Key Notes

- Inflation-adjusted gold prices hit record highs above $3,610 per ounce for the first time since the 1980s.

- Central banks in emerging markets are increasing gold reserves to reduce dollar dependency amid global tensions.

- Bitcoin maintains correlation with gold at $114,600 as both assets benefit from lower interest rate expectations.

The inflation-adjusted price of gold reached a record high for the first time since the 1980s while trading above $3,610 per ounce, according to a recent post by The Kobeissi Letter on September 11. Rising inflation plus upcoming interest rate cuts are “gold’s dream setup,” highlights the analyst, which also relates to Bitcoin’s value proposition—historically correlated to gold and both tied to economic data.

There it is:

Inflation adjusted gold prices have officially hit a new record high for the first time since the 1980s.

Inflation + rate cuts = gold's dream setup. pic.twitter.com/eS7blRIHkQ

— The Kobeissi Letter (@KobeissiLetter) September 11, 2025

Basically, the inflation-adjusted gold price takes historical nominal prices and multiplies them by the ratio of the current US Consumer Price Index (CPI) to the historical CPI at that time. This expresses all prices in equivalent current dollar purchasing power for accurate long-term comparisons.

The latest US CPI data released today for August revealed annual inflation at 2.9%, climbing from July’s 2.7% and exceeding expectations, which increases the adjustment impact on gold’s historical price. Meanwhile, Core CPI remained steady at 3.1% year-over-year , signaling persistent price pressures in non-volatile categories.

On the other hand, data released on September 10 for the US Producer Price Index (PPI) for August came in lower than expected, at 2.9% against the forecasted 3.3%. PPI is usually seen as an early indicator for the CPI in the next two to three months, signaling potentially declining inflation—which has brought a speculative 50 basis-point interest rate cut to the table for the Fed’s September 17 meeting, as Coinspeaker reported yesterday.

Bitcoin and Gold Price Analysis

The demand for gold in 2025 has surged, pushing prices upward, powered by a different set of factors. Global tensions, including trade disputes, political instability, US elections, Middle East conflicts, and tariff increases under policies like those emphasized by President Trump, have heightened gold’s appeal as a safe-haven asset.

Central banks, particularly in emerging markets like China, India, Russia, and Turkey, have ramped up gold reserves to diversify away from the US dollar amid concerns over its stability and sanctions. On that note, the US Dollar Index declined significantly, making gold more affordable for international buyers and reflecting diminished confidence in US economic leadership.

Inflation and interest rate cut expectations add up to the equation, as lower rates reduce the opportunity cost of holding gold, which yields no interest, fueling its price surge. Interestingly, the same logic above applies, in part, to Bitcoin and other cryptocurrencies, usually seen as a risk-on bet against inflation. BTC, in particular, is often called “digital gold.”

As of this writing, Bitcoin is changing hands at around $114,600 per coin and gold at $3,635 per ounce.

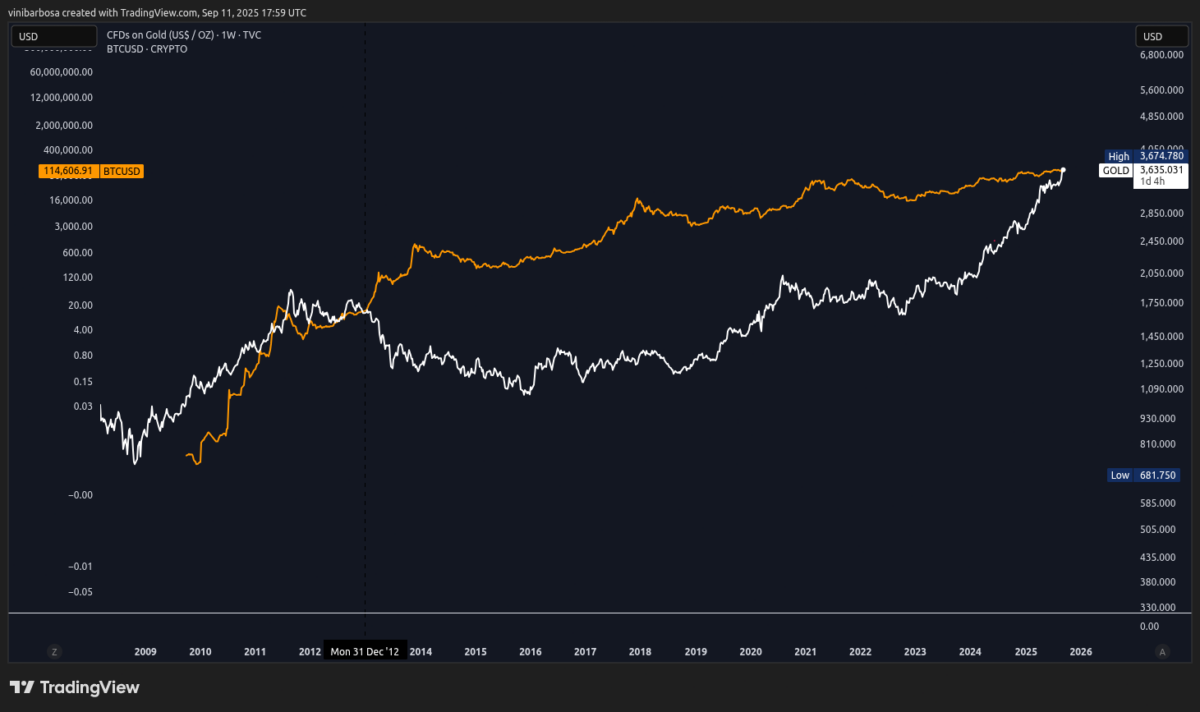

Historically, both assets have seen similar cyclical behavior, with Bitcoin decoupling from the leading commodity in December 2012 to massively outperform gold. Nevertheless, TradingView’s gold vs. BTC adjusted scale shows a balance was found between the two assets in September 2025.

Gold vs. Bitcoin weekly (1W) price chart | Source: TradingView

This recovery highlights financial maturity for the leading cryptocurrency, reducing volatility and slowing down Bitcoin’s growth against its traditional pair, gold. However, market indicators like Tether minting 2 billion USDT for the first time since December 2024 suggest cryptocurrencies could regain momentum and potentially experience a new rally, similar to past cycles, though so far lagging against gold’s historical performance, weighted by previous years.

next