Ondo’s (ONDO) governance token has sustained its crucial support level of $0.87 since mid-July. Over the past month, other altcoin markets have struggled to gain momentum, potentially due to the volatility surrounding Bitcoin (BTC) $0.036358 and Ethereum (ETH) $4,300 , which have shown no clear trend recently. The daily market structure for ONDO has been bearish, as the token has created lower highs over the past three weeks. Moreover, the Chaikin Money Flow (CMF) indicator has remained well below the -0.05 threshold, indicating significant capital outflows and seller dominance. If this selling pressure persists, ONDO may fall below its $0.87 support zone.

Is ONDO Currently Undervalued?

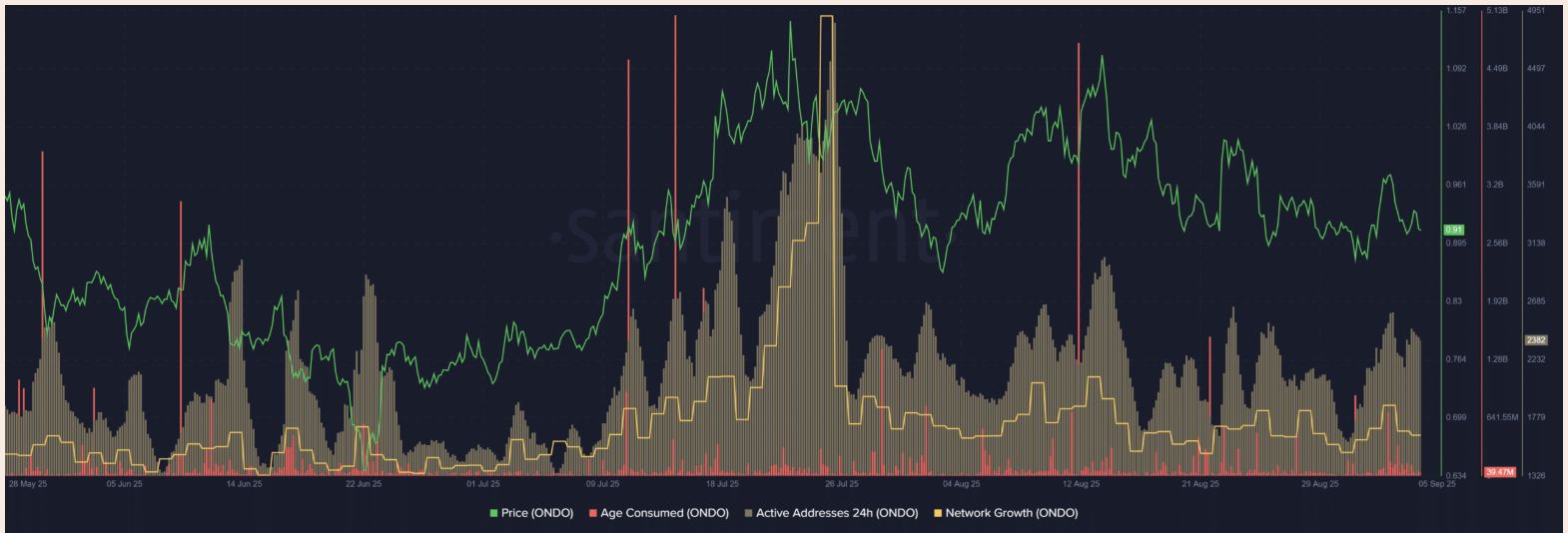

Data from Santiment reveals that network growth and daily active addresses metrics have remained relatively unchanged since late July. This stable trend suggests neither expansion nor contraction of the network, reflecting a positive development amid price volatility. Interestingly, the “age consumed” metric has also been relatively calm in recent weeks. This metric tracks the movement of previously inactive tokens. A surge in age consumed typically indicates the movement of large quantities of dormant tokens, often occurring before or during a sale. Although ONDO prices are at a significant support point, the absence of this activity is an encouraging sign.

The supply distribution reflects a steady buying pressure from wallets holding up to 1 million ONDO. In contrast, the number of wallets with larger investments ranging from 1 million to 100 million has slightly decreased over the past ten days. When considered alongside the age consumed metric, these factors suggest some accumulation signal for ONDO.

At the time of writing, the SOPR (Spent Output Profit Ratio) stood at 0.98. As SOPR indicates the ratio of the selling price to the paid price, values below 1 suggest that holders are at a loss. SOPR has hovered around 0.9-1 since late July, except for a brief rise to 1.4 in August. The recent low SOPR figures imply that ONDO might be undervalued, presenting a potential buying opportunity. However, as signaled by the CMF on the daily chart, such purchases also carry risks, and investors should be wary of further price losses.

Price Analysis

This analysis offers a balanced perspective on the current state of the ONDO token. On one hand, technical charts and indicators like the CMF point to short-term bearish trends and seller pressure, risking the token losing its critical $0.87 support level.

However, on-chain data paints a more optimistic picture. The stability in network growth and active addresses suggests a strong foundation and continued user interest. The calmness in the age consumed metric indicates that major investors (whales) are not panic selling and might be in a phase of accumulation. The continued purchasing activity by smaller investors further supports this thesis.

In conclusion, despite short-term bearish risks, ONDO could present a long-term buying opportunity from a fundamental analysis perspective. The SOPR being below 1 signifies that current prices are below average cost, indicating the token might be undervalued. Investors should carefully evaluate these conflicting signals and conduct their research before taking any position.