GameStop Posts Narrower Loss in Q2 as Bitcoin Holdings Lift Balance Sheet

Contents

Toggle- Quick breakdown:

- GameStop’s Bitcoin investment strategy under Chairman Ryan Cohen

Quick breakdown:

- GameStop reported a narrower net loss of $18.5 million in Q2 2025, a significant improvement from the previous quarter.

- Revenue dropped to $673.9 million due to lower hardware and software sales, offset by growth in collectibles.

- The company holds 4,710 Bitcoin valued at $528.6 million, generating $28.6 million unrealized gains, strengthening its balance sheet amid ongoing restructuring.

GameStop Corp., the well-known video game retailer, has reported a significantly narrower net loss of $18.5 million for the second quarter of 2025, a marked improvement from prior quarters, boosted substantially by its Bitcoin holdings. The company disclosed acquiring 4,710 Bitcoin during the quarter for about $500 million, which appreciated to $528.6 million by quarter-end, yielding $28.6 million in unrealized gains that helped lift its balance sheet despite a decline in traditional revenue streams.

Total revenue for the quarter fell to $673.9 million, dragged down by lower hardware and software sales, while collectibles experienced robust growth, signaling the company’s continuing diversification efforts. This decline contrasts with GameStop’s Q2 2024 performance but highlights ongoing challenges in its legacy business segments.

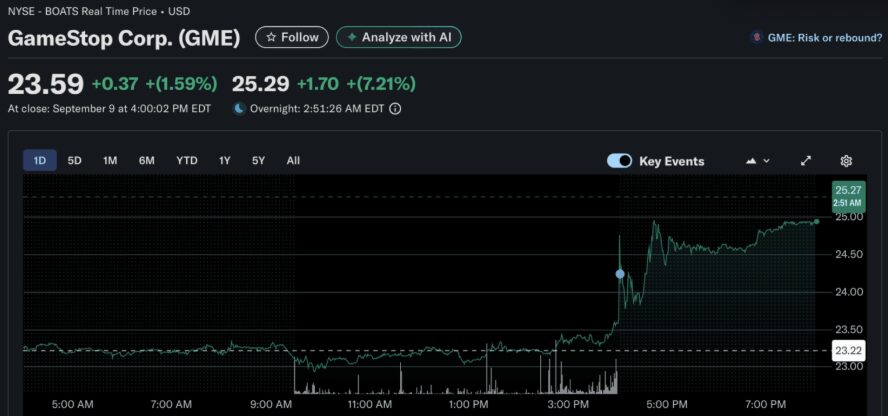

Source: Yahoo Finance

Source: Yahoo Finance GameStop’s Bitcoin investment strategy under Chairman Ryan Cohen

GameStop’s Bitcoin investment strategy, approved by its board in March 2025, marks a pivotal move into digital assets , aligning with a broader corporate transformation under Chairman Ryan Cohen. The company’s digital asset portfolio is now a core component of its financial structure, enhancing stability amid market volatility. This step places GameStop among a growing list of publicly traded companies embracing cryptocurrency treasury reserves as a strategic asset.

Additionally, GameStop has strengthened its financial footing through a $2.7 billion convertible bond offering earlier in the year and divesting non-core international operations in Canada and France. Cash and cash equivalents, excluding digital assets, were reported at approximately $6.1 billion.

Though traditional sales pressure continues, digital asset gains and strategic cost management reveal a reshaped GameStop emerging from transition, signaling potential for sustained fiscal resilience moving forward.

This financial report underscores GameStop’s dual approach of innovation in crypto investments and adaptation within its retail operations, positioning the company for renewed growth in an evolving market landscape.

Meanwhile, Public companies have collectively reached a significant milestone in the cryptocurrency market, now holding over 1 million bitcoins, which constitutes approximately 5.1% of Bitcoin’s total supply.