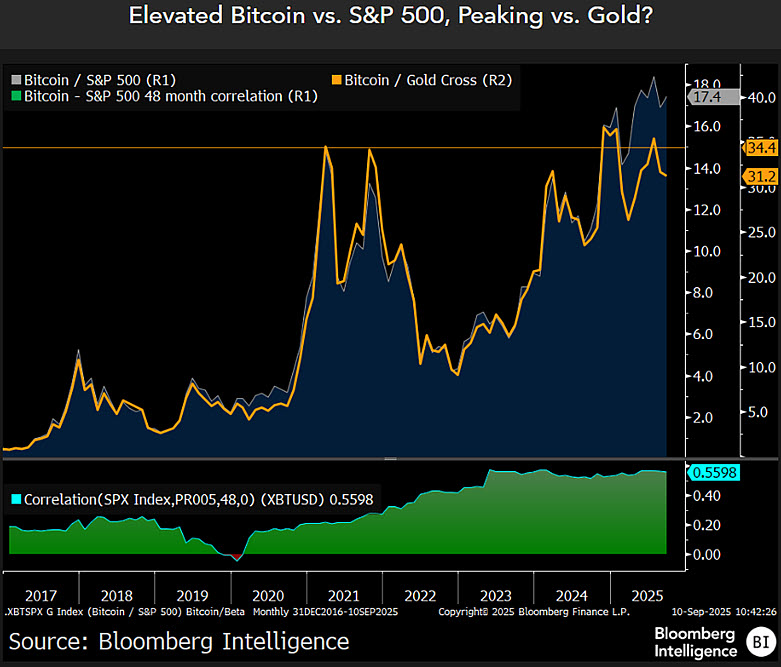

Bitcoin correlation with SP 500 reached a record 0.5598 (48-month) as of Sept. 10, showing BTC now moves more like a high-beta equity than a safe-haven. Investors should treat Bitcoin as a risk asset tied to equities, not as a stable store of value.

-

48-month correlation: 0.5598 (record high)

-

Bitcoin’s beta to the SP has traded above 10, peaking near 17 this year.

-

Correlation was <0.2 in 2017–2018; by 2025 BTC-to-gold performance crossed above 30.

Bitcoin correlation with SP 500 at a record 0.5598 — read how this shifts BTC from “digital gold” to a high-beta equity and what investors should do next.

What is Bitcoin correlation with the SP 500?

Bitcoin correlation with SP 500 measures how BTC price movements align with U.S. equities. As of Sept. 10 (48-month window) the correlation reached 0.5598, indicating a substantial and sustained co-movement with stocks rather than independent, non-correlated behavior.

How has Bitcoin’s correlation changed over time?

Historically, Bitcoin showed low correlation with equities (below 0.2 in 2017–2018). Since late 2019 the link strengthened, accelerating through pandemic liquidity cycles and Federal Reserve rate shifts. Michael McGlone, a Bloomberg Intelligence strategist, reported the latest 48-month correlation at 0.5598.

Source: Michael McGlone

Why does Bitcoin now behave like a high-beta equity?

Bitcoin’s market role has shifted because large-scale flows, institutional allocations, macro liquidity, and risk-on/risk-off dynamics increasingly drive crypto and equities together. BTC’s reported beta to the SP above 10 — with peaks near 17 — shows amplified sensitivity to equity moves.

What does this mean for the “digital gold” thesis?

Data indicates Bitcoin no longer reliably mirrors traditional safe-haven assets. Bloomberg’s analysis shows BTC-to-gold performance rose above 30 in 2025 while gold remained relatively stable. This supports the view that Bitcoin now acts more as a barometer of risk appetite than as a store-of-value hedge.

How should investors interpret these metrics?

Investors should update portfolio assumptions: treat BTC exposure as a high-volatility, high-beta allocation correlated with equities. Risk management should include position sizing, correlation monitoring, and stress tests tied to equity scenarios rather than solely to inflation or currency hedges.

Which indicators to monitor going forward?

- Rolling correlation windows (30-, 90-, 48-month)

- Bitcoin beta vs. SP 500 and NASDAQ

- Macro liquidity indicators (Fed policy statements, money supply trends)

- Flows into crypto-focused institutional products

Frequently Asked Questions

How high is Bitcoin’s beta to the SP 500?

Bitcoin’s beta against the SP has consistently traded above 10 and approached peaks near 17 this year, meaning BTC swings many multiples for each percentage point move in equities.

When did Bitcoin stop being uncorrelated with stocks?

Correlation began rising steadily after late 2019, accelerating through pandemic-era liquidity and subsequent monetary policy cycles, moving from sub-0.2 levels in 2017–2018 to the current ~0.56 (48-month).

What data sources confirm these trends?

Industry analysis and market-data providers, including Bloomberg Intelligence commentary from Michael McGlone, document the correlation and beta metrics referenced in this report (presented here as plain text sources).

Key Takeaways

- Correlation spike: 48-month BTC-SP correlation at 0.5598 signals elevated co-movement.

- High beta: BTC’s beta >10 (peaks near 17) implies amplified volatility relative to equities.

- Investment stance: Treat Bitcoin as a risk-on asset; update risk management and allocation frameworks accordingly.

Conclusion

Empirical metrics show Bitcoin correlation with SP 500 has risen to record levels, reshaping BTC’s market role from a potential store-of-value to a high-beta equity proxy. Investors and advisors should reassess allocations, monitor correlation windows, and prioritize risk controls as macro conditions evolve. COINOTAG will continue to track these metrics and market impact.