US dollar stablecoins are becoming commoditized: exchanges will likely hide individual tickers and present a single “USD” option while converting varied stablecoins on the backend, reducing user friction and fragmentation in fiat-denominated crypto payments.

-

Exchanges will show a single “USD” option, abstracting stablecoin tickers for users.

-

AI agents and backend conversion will manage yield-bearing and issuer-specific stablecoins automatically.

-

The shift aims to reduce liquidity fragmentation but could trap capital inside issuer-specific payment chains.

US dollar stablecoins are being abstracted by exchanges; learn how this simplifies fiat onchain and what it means for liquidity. Read on for implications and actions.

US dollar-pegged Stablecoins have become commoditized, diminishing the need for individual price tickers from the viewpoint of crypto users.

What will happen to US dollar stablecoins and their tickers?

US dollar stablecoins will increasingly be abstracted by exchanges that present a single “USD” option while performing backend conversions between issuer tokens, reducing the prominence of tickers like USDC or USDT for end users. This approach prioritizes UX and minimizes visible token fragmentation.

Why are stablecoins becoming commoditized?

Market competition and product convergence have turned many digital dollar tokens into interchangeable instruments. Mert Mumtaz, CEO of Helius (an RPC node provider), described the sector as “commoditized” after events around USDH demonstrated intense market-level incentives and yield offers.

As issuers launch more variants and payment chains, the practical difference for everyday users shrinks, pushing platforms to simplify displays and workflows.

How will exchanges implement stablecoin abstraction?

Exchanges will accept multiple US dollar stablecoins and perform automated swaps or internal accounting conversions to a single displayed denomination. This requires standardized backend interfaces for routing liquidity and reconciling balances.

-

Step 1: Accept deposits across stablecoin issuers.

-

Step 2: Route liquidity via automated swaps or internal ledgering.

-

Step 3: Display “USD” to users while managing token-level complexity behind the scenes.

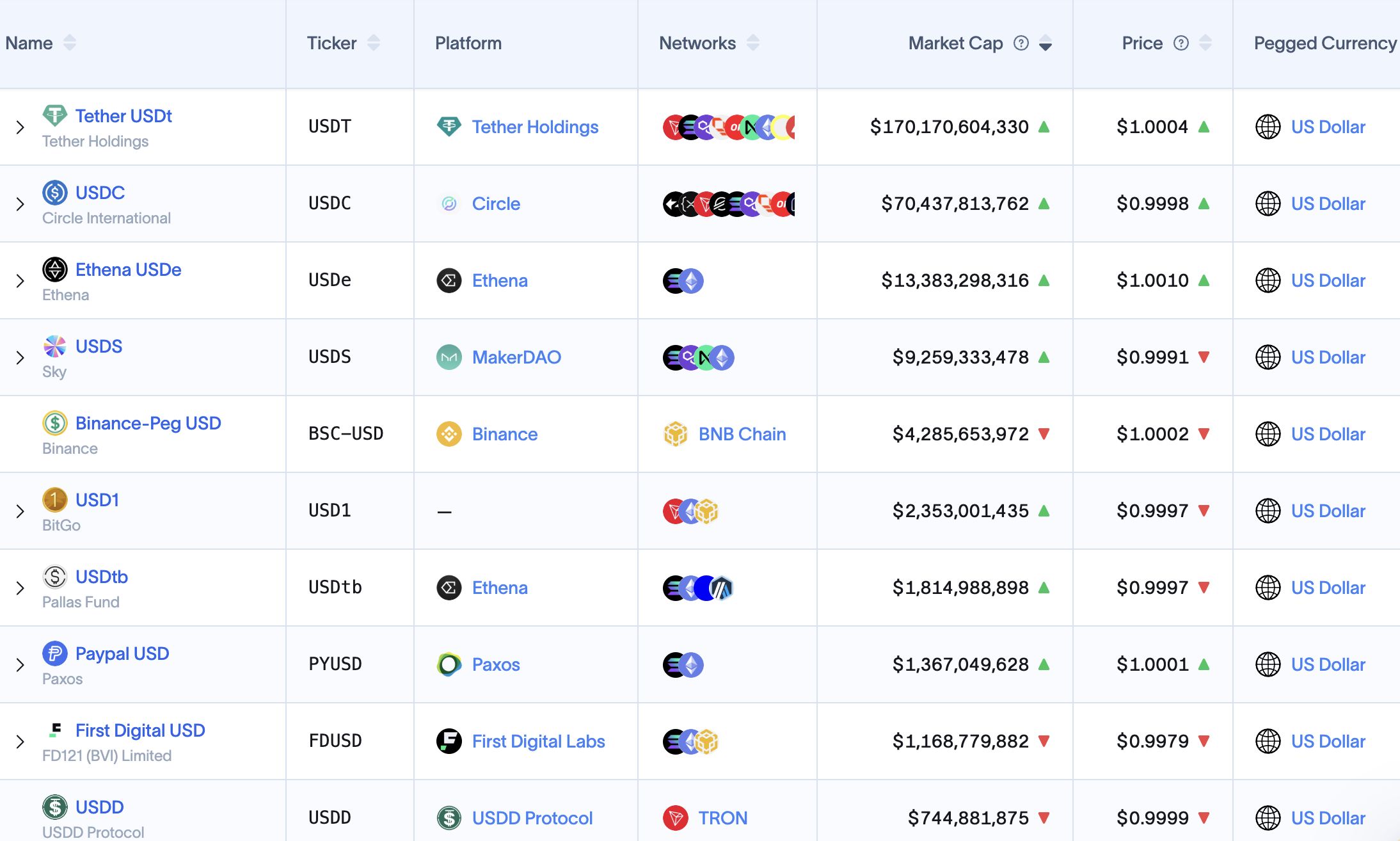

The number of US dollar stablecoin issuers continues to grow. Source: RWA.XYZ

What are the liquidity implications?

Issuers creating their own payment chains can fragment liquidity, trapping capital within particular ecosystems. That fragmentation raises execution costs and narrows available liquidity pools for inter-ecosystem settlement.

Exchanges and market makers will need standardized interfaces and cross-chain liquidity solutions to keep capital fungible at the user level.

Will AI accelerate stablecoin abstraction?

Yes. Reeve Collins (co-founder of Tether and WeFi) expects agentic AI to manage multi-token portfolios, including yield-bearing stablecoins. AI-driven agents will select tokens on performance and ease of use, further abstracting issuer differences from users.

AI delegation reduces decision friction: users see returns and balances denominated in USD while agents handle token choice and yield optimization.

Comparative snapshot of common US dollar stablecoin attributes

| Issuer | Various (institutional, algorithmic) | Differing trust and regulatory profiles |

| Use case | Payments, trading, yield | Interchangeable for users if abstracted |

| Liquidity risk | Fragmented across chains | Requires cross-chain routing and market-making |

Frequently Asked Questions

Will I still see token tickers in wallets?

Wallets and exchanges may hide issuer tickers behind a single “USD” label for simplicity, though advanced views will likely retain token-level details for power users.

Does this change regulatory or custody risk?

Abstraction does not eliminate issuer, custody, or regulatory risk. Users and platforms must still assess backing, reserves, and legal structures of the underlying stablecoins.

Key Takeaways

- Commoditization: US dollar stablecoins are becoming operationally interchangeable for end users.

- Abstraction: Exchanges will likely present a single “USD” option while converting tokens in the backend.

- AI liquidity: Agentic AI will manage token selection and yield, but liquidity fragmentation remains a technical and market challenge.

Conclusion

As the market evolves, US dollar stablecoins and broader stablecoins will be increasingly abstracted by exchanges and AI, improving usability but raising architectural questions about liquidity and settlement. Industry participants should prioritize standardized interfaces and cross-chain liquidity to ensure seamless USD-denominated experiences for users.

By COINOTAG • Published: 2025-09-13 • Updated: 2025-09-13