SEC and CFTC issue joint statement: Allowing brokerages to trade cryptocurrencies!

01

Main points of the statement- Trading liberalization: Exchanges registered with the SEC or CFTC can legally conduct certain spot crypto asset trading.

- Regulatory cooperation: The SEC's "Project Crypto" and the CFTC's "Crypto Sprint" are interfacing for the first time, demonstrating a cooperative stance between the two major regulators.

- Market freedom: Officials emphasized that market participants should have the freedom to choose trading platforms. The goal of regulation is to create a fair and transparent environment, not to stifle innovation.

- Future-oriented: The statement emphasizes that this is not the end, but the beginning of a clearer regulatory path for digital assets in the U.S.

SEC Chairman Paul Atkins:

SEC Chairman Paul Atkins:  "Today's joint statement marks the return of innovation in the crypto asset market to the United States. Market participants should have the freedom to choose their trading venues. The SEC will work with the CFTC to ensure that the regulatory framework supports innovation and competition."

"Today's joint statement marks the return of innovation in the crypto asset market to the United States. Market participants should have the freedom to choose their trading venues. The SEC will work with the CFTC to ensure that the regulatory framework supports innovation and competition."

CFTC Acting Chair Caroline Pham:

CFTC Acting Chair Caroline Pham:  "Under the previous administration, we sent out chaotic regulatory signals, leaving no room for innovation. That chapter is over. Through cooperation, we can make the United States the global capital of crypto. Today's statement is not the end, but just the beginning."

"Under the previous administration, we sent out chaotic regulatory signals, leaving no room for innovation. That chapter is over. Through cooperation, we can make the United States the global capital of crypto. Today's statement is not the end, but just the beginning."

02

Implementation technical details This statement is not just empty talk; it also confirms a very important technical detail for implementation: The SEC's Division of Trading and Markets + the CFTC's Division of Market Oversight and Division of Clearing and Risk, which are essentially the core departments in both agencies responsible for "exchange compliance" and "market risk control."They will now take the lead in cooperation, helping those exchanges already registered with the SEC or CFTC to open a formal channel: to legally and compliantly list and operate some crypto spot trading products.

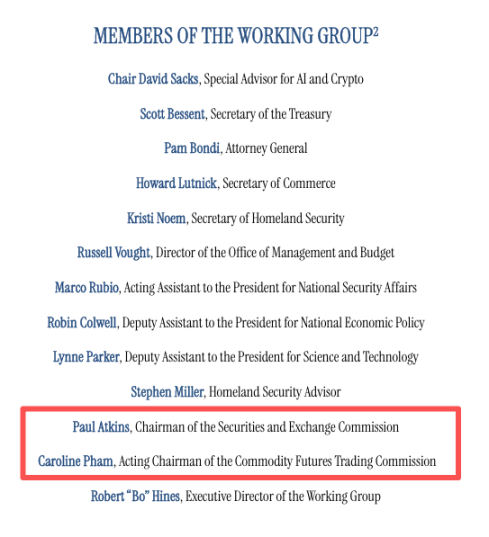

Behind this is a larger "top-level design"—the Presidential Working Group on Financial Markets (somewhat like a national-level fintech strategy group, with the heads of the SEC and CFTC ranking low in this group, just above the post-95 secretaries) had previously made recommendations:

The U.S. must seize the initiative in digital finance,

Do not let crypto innovation all move overseas,

Regulatory agencies must coordinate, and stop working at cross purposes.

So this SEC and CFTC cooperation aims to:

Provide compliant pathways for exchanges: For those willing to operate in the U.S., a clear track will be provided.

Keep the crypto market in the U.S.: No more watching innovation, trading volume, and capital flow overseas.

Great power competition strategy: Through clear rules, regain the "leadership in digital fintech" for the United States.

03

Occupying traditional exchanges This statement has a profound impact on the crypto industry. Because exchanges registered with the SEC or CFTC are all traditional large exchanges (such as NYSE, Nasdaq, CME, Cboe). If these exchanges directly support spot trading of cryptocurrencies, it means all traditional brokers can directly purchase cryptocurrencies—so why bother with spot ETFs? At that time, every stock investor with a U.S. stock account could directly buy spot crypto. Isn't that attractive?

If these exchanges directly support spot trading of cryptocurrencies, it means all traditional brokers can directly purchase cryptocurrencies—so why bother with spot ETFs? At that time, every stock investor with a U.S. stock account could directly buy spot crypto. Isn't that attractive?