Small Businesses Quietly Driving Bitcoin Adoption in 2025 — River

Contents

Toggle- Quick Breakdown

- Businesses Reinvest Profits Into Bitcoin

- Bitcoin’s Bull Run Backed by Business Activity

- Small Firms Leading the Charge

- Modest Allocations Still Common

Quick Breakdown

- River clients are reinvesting 22% of profits into Bitcoin, with real estate firms leading adoption.

- Small businesses have collectively acquired 84,000 BTC in 2025, fueling Bitcoin’s rally to $124,450.

- Most firms still invest modestly, with widespread misunderstandings slowing broader adoption.

Businesses Reinvest Profits Into Bitcoin

Bitcoin financial services firm River has revealed that its business clients are channeling an average of 22% of their profits into Bitcoin, highlighting a growing wave of grassroots adoption.

Source: River

Source: River According to River’s latest report released Wednesday, real estate companies have emerged as the leading adopters, with nearly 15% reinvesting their earnings into Bitcoin, currently trading at $110,446. Sectors including hospitality, finance, and software are allocating between 8% and 10%.

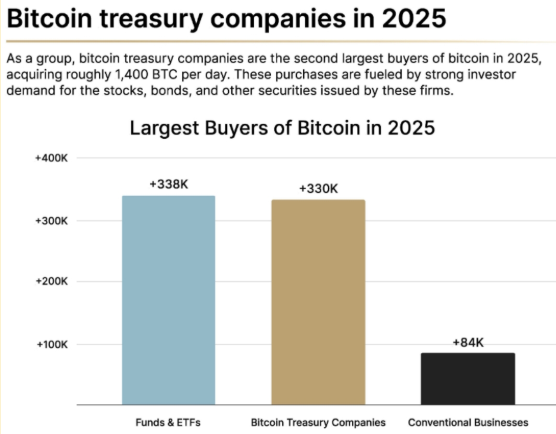

River research analyst Sam Baker noted that unconventional adopters such as fitness studios, painting firms, roofing contractors, and even religious nonprofits have collectively amassed 84,000 BTC this year, roughly a quarter of what institutional fund managers and large corporate treasuries hold.

Bitcoin’s Bull Run Backed by Business Activity

Baker stressed that improvements in Bitcoin accounting rules, clearer regulations, rising institutional confidence, and a strong market rally have created “ideal conditions” for adoption.

He added that these business allocations, alongside heavy buying from spot Bitcoin ETF issuers sometimes outpacing miner supply tenfold have fueled Bitcoin’s surge to a new cycle peak of $124,450.

This contrasts with the 2020–2021 bull cycle, which was largely retail-driven as businesses stayed on the sidelines while Bitcoin hit $69,000.

Small Firms Leading the Charge

River’s data shows that 75% of its business clients employ fewer than 50 workers, a factor Baker says gives smaller companies an advantage in adopting Bitcoin. With fewer bureaucratic hurdles, they can act faster than large corporations, where decision-making committees tend to avoid controversial moves.

Modest Allocations Still Common

Despite the growing trend, most businesses are only dipping their toes. River found that 40% of clients allocate between 1% and 10% of profits into Bitcoin, while just 10% commit more than half of their earnings.

Purchases by smaller firms are often minimal. For example, Rhode Island’s Western Main Self Storage added only 0.088 BTC ($9,830) last week, bringing its total holdings to 0.43 BTC. Baker cautioned that many businesses remain hesitant due to widespread misconceptions.