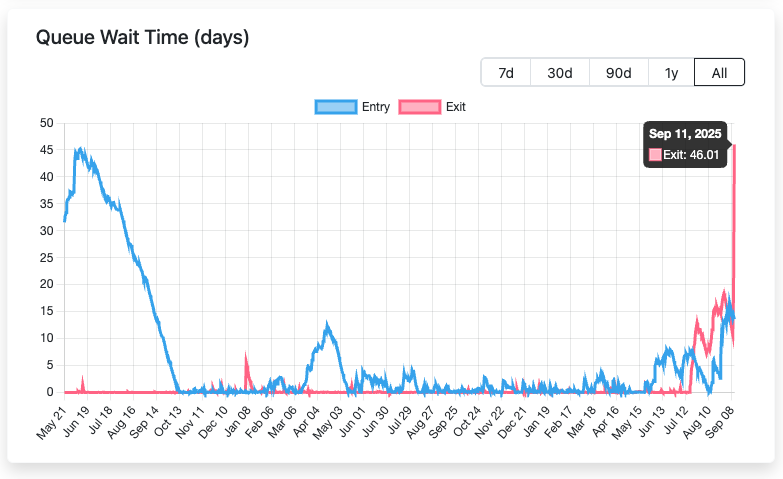

Ethereum staking exit times have surged to a record 46 days, creating liquidity stress for stakers, while Cardano liquid staking offers immediate liquidity and renewed ADA whale accumulation, positioning Cardano as a flexible alternative for investors seeking accessible staking exposure.

-

Ethereum staking exit times hit 46 days, causing significant unstake delays for ETH holders.

-

Cardano liquid staking provides instant access to capital without long exit queues, boosting user flexibility.

-

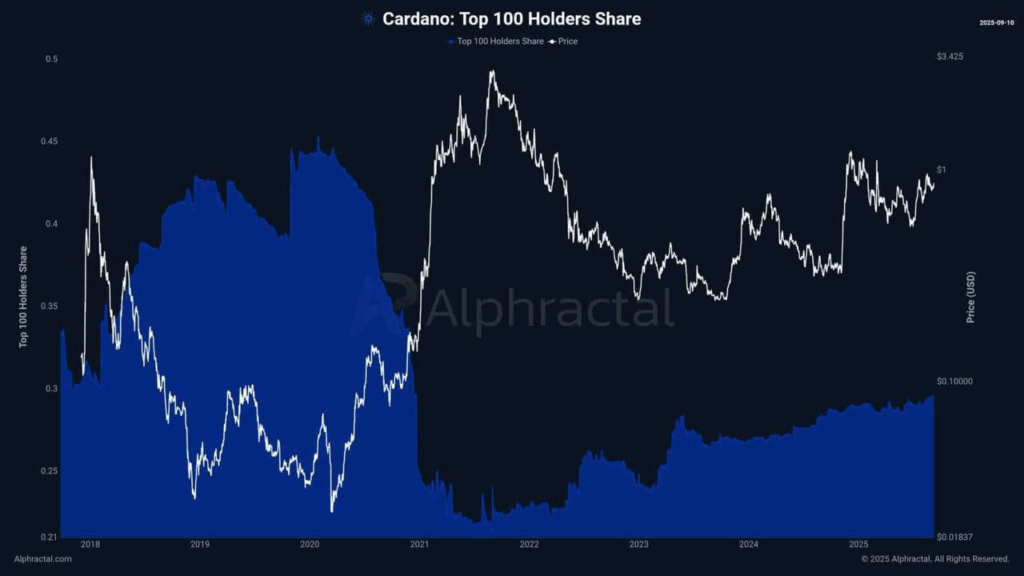

Top 100 ADA wallets show rising concentration in 2025, indicating strategic accumulation by whales.

Ethereum staking exit times surge to 46 days; Cardano liquid staking and ADA whale accumulation signal a liquidity and confidence shift—read our concise analysis.

What are Ethereum staking exit times and why do they matter?

Ethereum staking exit times measure how long validators and stakers must wait to withdraw staked ETH. Longer exit times reduce liquidity and raise counterparty risk, as stakers cannot freely access funds during market shifts. Recent queue growth to 46 days highlights systemic stress in rigid staking models.

How does Cardano liquid staking differ from Ethereum’s model?

Cardano liquid staking swaps locked ADA for a liquid tokenized representation, enabling immediate trading or use while keeping protocol-level validation intact. Data from Cardanians and analyst Kamil (plain text sources) show Cardano’s liquid designs avoid lengthy exit queues. This reduces opportunity cost and preserves portfolio agility.

Ethereum’s recent exit queue spike on September 11, 2025, pushed unstake wait times to 46.01 days. This number is driven by a surge in withdrawal requests paired with validator churn constraints. Analysts note that while staking secures networks, extended lock-ups change risk profiles for retail and institutional participants.

Cardano’s approach emphasizes continuous access. Liquid staking instruments let users redeploy capital while maintaining exposure to staking rewards. That difference matters for traders, yield managers, and long-term holders weighing protocol design trade-offs.

Source: Cardanians

Why are ADA whales accumulating in 2025?

Data analysis indicates Cardano’s top 100 wallets have expanded holdings through 2025. ADA whales increased concentration from ~0.28 shares to near 0.29 shares while price hovered around $1. This quiet accumulation suggests strategic confidence by large holders and a shift in supply distribution toward long-term wallets.

Historical context matters. In 2020, top holders peaked at 0.45 shares before markedly reducing exposure in 2021, coinciding with a price peak near $3.425 (plain text source: historical market records). From 2022–2024, concentration stabilized between 0.25–0.28 shares. The 2025 uptick signals renewed conviction amid contrasting staking dynamics on competing chains.

Source: Kamil

How do staking liquidity and exit mechanics compare?

Compare mechanics quickly using the table below. It highlights key differences that affect capital flexibility and market risk.

| Exit wait time | Up to 46 days (exit queue) | Instant (liquid tokenized representation) |

| Liquidity | Low during queue | High via liquid tokens |

| Suitability | Long-term stakers; less flexible | Traders, yield managers, and flexible investors |

| Observed 2025 trend | Record exit queue surge | Increased whale accumulation |

How should investors assess staking risk?

- Check exit queue metrics and recent trends for the network.

- Compare liquid staking availability and tokenization options.

- Evaluate concentration among top holders and on-chain supply trends.

- Factor in protocol-level penalties, validator churn, and governance changes.

Frequently Asked Questions

What caused Ethereum’s exit queue to reach 46 days?

High withdrawal volume combined with validator removal and protocol safety limits led to queue growth. The network processes exits at a capped rate, which caused an extended backlog in September 2025.

Can liquid staking tokens fully replace native staked assets?

Liquid staking tokens replicate economic exposure to rewards but introduce protocol and counterparty nuances. They are useful for liquidity but require assessing token design and peg mechanics.

Key Takeaways

- Exit delays matter: Long Ethereum unstake times reduce liquidity and increase risk for stakers.

- Liquid staking advantage: Cardano’s liquid staking offers immediate access and flexibility for capital deployment.

- Whale accumulation: Rising concentration among ADA top holders in 2025 suggests strategic long-term positioning.

Conclusion

Ethereum staking exit times reaching 46 days in 2025 underscore the trade-off between network security and liquidity. Cardano liquid staking and growing ADA whale accumulation present a contrasting model that prioritizes flexibility. Investors should weigh exit mechanics, on-chain concentration, and protocol design when allocating between staking ecosystems. For readers seeking deeper data, on-chain analytics providers and community reports (plain text sources: Cardanians, Kamil) offer additional context.