3 Reasons Why Ethereum Price Could Peak in Its Weakest Month

September has historically been the weakest month for Ethereum, with median returns showing losses of more than 12%. This year’s September started no differently. ETF outflows and broader market hesitation kept the Ethereum price under pressure in the opening week.

However, September 2025 might not follow history so neatly. Three bullish signs have emerged that could flip the script and push the Ethereum price toward new highs, in its historically weakest month. Well, that would be such an anti-climax.

Whales Buy Big as Weak Hands Exit

At press time, Ethereum trades near $4,406. Just this week, ETH touched lows of $4,261 but quickly regained ground.

Over the past 24 hours, the ETH price has remained mostly flat, showing no signs of a possible breakout on paper. Yet, whales have aggressively accumulated. The supply held by whale wallets outside exchanges increased from 95.72 million ETH to 99.41 million ETH in under a day. That represents a net pickup of 3.69 million ETH, valued at over $16 billion at current prices.

Ethereum Whales Add Millions In ETH: Santiment

Ethereum Whales Add Millions In ETH: Santiment Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Such large inflows from whales suggest confidence. While retail traders may hesitate, whales appear to be positioning for a rally.

But whale buys can meet resistance if retail, especially the short-term holders, sell. Well, that seems to have been taken care of, too. Their buying coincides with weak hands exiting.

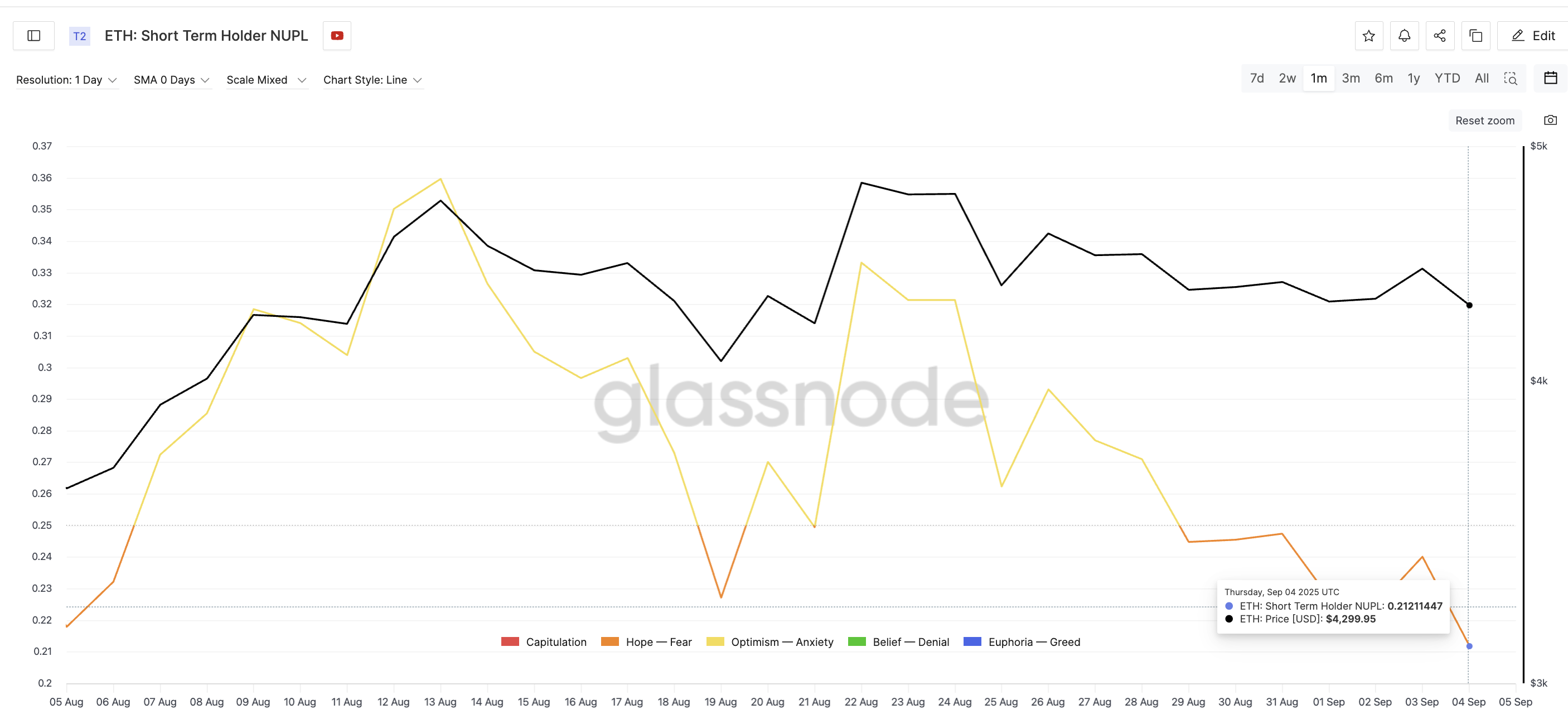

Weak Hands Exit As NUPL Takes A Hit: Glassnode

Weak Hands Exit As NUPL Takes A Hit: Glassnode The short-term holder Net Unrealized Profit/Loss (NUPL) metric — which indicates the profit or loss of short-term holders — has decreased to 0.21, the second-lowest level in a month. Historically, local lows in this metric often signal rebound points as hints at weak hands exiting and others sitting on smaller profits.

For example, on August 19, when NUPL was near 0.22, the Ethereum price was $4,077. In the following sessions, ETH rallied nearly 20% to $4,829.

This combination of whales buying and weaker holders selling paints a bullish picture. Even a 10% move (not 20%) from current levels could bring ETH close to testing new highs.

Ethereum Price Levels and RSI Divergence Validate Bullishness

The third reason for the all-time high-inclined bullishness comes from the charts themselves. Ethereum’s daily price chart shows a hidden bullish divergence. While ETH made a higher low, the Relative Strength Index (RSI) — which measures buying and selling momentum — made a lower low.

Ethereum Price Analysis: TradingView

Ethereum Price Analysis: TradingView This divergence is important because it usually signals trend continuation. It shows that sellers are running out of steam even as the Ethereum price holds firm. RSI divergences, when combined with whale accumulation, strengthen the upside case further.

For the Ethereum price, the key resistance to watch is $4,672 once it breaks $4,496. A clean break above this level opens the path to $4,958, and potentially higher into price discovery.

On the downside, invalidation comes if ETH breaks below $4,210, which would weaken the bullish case.