Bitcoin resistance at $116k is a key inflection: liquidity stacking and short-term holders (STHs) are creating a contested supply wall that could trigger either a distribution-led pullback or a rapid breakout; monitor $107k support and order-book bid depth for the next directional clue.

-

Primary risk: $116k supply wall — contested resistance with heavy realized profit clusters.

-

Short-term holders show mixed behavior: recent STH NUPL swings point to capitulation risk if bids fail.

-

On-chain and order-book data (Glassnode, TradingView, Farside Investors) indicate $107k support and $114k liquidity clusters as critical levels.

Meta description: Bitcoin resistance is stacking at $116k with liquidity and STH profit-taking. Watch $107k support and order-book bids; read actionable signals now.

What is Bitcoin resistance at $116k signaling for price action?

Bitcoin resistance at $116k represents a concentrated supply zone where realized profit holders and liquidity clusters create overhead friction. If bulls fail to absorb selling here, a deeper correction toward $107k could occur; conversely, a decisive break would likely trigger rapid FOMO-driven retests of $120k.

How does on-chain data show liquidity stacking near $116k?

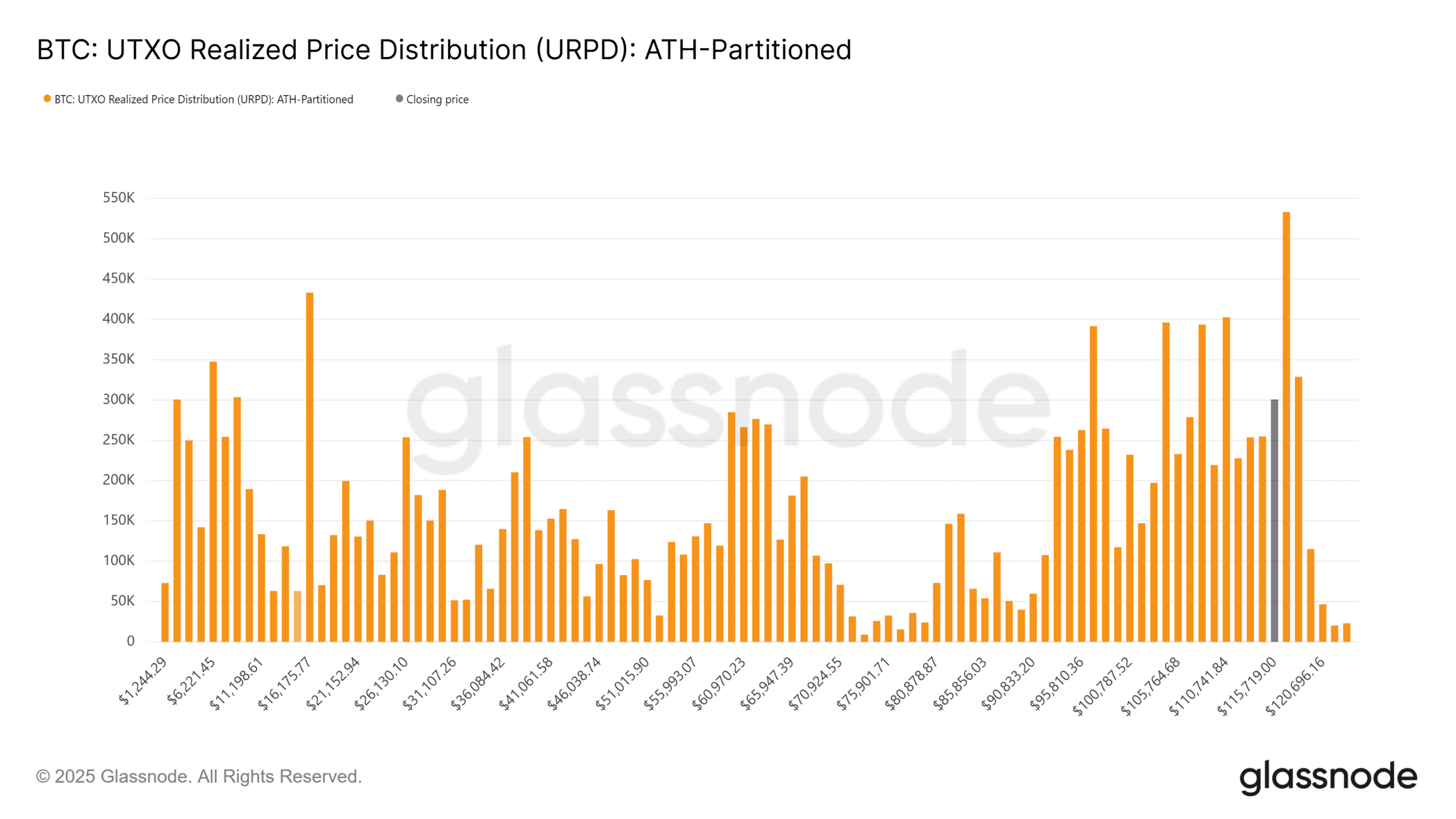

On-chain metrics reveal a large realized price distribution around $116,963 with roughly 534k BTC (about 2.68% of circulating supply) in play. Historically, this band has acted as both profit-taking and distribution. Glassnode data pointed to elevated realized profits after the $123k cycle, which correlated with the multi-week consolidation that preceded a 6% pullback.

Source: Glassnode

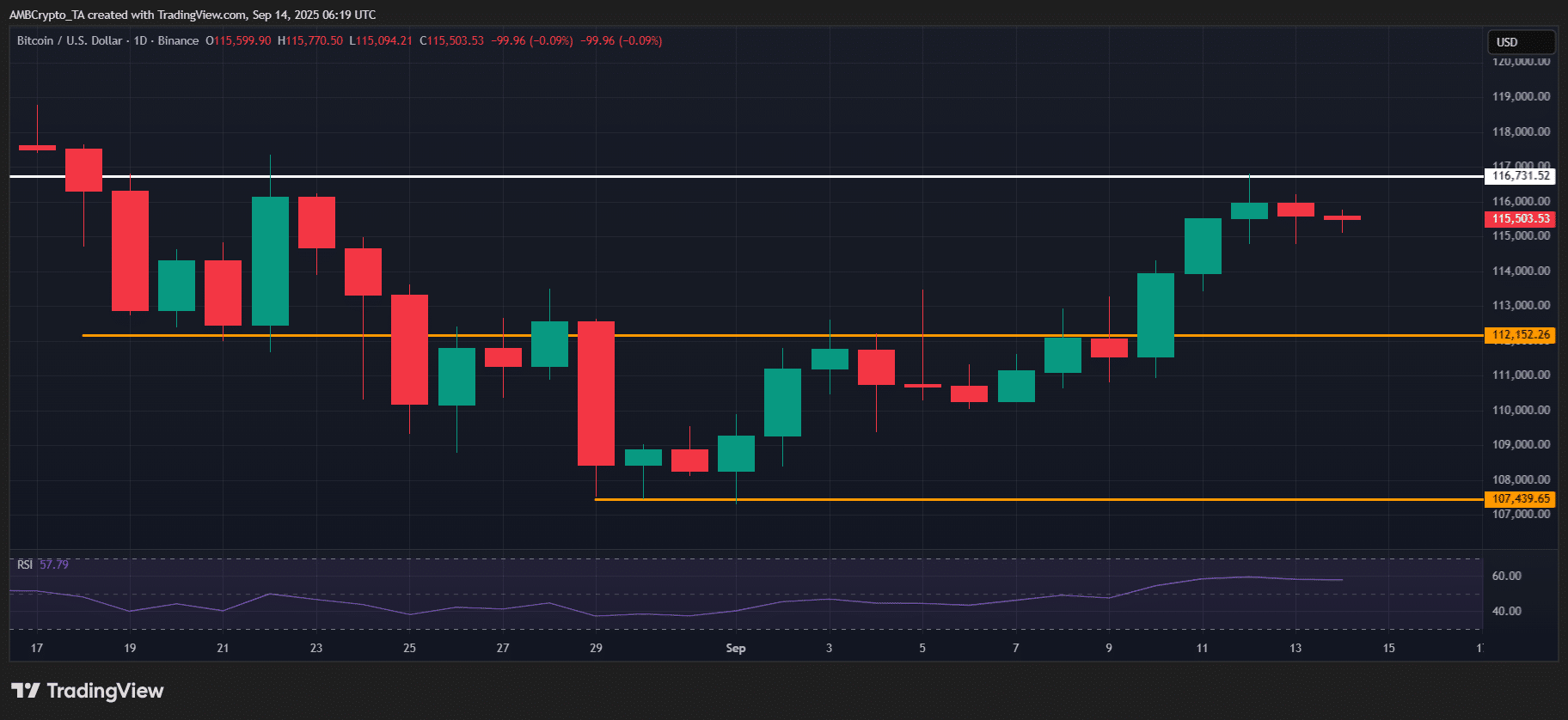

STH NUPL dropped to -0.07 when BTC failed $116k and slid to $108k, signaling short-term capitulation. The subsequent 8% bounce off $107k left many STHs with modest unrealized gains, creating a fresh distribution opportunity if sellers re-emerge near resistance.

Why could $107k be the make-or-break support for BTC?

$107k functions as a tactical bid wall observed in recent on-chain flows. A clean hold here preserves the current bullish thesis and lets institutions accumulate; a failure would likely open room for a deeper correction. Traders should watch order-book depth and institutional ETF inflows for confirmation.

What do order-book and institutional flows reveal right now?

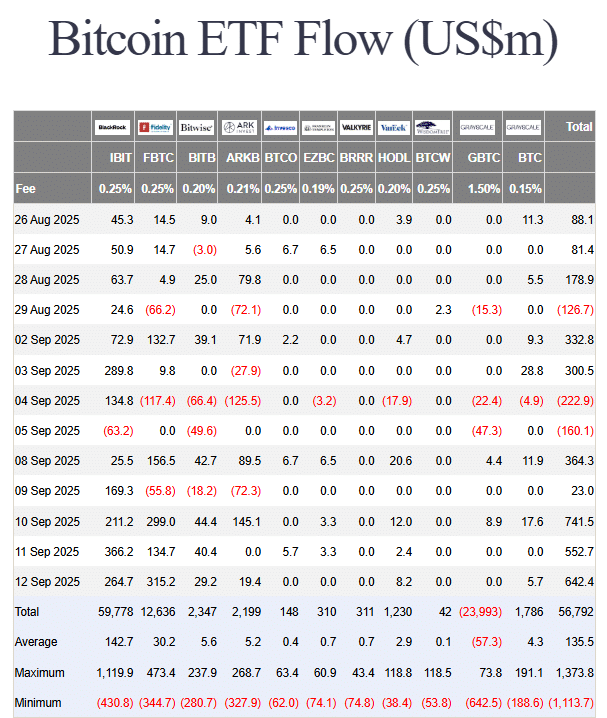

Current BTC/USDT order-book depth shows approximately $32 million in buy orders ~2% below price and $22 million in sell orders ~2% above price, indicating stronger immediate buy-side support. Institutional flows are notable, with nearly $2 billion moving into ETFs this week (Farside Investors data), suggesting smart-money accumulation despite retail caution.

Source: TradingView (BTC/USDT)

Retail indicators show weak-hand shaking as STH NUPL declined and realized profit metrics rose during the local top. This divergence — retail trimming versus institutional stacking — often precedes volatile breakouts or flushes, depending on whether bids absorb selling near $116k.

How should traders monitor and act on these signals?

Watch three real-time signals: order-book imbalance around ±2%, changes in STH NUPL, and incremental ETF inflows. Use layered risk management: reduce size into heavy resistance, keep stop layers under $107k, and consider scaled entries if $116k breaks with sustained volume.

Does this look like a distribution or accumulation phase?

At present, data suggests mixed behavior: accumulation by institutions (ETF flows) alongside short-term distribution pockets around realized-profit clusters. The net outcome depends on whether the $116k supply wall cracks or repels price — both outcomes are plausible and data-dependent.

Source: Farside Investors

Frequently Asked Questions

What happens if Bitcoin breaks above $116k?

If Bitcoin decisively clears $116k on sustained volume, expect rapid short-covering and potential FOMO-driven retests of $120k. Institutional inflows could accelerate the move, but traders should confirm breakout volume and shrinking sell-side order clusters before committing.

How should traders size positions around the $107k support?

Prefer tranche sizing: keep initial allocations small, add on confirmed holds above $107k, and place protective stops below the level. Maintain disciplined position sizing to limit downside if support fails.

Key Takeaways

- Critical level: $116k supply wall is the immediate battleground for bulls and bears.

- Support to watch: $107k represents a tactical bid wall — failure could invite deeper corrections.

- Actionable signals: monitor order-book depth, STH NUPL, and ETF inflows for confirmation; trade in scaled tranches.

Conclusion

Bitcoin resistance at $116k is shaping a pivotal moment where liquidity stacking, STH profit-taking, and institutional ETF flows converge. Traders should front-load risk controls, watch the $107k support closely, and use on-chain and order-book signals to guide entries. COINOTAG will monitor developments and provide updates as data evolves.