HBAR ETF Approval Odds Hit 90%: Can the Price Rally From Here?

The Hedera (HBAR) market just got a major catalyst. Bloomberg Terminal data shows that both Grayscale and Canary have filed for spot HBAR ETF, with the SEC setting November 11, 2025 as the final deadline. The approval odds sit at a strong 90%. That puts HBAR price in the same league as XRP, Cardano, and Polkadot, all lined up for possible approval before year-end. This development shifts Hedera price outlook from speculative to potentially institutional-grade, but the charts suggest timing will be everything.

HBAR Price Prediction: Why the HBAR ETF Deadline Matters?

ETFs are the bridge between traditional finance and crypto. A spot HBAR ETF means pension funds, hedge funds, and retail investors could gain exposure without touching crypto exchanges. With Grayscale’s involvement, liquidity is almost guaranteed if the product goes live. The November deadline sets a clear timeline for when this narrative could ignite. Between now and then, price will likely be shaped by positioning and speculative accumulation ahead of approval.

HBAR Price Prediction: Short-Term Weakness, Long-Term Setup

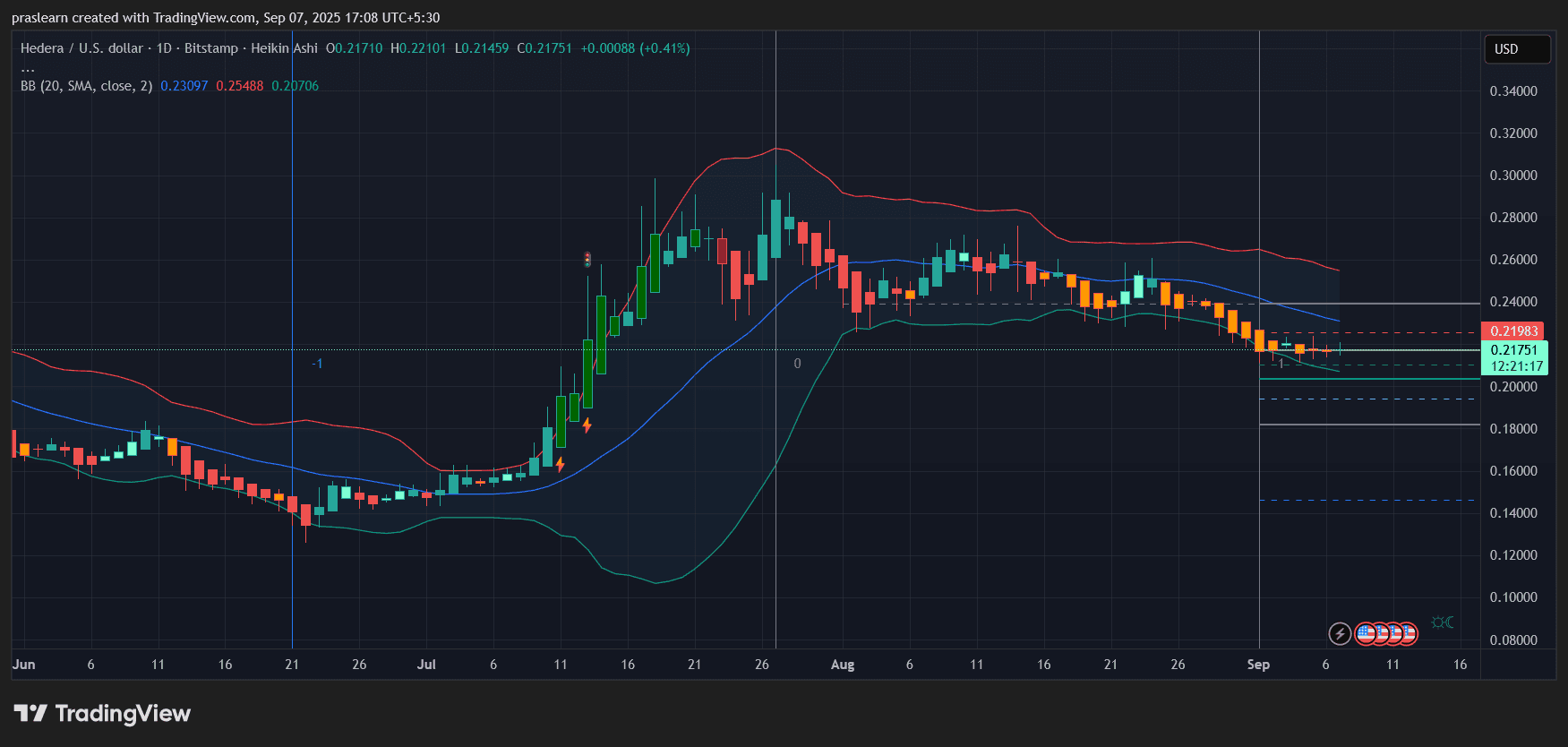

HBAR/USD Daily Chart- TradingView

HBAR/USD Daily Chart- TradingView Looking at the daily chart, HBAR price has been sliding since late July after its summer rally. The price is currently at 0.217, clinging just above the lower Bollinger Band. Momentum is clearly bearish, with candles printing red in a consistent downtrend. The middle band around 0.23 acts as immediate resistance, while the upper band near 0.25 marks the next ceiling.

Support zones stand out around 0.20 and 0.18. A break below 0.20 would open risk toward the mid-0.10s, but holding above 0.21 keeps the door open for a base-building phase. If ETF hype builds closer to November, we could see an explosive move once resistance near 0.24 is cleared.

Volatility Compression Signals a Bigger Move Ahead

The Bollinger Bands have narrowed compared to the July rally, a classic sign of volatility compression. This usually precedes a breakout move. Given the HBAR ETF news, the probability leans toward an upside breakout, but the timing is uncertain. Short-term traders should watch for a decisive daily close above 0.23, which would confirm that buyers are regaining control.

What Happens If HBAR ETF Approval Comes?

If the SEC gives the green light in November, HBAR price could quickly re-rate to new levels. Institutional inflows combined with FOMO from retail could push the token toward its July highs near 0.28 and potentially retest 0.30+. With supply locked in staking and governance, liquidity shocks are likely to magnify any demand surge. On the other hand, a rejection or delay would likely send Hedera price back into the 0.15–0.18 range.

Accumulation Window Before the Catalyst

$HBAR sits at a critical juncture. The HBAR ETF timeline provides a medium-term bullish driver, but the chart still leans bearish in the short run. Traders should watch for accumulation near 0.20–0.21, where risk-reward looks attractive ahead of November. A breakout above 0.23 would confirm upside momentum, while a breakdown below 0.20 would delay the bull case.

In short: Hedera price is in a quiet accumulation zone now, but once November approaches, the HBAR ETF decision could flip the switch into full-scale price discovery.