MYX Correction Ahead? Smart Money Says It’s Just a Dip

MYX Finance (MYX) price exploded nearly 1,500% in the past week, even printing a fresh all-time high just hours ago. Trading around $17.60 at press time, the token has cooled slightly, slipping 1.5% on the daily chart and consolidating for the past three sessions.

After such a parabolic move, some profit booking was expected. But one “smart” cohort continues to add, suggesting this profit booking-led correction may be nothing more than a short dip before the MYX price pushes higher.

Selling Pressure And Technical Weakness Signal A Correction

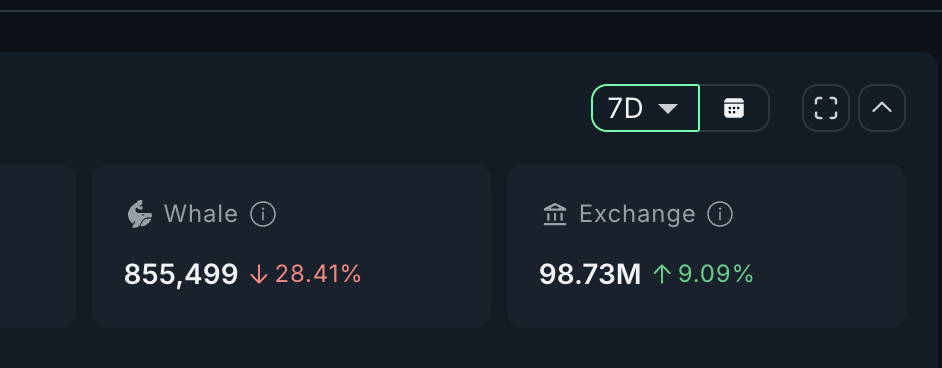

The first signs of strain have come from whales. Over the past seven days, whale wallets sold about 339,499 MYX, worth close to $5.9 million. Their total holdings now sit at 855,499 MYX.

MYX Experiences Selling Pressure:

MYX Experiences Selling Pressure: Exchanges have also absorbed new supply, with balances climbing by 8.23 million MYX to a total of 98.73 million tokens — roughly $143.6 million at current prices. Rising exchange balances usually suggest holders are preparing to sell, adding more supply-side pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

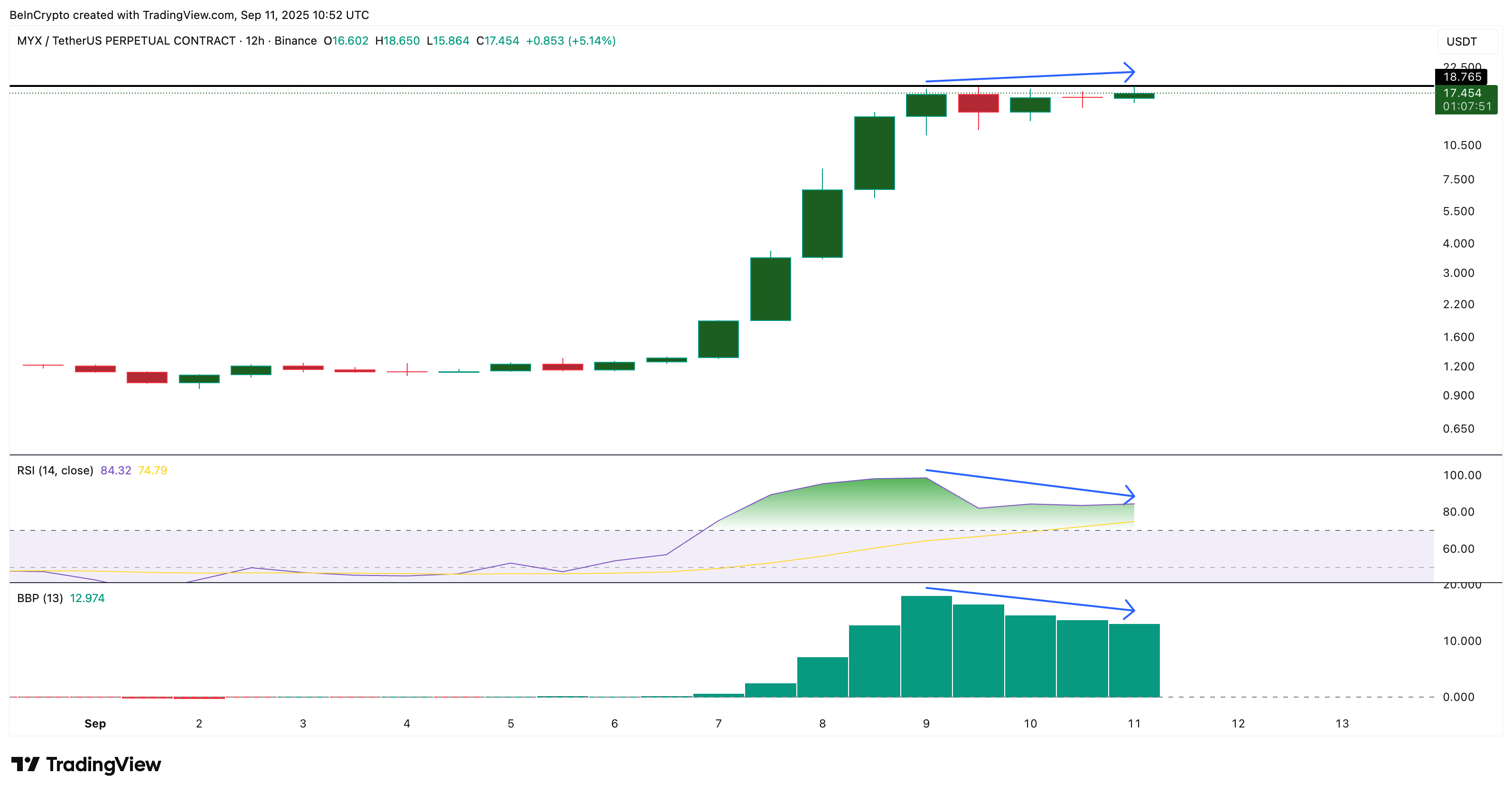

This selling has already shown up on the charts. On the 12-hour timeframe, MYX price made a higher high while the Relative Strength Index (RSI), which measures momentum, slipped to a lower high.

MYX 12-Hour Price Chart With Divergence:

MYX 12-Hour Price Chart With Divergence: This “bearish divergence” is often a warning that buyers are losing strength even as the price climbs. Although on such a short time frame with only a few candles, this usually signals a pullback rather than a full reversal.

The Bull/Bear Power Index, which compares the force of buyers and sellers, tells a similar story. Bulls remain in control, but their dominance has weakened. Together, these factors indicate a fading of bullish momentum and make a pullback increasingly likely.

Why A MYX Price Pullback May Be Limited

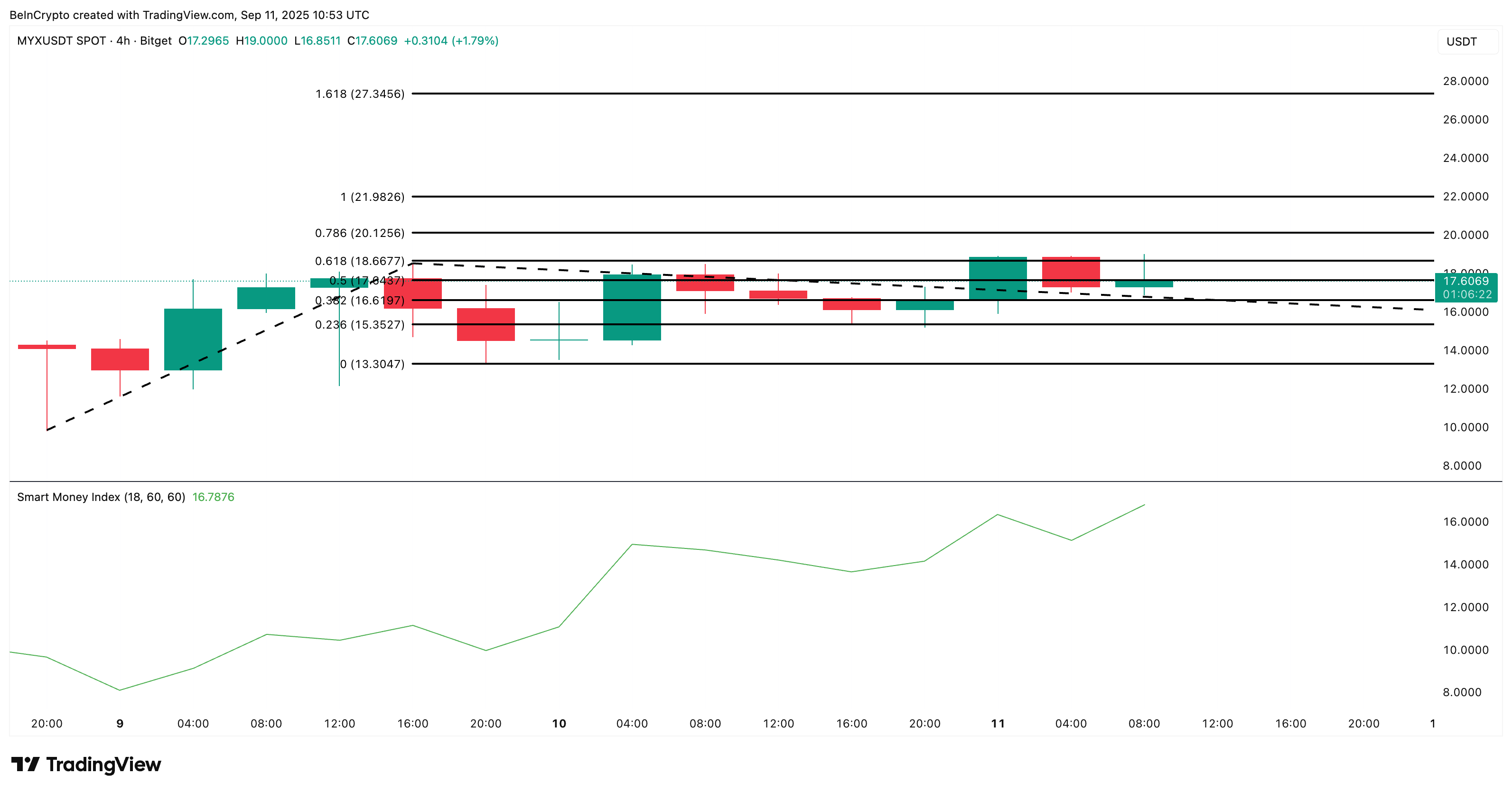

While momentum is cooling, the 4-hour chart shows the correction may not evolve into a collapse. The 12-hour chart gives a broad view, but the 4-hour view is valuable for tracking how dips unfold inside that larger trend.

MYX Finance has been range-bound since September 9, but the Smart Money Index (SMI) continues to climb. That means short-term capital — the kind looking for quick gains — is still being deployed into MYX Finance.

MYX Price Analysis:

MYX Price Analysis: This rise in SMI aligns with the short-term bearish divergence. Sellers are adding pressure, but active buying shows dips are being absorbed. That suggests the correction is more likely a pullback inside an uptrend than the start of a reversal.

The Smart Money Index (SMI) tracks the activity of capital often considered more informed or tactical.

Key MYX price levels remain important. Support is visible at $16.61 and $15.35.

A MYX price drop below $13.30 would break the bullish setup, while a daily close above $18.66 could clear the path toward $20.12–$27.34.