Recent predictions regarding HBAR indicate the potential for a significant surge, contingent on the progression of technical indicators as anticipated. The projections are based on Hedera’s HBAR crypto ETF being listed on the DTCC (Depository Trust & Clearing Corporation) platform, alongside Canary’s XRP ETF and Fidelity’s Solana $240 ETF. This development is viewed as an essential step in the administrative process for ETF approval.

HBAR Technical Outlook

At the time of writing, HBAR is trading around $0.2445, having established solid support near $0.21. The token has risen by 1.82% over the past 24 hours, suggesting it has exited a prolonged correction phase. According to analyst EgragCrypto, HBAR is exhibiting a pattern resembling the parabolic rise witnessed in 2021. Elliott Wave analysis and Fibonacci levels point to the potential for a fifth wave extending to approximately $3.30.

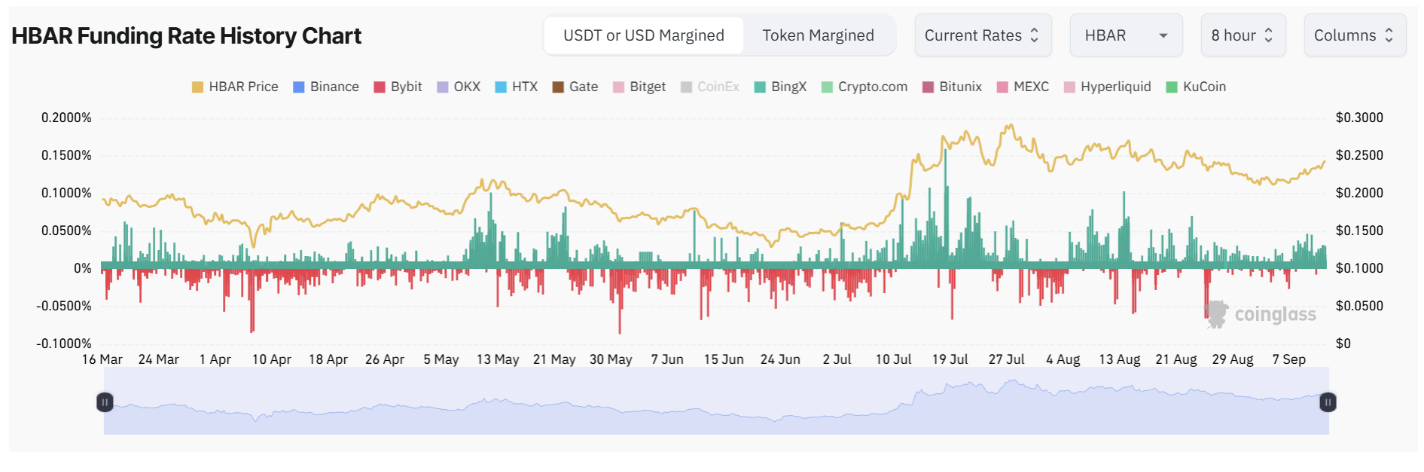

Technically, exceeding the $0.10 and $0.12 resistance levels is anticipated to accelerate price increases. In addition to technical indicators, funding rates remain positive, and the continued high interest in open positions indicates traders’ bullish expectations. Furthermore, an expert trader known as Sjuul highlights the classic “Power of 3” formation, asserting that HBAR is entering an expansion phase.

The registration of Canary’s HBAR ETF with the DTCC marks a crucial preparatory step before SEC approval. Although official trading has not yet commenced, this development signals increased institutional investor interest and indicates that technical and on-chain indicators for HBAR point towards a robust growth phase.

Impact of the ETF News

According to CoinMarketCap data, HBAR has gained nearly 14% over the past week, reflecting the positive impact of the ETF news on investors. Additionally, after steps taken by BlackRock concerning ETF listings, attention toward alternative projects has brought Hedera’s potential back into the spotlight. Such news flows, aligning with technical indicators, ensure the sustainability of price increases; meanwhile, investors are advised to carefully monitor the ETF processes and on-chain movements.