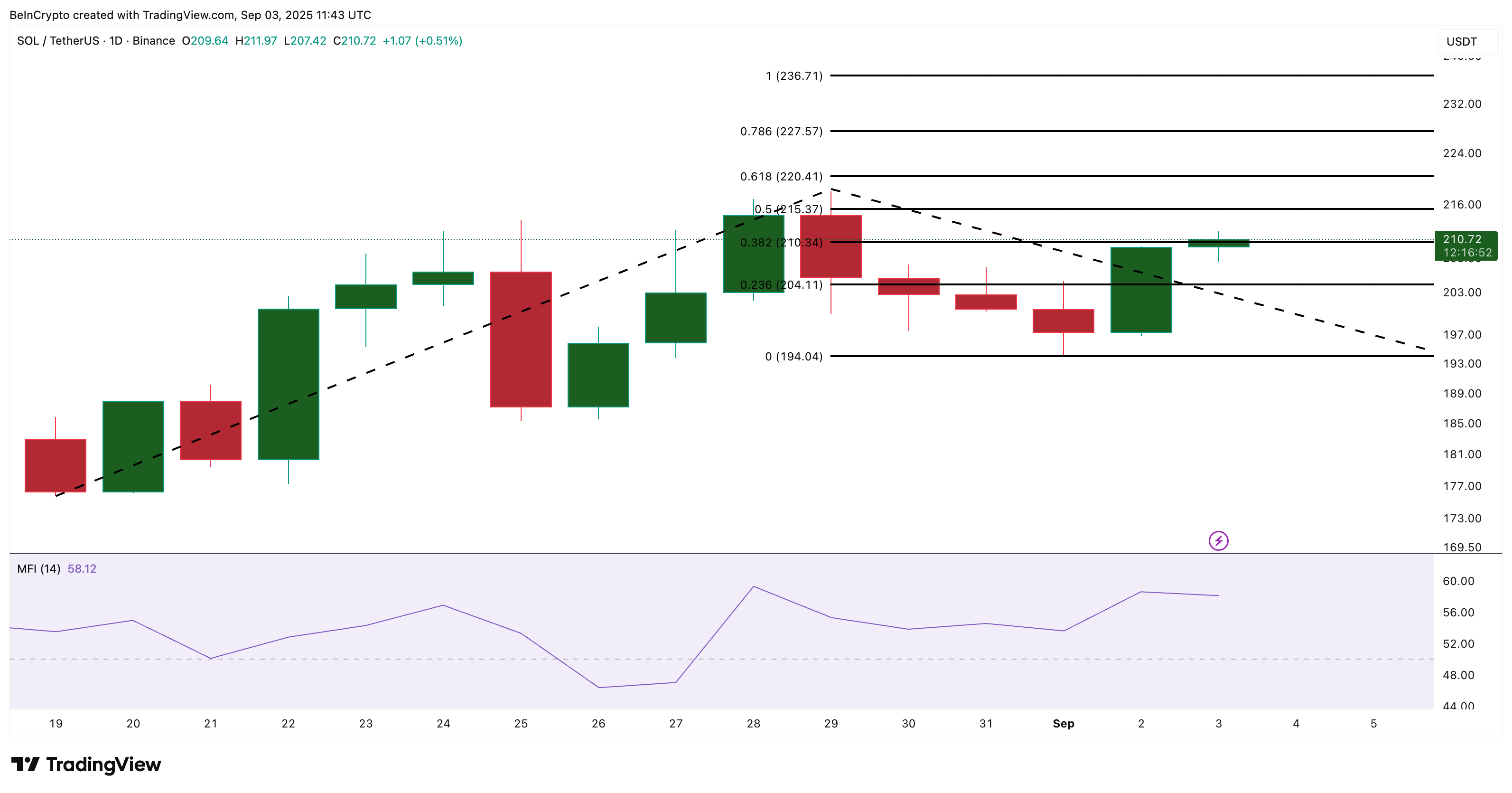

Solana Price Action and Money Flow Confirm Weakness

The Solana price action reflects the same hesitation. Solana trades just above $210 after a 30% monthly rise, but has been unable to convert bounces into full-fledged rallies. Key downside levels sit at $194 if $204 breaks, and lower if selling accelerates.

A clean breakout above $215–$220 would be needed to extend the uptrend and invalidate the correction-specific outlook.

Solana Price Analysis:

Solana Price Analysis: The Money Flow Index (MFI) — which measures inflows and outflows of capital relative to price — adds another cautionary sign. Although MFI climbed alongside Solana’s current price bounce, it has since trended lower as the price pulled back. This divergence suggests weaker dip buying: new money isn’t flowing in aggressively to support higher prices.

The lack of dip-buying followed by long-term investors cashing out, all while unrealized profits stay high, marks a risky trifecta for the Solana price.