Copper Prices Soar: Geopolitical Strains and Green Energy Shift Drive Supply and Demand Disparity

The international copper market currently stands at a pivotal

Supply Disruptions: Compounding Global Challenges

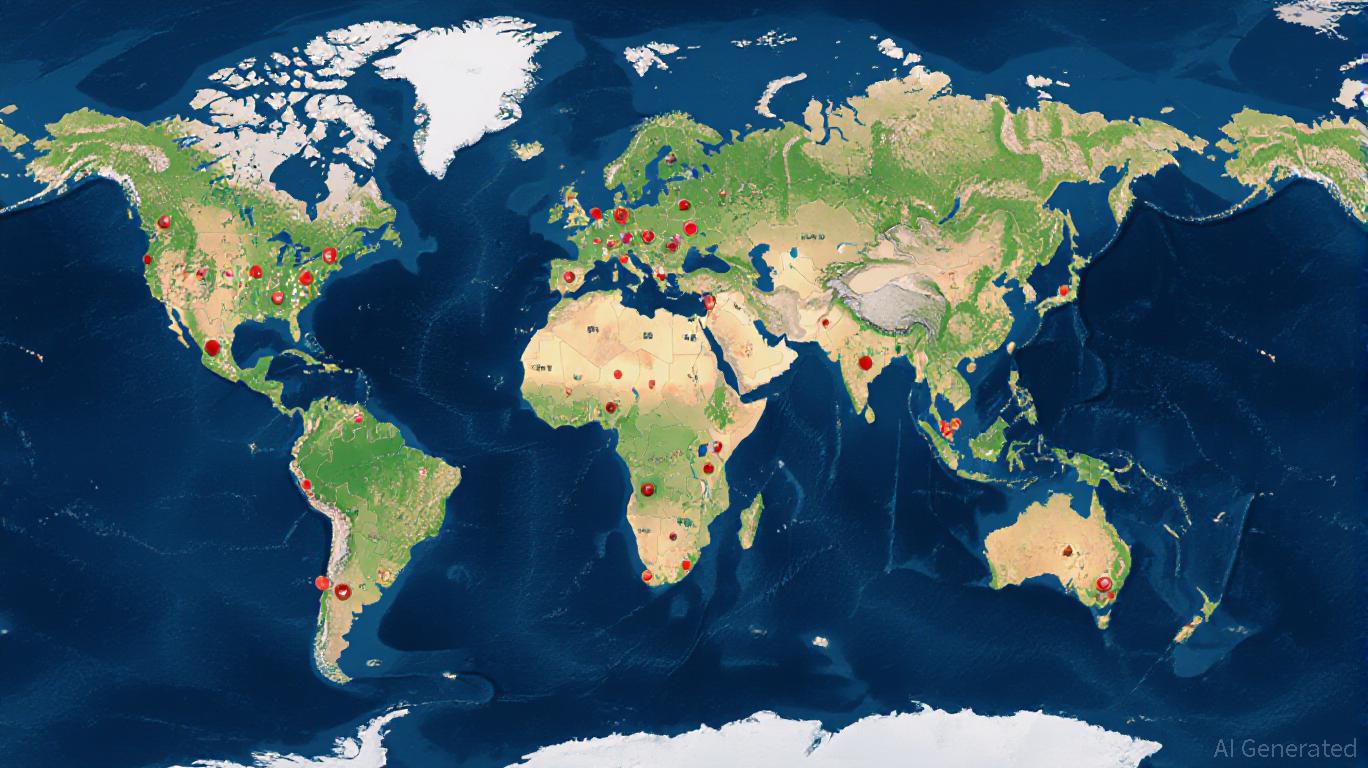

Copper output has experienced extraordinary instability over the last two years. Major producing nations—Chile, Indonesia, Mongolia, Peru, and Panama—collectively supply more than 40% of the world’s copper, yet all have been hit with overlapping issues:

Chile’s Twin Setbacks: As the globe’s top copper supplier, Chile’s production fell by 350,000 metric tons in 2025, hindered by labor disputes, water shortages, and slow regulatory approvals. The Escondida and Collahuasi mines, operated by

BHPand Glencore, are prime examples of sector vulnerability. Climate-induced water scarcity has led to operational delays, and tighter environmental rules have impeded expansions.Cobre Panamá Impasse: Since the end of 2023, Panama’s Cobre Panamá mine, accounting for 1.5% of global supply, has remained out of commission, as First Quantum Minerals halts arbitration and focuses on asset preservation. Although 121,000 metric tons of copper concentrate from the mine have been cleared for export, this temporary measure does not resolve ongoing legal and political obstacles. Panama’s economic growth has fallen sharply from 7.4% in 2023 to 2.9% in 2024, highlighting the stakes involved.

Emerging Market Hurdles: Indonesia’s Grasberg mine (down by 100,000 metric tons), Mongolia’s Oyu Tolgoi (down by 75,000 metric tons), and Peru’s Las Bambas (down by 120,000 metric tons) are also struggling. Issues such as political unrest, labor shortages, and logistical constraints have widened the global supply deficit to 7%.

Demand Acceleration: Clean Energy and AI Supercharge Consumption

Even as supply tightens, copper demand is rising at a record pace. The International Energy Agency (IEA) forecasts copper demand to surge by 70% by 2050, primarily fueled by electric vehicles (EVs), renewable energy installations, and expanding data centers. Each EV uses between 80 and 100 kilograms of copper, in stark contrast to the 20 kilograms needed for traditional vehicles. Simultaneously, the rise of AI-powered data centers and 5G technology is ushering in a copper-dependent digital era.

Ambitious decarbonization efforts by the U.S. and EU are further amplifying demand. Initiatives like the Inflation Reduction Act (IRA) in the U.S. and the Critical Raw Materials Act (CRMA) in Europe promote local refining and recycling, but progress lags behind the growing demand. Meanwhile, China—responsible for 60% of global refining—has introduced stricter export controls, further straining the market.

Speculation and Institutional Flows: ETFs and Central Banks Drive the Rally

Copper’s evolution from a raw material to a financial asset is evident in the surge of ETF investments. The iShares Global Copper ETF has witnessed a 45% increase in assets under management since January 2025, as major investors turn to copper as both an inflation hedge and a green energy proxy.

Central banks have also become key players. The U.S. Federal Reserve’s recent dovish stance, together with the European Central Bank’s recognition of commodity-fueled inflation, has encouraged long bets on copper. In China, the National Development and Reform Commission (NDRC) has signaled possible strategic stockpiling, adding to market anticipation.

Investment Outlook: Copper’s Bullish Short-Term Prospects

The intersection of fragile supply, escalating demand, and active speculation forms a compelling argument for copper as a high-conviction investment. Key drivers include:

Persistent Near-Term Supply Shortfalls: Until at least the first quarter of 2026, global copper supply is unlikely to rebound to pre-2023 volumes. Ongoing delays in resolving the Cobre Panamá dispute could keep markets tight through mid-2026 or beyond.

Policy Support for Green Initiatives: Legislative actions like the IRA and CRMA are set to further boost copper demand from 2026 onward, reinforcing upward price trends.

Institutional and ETF Inflows: Investment in copper ETFs is now surpassing that in precious metals such as gold and silver, reflecting a shift in investor focus.

Central Bank Policy Divergence: The contrast between dovish central banks in the U.S. and EU and more hawkish stances in China and India will create differing inflation pressures, enhancing copper’s value as a tangible asset hedge.

Risks and Offsets

Despite copper’s strong outlook, several risks remain:

- Unexpected Mine Restarts: Quick resolutions in Panama or Peru could alleviate supply pressures.

- Recycling and Alternatives: Innovations in urban mining or increased use of substitutes like aluminum could temper demand.

- Economic Downturns: A worldwide recession could slow investment in green energy.

Nonetheless, these are largely short-term concerns. The underlying drivers—energy transition, AI-fueled consumption, and fragmented supply chains—are expected to persist for years to come.

Conclusion: Copper – The New Strategic Resource

No longer just an industrial input, copper is emerging as a cornerstone of the modern economy. Those investing now—whether through copper ETFs, mining shares (such as First Quantum or BHP), or futures—could benefit from an extended market upswing. The key is to manage exposure carefully, balancing optimism with protection against both operational recoveries and economic headwinds. For investors with a horizon of 12 to 18 months, copper presents a rare mix of fundamental demand, geopolitical risk, and speculative momentum.