Ordinals and BRC-20: Effects on Bitcoin Nodes

Ordinals have introduced a new dimension to Bitcoin by embedding additional data such as tokens and images directly into the blockchain. Their rise has triggered discussion about how they reshape Bitcoin’s resource use and the responsibilities of those operating nodes. Research from BitMEX has examined these changes, highlighting the differences between BRC-20 token inscriptions and image-based inscriptions, and how each type affects Bitcoin in distinct ways.

In brief

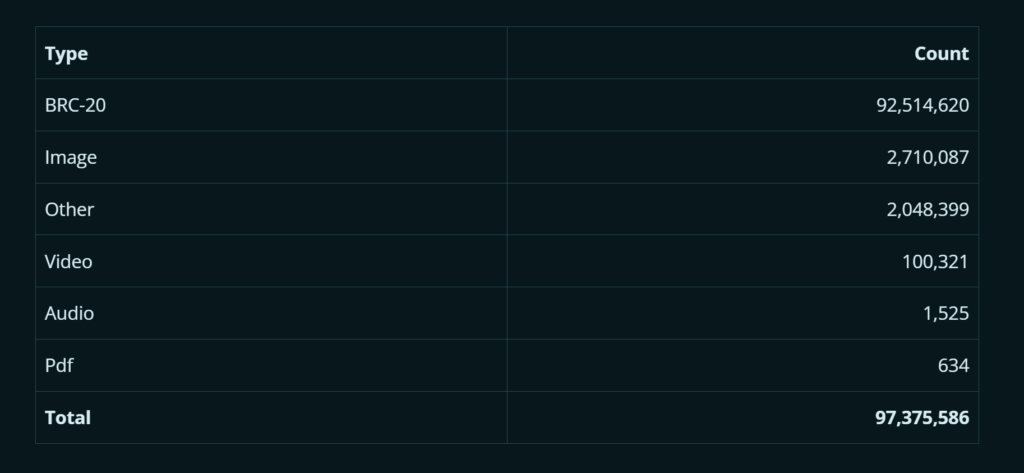

- BitMEX revealed Bitcoin has ~97.4M Ordinal inscriptions, with BRC-20 tokens dominating at 92.5M transactions.

- BRC-20 inscriptions use about 13.9B weight units, while images account for 8.9B and benefit from the Taproot witness discount.

- BitMEX tests found a weak positive link between larger Ordinals and faster verification, with R=11% when assume valid is off.

BRC-20 Activity and Ordinal Data Use

Bitcoin has seen a total of about 97.4 million Ordinal inscriptions. Most of these, around 92.5 million, are BRC-20 token transactions, while roughly 2.7 million are image inscriptions. In terms of transaction count, BRC-20 inscriptions dominate the network, whereas image inscriptions make up a small fraction of the total.

BRC-20 dominates Bitcoin inscriptions.

BRC-20 dominates Bitcoin inscriptions. Looking at data use, the situation is mixed. Although far fewer in number, Ordinal images occupy about 30.0 GB of blockchain space, slightly more than the 27.8 GB taken up by all BRC-20 transactions. While BRC-20 tokens make up most of the transactions, images account for a similar share of data on the blockchain.

Blockweight and Node Validation Costs

The impact is also evident in blockweight, Bitcoin’s measure of how much processing a transaction requires. BRC-20 inscriptions account for roughly 13.9 billion weight units, while images account for about 8.9 billion weight units.

BitMEX researchers noted that, when considering node running costs, images occupy a non-executed part of the Taproot witness field, which gives them a witness discount. This means they do not require signature checks during validation. BRC-20 inscriptions, by contrast, function like standard Bitcoin transactions and must undergo signature verification, which adds computational effort for nodes.

Long-Term Node Concerns: BRC-20 and UTXO Expansion

A more long-term concern for nodes is the apparent growth of the unspent transaction output set, or UTXO. Between December 2022 and September 2025, this set increased from 84 million to 169 million entries, largely due to BRC-20 tokens, since each inscription creates outputs that remain in the set. The expansion of UTXOs adds strain on nodes, particularly pruned nodes that discard older block data but must still maintain the current state.

Unlike images, BRC-20 inscriptions do not qualify for the witness discount and have paid higher fees for their blockspace. Since their launch, they have contributed over 5,000 BTC in transaction fees, reflecting their share of transaction costs. Images, in contrast, take up more storage but carry a lower effective cost per byte because of the witness discount.

Performance Testing and Node Impact of Ordinals

To assess performance impacts, BitMEX researchers carried out a test of initial blockchain download. The setup used eight CPU cores, 8 GB of memory, a one-terabyte solid-state drive, and a one-gigabit internet link, with Bitcoin Core version 29.1. The team measured how quickly blocks could be downloaded and verified, then compared those speeds with the level of ordinal data in the same blocks.

BitMEX researchers called the results inconclusive, but their analysis highlighted a few notable patterns:

- Regressions showed a positive relationship between larger ordinal data and faster verification speeds, though the effect was weak and inconsistent.

- With “assume valid” switched off, the positive relationship between ordinal size and verification speed increases. The team described this as probably the most accurate way to test, since most nodes verify signatures once synced.

- In this scenario, the strongest R value in the test is 11%, indicating that larger Ordinals account for a portion of the variation in verification times.

BitMEX researchers noted that their analysis does not endorse large Ordinal-related images as beneficial for Bitcoin. They highlighted both the potential drawbacks, such as limiting space for financial transactions, and the small potential advantage these images may provide for node operators.