MicroStrategy’s Bitcoin Play Misses Out On S&P 500

Strategy, formerly known as MicroStrategy, has built its reputation as the world’s largest corporate Bitcoin holder, yet the company was left out of the S&P 500 during the latest rebalancing.

The decision surprised many in the crypto community, who expected the Michael Saylor–led firm to join the ranks of America’s most valuable companies. Notably, crypto trading platform Robinhood was included in the index.

Why Did Strategy Miss Out on S&P 500 Inclusion?

The S&P Dow Jones Indices does not disclose why specific firms are excluded, but its criteria require that companies post positive earnings over the last four quarters, including the latest quarter. Strategy’s financial record does not meet that bar.

Since pivoting to Bitcoin in 2020, the company’s results have swung sharply depending on BTC’s price.

In the second quarter of this year, rising Bitcoin valuations pushed Strategy’s net profit above $10 billion. However, just one quarter earlier, a BTC slump forced the firm to record a $4.2 billion net loss.

This inconsistency likely factored into the decision to exclude the stock despite its market capitalization and trading volume.

“MicroStrategy’s financials are dominated by unrealized gains/losses on Bitcoin holdings, which swing its income from big profits to big losses quarter by quarter,” crypto analyst Vincent Van Code said on X.

Indeed, Strategy’s potential addition to the S&P 500 carries weight beyond prestige. The index anchors trillions of dollars in institutional funds and ETFs, meaning inclusion often sparks additional buying pressure.

Strategy, which currently holds 636,505 BTC in its corporate treasury, could use that recognition to attract more mainstream investors to the emerging industry.

Considering this, some crypto community members argue that the index should adapt to the new financial reality Bitcoin represents.

“S&P 500 needs MSTR, MSTR doesn’t need S&P 500. Bitcoin deserves a spot in every retirement account,” Jeff Walton, the Vice President of Bitcoin Strategy at Strive, stated.

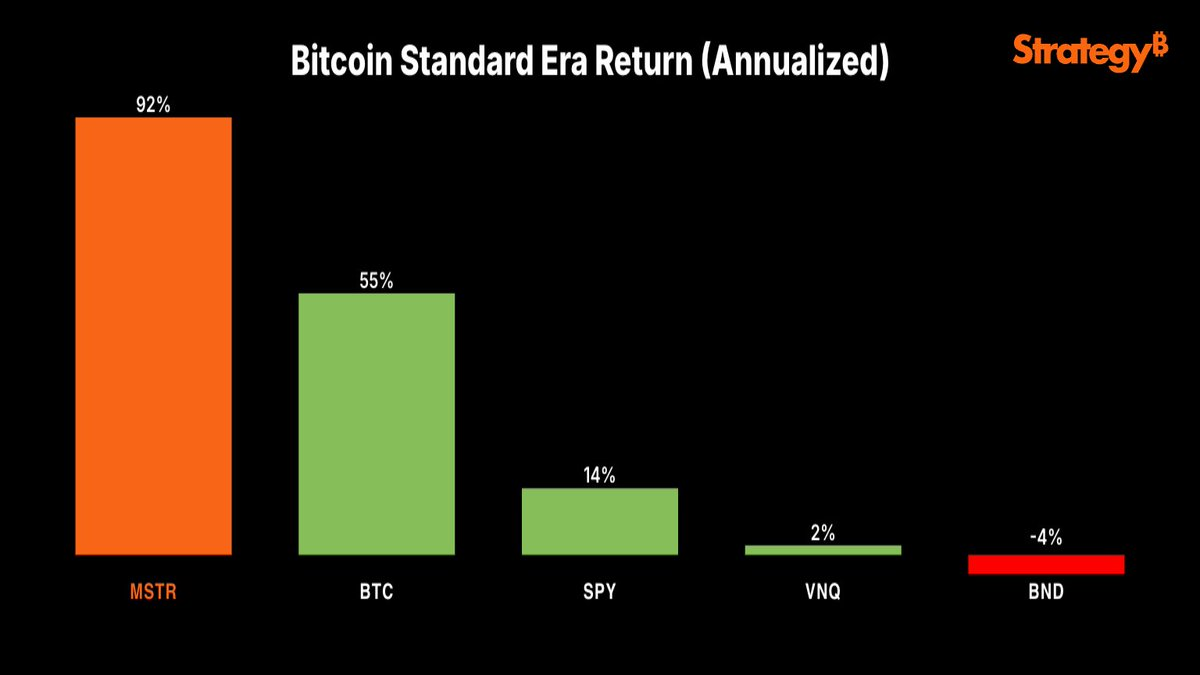

To corroborate this point, Saylor pointed out that the firm’s stock has delivered nearly double the return of Bitcoin itself. He added that it has outclassed traditional assets such as the S&P 500.

Strategy’s Stock Performance vs. S&P 500 Index. Source: Michael Saylor

Strategy’s Stock Performance vs. S&P 500 Index. Source: Michael Saylor Meanwhile, the next opportunity for inclusion will come in December, when S&P will announce its new quarterly adjustments.

Until then, Strategy’s exclusion highlights the tension between traditional financial metrics and digital assets’ volatile but growing influence.