Ethena Labs has pulled its proposal to issue Hyperliquid’s USDH stablecoin, founder Guy Young announced on X.

The decision follows community feedback, while the message expresses strong support for another contender, the Native Markets team.

Young acknowledged the concerns raised by the community, noting that Ethena is not a Hyperliquid-native team, has multiple product lines outside of USDH and does not limit its ambitions to a single partner exchange.

Sponsored

“It appears the decision is a near certainty now and we will respectfully be withdrawing our proposal to allow validators to signal their support elsewhere if they want to,” Young said, explaining the team’s decision.

While Ethena will no longer pursue the USDH bid, Young emphasized that the team remains fully committed to building on Hyperliquid.

He outlined a series of initiatives that the team will continue to develop, including hUSDe native synthetic dollars, USDe-enabled savings and card products, hedging flows on Hyperliquid, and HIP-3 markets, such as reward-bearing trading collateral, modular prime broking, and perpetual swaps on equities.

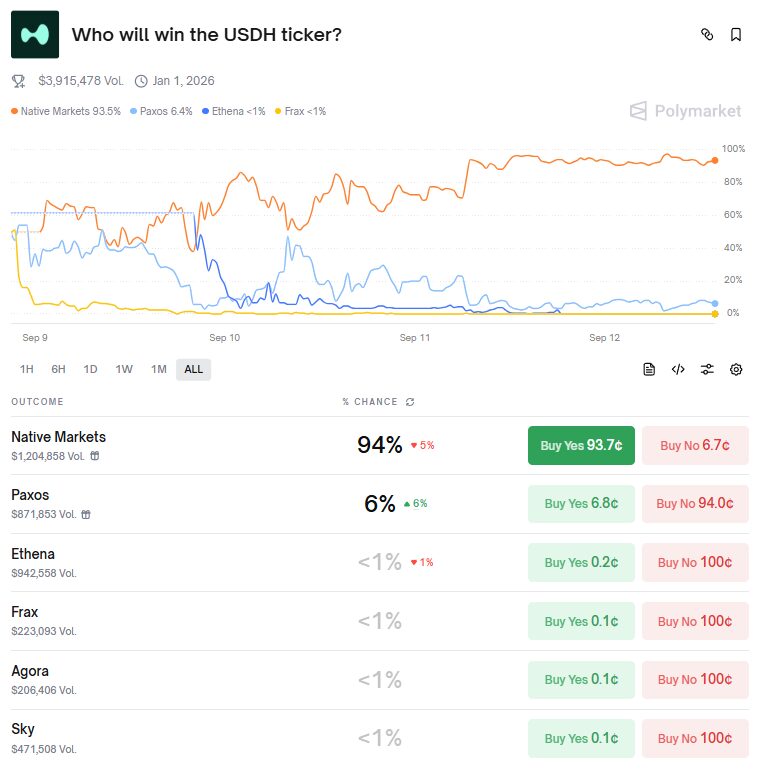

Young also congratulated the Native Markets team, one of Ethena’s main competitors for the Hyperliquid USDH bid. With Ethena stepping back, Native Markets has emerged as the frontrunner, with prediction markets giving it a 94% chance of winning, according to Polymarket.

Source: Polymarket

Source: Polymarket The team behind the new organization includes Max Fiege, a Hyperliquid investor and adviser; MC Lader, former president and COO of Uniswap Labs; and Anish Agnihotri, a blockchain researcher and former Paradigm contributor.

The market reacted sluggishly to the news. After an initial jump of nearly 3%, Ethena (ENA) pulled back to around $0.76, roughly the same level as before the announcement. As of Friday, ENA was trading at about $0.76, with its 24-hour trading volume falling 10% to just over $629 million.

On the Flipside

- Critics warn the USDH process may have been stacked for Native Markets, citing its weak track record and unusually fast bid proposal.

Why This Matters

Ethena’s exit underscores the power of community backing in deciding which projects gain traction on Hyperliquid, while clearing the path for Native Markets to take the lead in issuing USDH.

Stay in the loop with DailyCoin’s top crypto news:

Hayes Slams Stack Into Ethena (ENA) As Binance Lists USDe

Forward Industries Bets on Solana with $1.65 Billion PIPE Deal

People Also Ask:

Ethena is a crypto protocol known for its synthetic dollar product, USDe, and related financial tools. The project focuses on creating stable, yield-bearing digital dollars that can be used across DeFi and centralized platforms.

USDe is backed by derivatives and hedging strategies rather than traditional bank deposits. This design helps reduce reliance on centralized banking and makes it usable across decentralized finance (DeFi).

Ethena focuses on synthetic stable assets, savings tools, and DeFi-native services like collateral for trading and hedging flows across exchanges.

Hyperliquid is a decentralized exchange (DEX) specializing in perpetual futures and derivatives trading. It has its own ecosystem and governance process, including validator voting for new initiatives such as issuing stablecoins.

Stablecoins provide a consistent unit of account and reduce volatility risks. On trading platforms, they serve as base collateral and settlement currency.