Ethereum (ETH) to $25,000 in 2026: Key Reasons Why It Can Happen

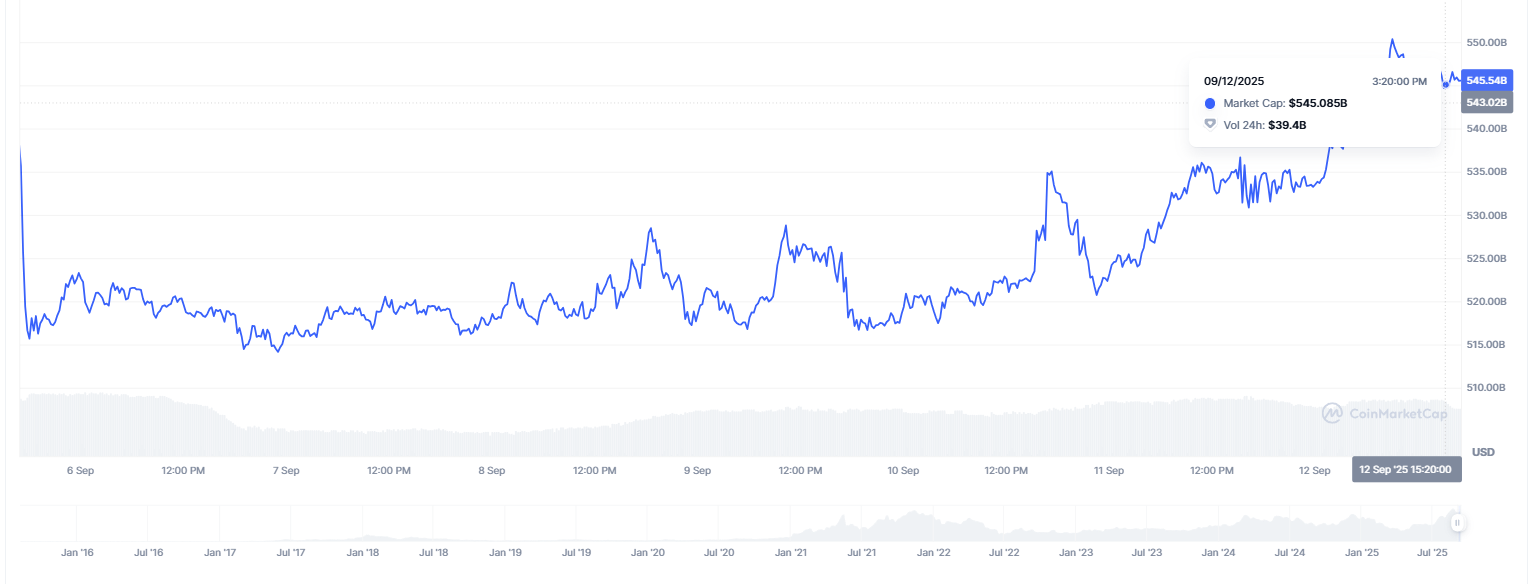

With a market valuation of slightly more than $549 billion, Ethereum is currently trading at about $4,550. Even though this is a solid position for the second-largest cryptocurrency, ETH reaching $25,000 in the coming years sounds too good to be true, and it most likely is.

No single asset outside of global equities has ever maintained a market capitalization of approximately $3 trillion, which would require a price increase of almost six times. However, in the most dire circumstances, the route to such a valuation is imaginable.

By 2026, the three hypothetical factors listed below might make Ethereum even more valuable than Bitcoin seemed at some point in market history.

Unparalleled surge in market

If ETH were to hit $25,000, the whole cryptocurrency market would have to undergo an unprecedented surge in capital inflow and adoption. If Bitcoin were to trade between $500,000 and $600,000, it might influence other cryptocurrencies, making Ethereum the leading smart contract platform. The basis for such growth would be a fourfold increase in ETH's market capitalization, which would be fueled by a mix of institutional inflows, retail speculation and the widespread acceptance of the cryptocurrency as a mainstream asset class.

Institutional market control

The dominance of institutions in ETH trading may be a second factor. If the market makers of ETFs and big funds took over the supply of Ethereum, selling pressure might be minimal. Reduced token availability on exchanges could artificially push prices higher. This would be similar to the kind of supply-demand engineering that occurs in conventional commodities markets, where controlled liquidity and scarcity lead to exaggerated valuations. Although there is a considerable chance that a bubble will form, it is possible if Ethereum will end up being the regulated choice for institutions.

Manipulation of supplies

By removing a portion of ETH from circulation, Ethereum might imitate corporate stock split or denomination strategies, where the circulating supply effectively shrinks if future network upgrades intensify this effect. Exaggerated price levels could result from a rapid reduction in the supply that is available as well as persistent demand from institutions and retail.

This would necessitate a drastic tightening of liquidity requirements, which would only be possible if ETH is firmly established as the foundation of not just crypto's, but the world's, financial system.

Bottom line

Ethereum is unlikely to reach $25,000 by 2026 given the current circumstances. However, such a level might theoretically be achievable due to a confluence of institutional dominance, engineered scarcity and explosive market growth. It is important for investors to distinguish between realistic market trajectories and speculative scenarios, but knowing these dynamics shows how important Ethereum's role could become if the next bull cycle surpasses all previous projections.