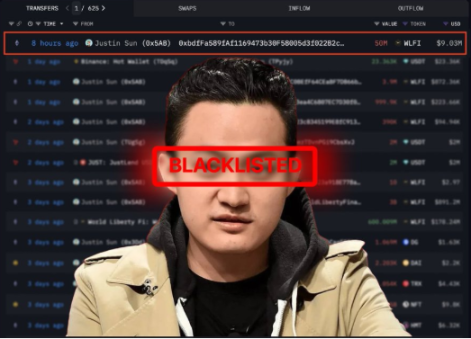

Trump-affiliated DeFi project WLFI bans Justin Sun's wallet: $90 million transfer sparks centralization concerns

Recently, the decentralized finance project World Liberty Financial (WLFI), supported by the Trump camp, has sparked major controversy:

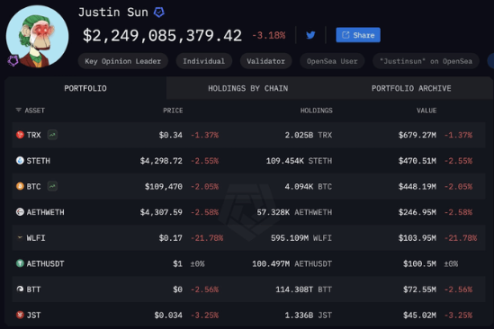

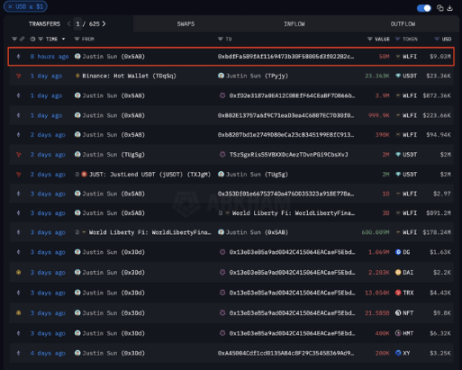

After a WLFI transfer worth $9 million, Justin Sun's wallet was directly blacklisted by the project team, and all his 595 million WLFI tokens (about $75 million investment) were frozen.

Event Review

As one of WLFI's largest investors, Justin Sun was originally seen as a representative of the project's long-term strategic capital;

However, on-chain data shows that he once transferred 50 million WLFI tokens into an exchange wallet;

Soon after, the WLFI smart contract activated the blacklist function, completely freezing all of Sun's tokens.

The project team explained that this move was to prevent "suspicious dumping behavior" and emphasized that 272 wallets had already been frozen for similar reasons. However, the freezing of the largest investor has led the community to question the real motives behind the action.

Justin Sun's Response

Justin Sun strongly opposed this freezing decision, stating:

He had no intention of cashing out, and the related transfer was merely an internal test;

He had previously promised not to sell WLFI early, and even planned to invest an additional $10 million;

In his public statement, he wrote: "Tokens are sacred and inviolable; this should be the fundamental value of blockchain."

Market and Community Reaction

The market immediately fell into turmoil: WLFI's price dropped from above $0.30 to $0.18, with daily trading volume surging;

In the short term, due to the freezing of Sun's 595 million tokens, the market's circulating supply decreased, and the price once rebounded by about 8%;

However, the question "If Sun's wallet can be frozen, then anyone's can" quickly spread, severely undermining investor confidence.

Deeper Issues

WLFI was originally designed to be a symbol of "free finance," serving as a decentralized alternative to traditional Wall Street. However, this incident exposed that:

The smart contract is still controlled by a centralized team, and key permissions can arbitrarily freeze funds;

The so-called "DeFi decentralization" may, in reality, have the same control issues as traditional financial institutions;

The handling of Justin Sun instead reveals the fragility of DeFi project governance and trust mechanisms.

Conclusion

The conflict between Justin Sun and WLFI is not just a dispute between an individual and a project team, but a clash between DeFi ideals and centralized power.

In the short term, WLFI has gained huge trading volume due to the high-profile incident, but price volatility and a crisis of trust are inevitable;

In the medium term, Justin Sun's reputation is once again under pressure. Although the TRON ecosystem was not directly affected, the concern that "if even Sun can be frozen, small investors have even less protection" will continue to ferment;

In the long term, WLFI's survival depends on whether it can prove itself to be a true free finance experiment, rather than just another "DeFi project with a centralized key."

This incident serves as a wake-up call for the entire industry: if decentralized protocols still retain back-end permissions to arbitrarily freeze assets, then so-called "free finance" may just be an illusion.