ECB: The Hidden Driver Behind Europe’s Debt Crisis?

Fitch has downgraded France’s sovereign rating from AA- to A+, mainly due to governmental instability and difficulties in reducing the public deficit. This situation reveals the failure of the French government, but also massive interventions by the European Central Bank (ECB).

In brief

- Fitch has downgraded France’s sovereign rating from AA- to A+, due to governmental instability and difficulties in reducing the public deficit.

- French debt reaches 114% of GDP.

- The ECB has created perverse incentives with its negative rates and bond purchase programs.

French Debt Worrying the Markets

Bayrou has fallen, but French debt continues to widen and worries the markets .

The five-year default risk has jumped by 20% in twelve months. This risk is generally measured via the price of CDS (Credit Default Swaps) and sovereign yields.

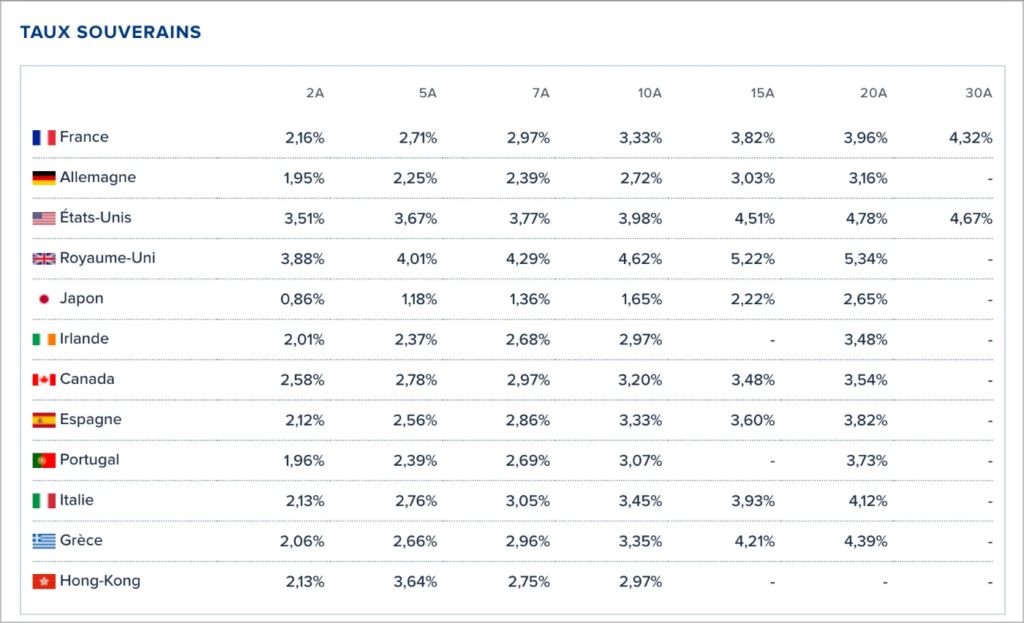

More alarming still, the French two-year bond yield exceeds that of Spain and Greece.

Comparison of sovereign yields by country. Source: Boursorama

Comparison of sovereign yields by country. Source: Boursorama This inversion of risk premiums perfectly illustrates the magnitude of the crisis. France, once a model of European fiscal stability, now pays more for its debt than countries considered more fragile. This is a historic reversal!

Finally, unfunded pension commitments represent thousands of billions of euros and further tarnish the French outlook.

The ECB, Accomplice in Fiscal Irresponsibility

The European Central Bank bears a major responsibility in this drift. Its key interest rates have fallen from over 4% in 2008 to a negative territory for years. This accommodative policy has eliminated all disciplinary mechanisms regarding budgeting.

Bond purchase programs such as the PEPP (Pandemic Emergency Purchase Programme) and OMT (Monetary Operations on Securities) have saturated bond markets. They have created a massive crowding-out effect penalizing credit to families and businesses. Simultaneously, they have masked solvency issues of European states.

The ECB’s anti-fragmentation tool has further aggravated this situation. By promising unlimited interventions, the ECB reassures markets that it will support sovereign debt at any cost. This implicit guarantee completely dilutes the discipline that risk premiums once imposed on profligate governments.

The ECB’s latent losses on its purchase programs reach several hundred billion euros, illustrating the scale of this disguised debt monetization.

The ECB Accelerated Europe’s Zombification

The European Union has reduced its emissions without any economic growth. Unlike the United States, which combines emissions reduction and growth, Europe sacrifices its competitiveness.

The productivity gap with the United States continues to widen. This difference explains 72% of the GDP per capita gap. By subsidizing low-productivity activities and fiscally penalizing high value-added sectors like technology, the EU methodically destroys its productive base.

The European technological decline is striking. Venture capital raised in the United States is 3.2 times that of the EU. Venture capital investments in start-ups reach 2.3 times the European level. This weakness in innovation dooms Europe to lag behind.

ECB’s long-term growth projections have fallen from 2.6% to much lower levels. This constant downward revision reflects the inefficiency of European interventionist policies.

Digital Euro: Rebound or ECB’s Desire to Control Everything?

Facing this loss of competitiveness, European authorities are preparing their response: the digital euro. Officially intended to modernize payments, this tool is in reality an unprecedented instrument of control.

The digital euro will allow authorities to monitor all transactions in real time. Unlike current electronic systems, data will be directly accessible to governments and the central bank. This widespread surveillance disguised as technological progress fundamentally threatens individual liberties.

The programmable nature of this digital currency authorizes authorities to create or destroy money supply as needed. It also allows rewarding or penalizing behaviors deemed compliant or not with political objectives.

This extreme monetary centralization aims to maintain the state monopoly on money in the face of growing citizen distrust and the development of uncensorable alternatives like bitcoin. The digital euro thus constitutes not a desirable financial innovation, but the ultimate attempt to preserve a dysfunctional economic system through technological constraint.

The ECB bears overwhelming responsibility for the current French debt crisis. Its accommodative policies have suppressed natural fiscal discipline mechanisms and encouraged member states’ fiscal irresponsibility. European governments, assured of cheap financing, have no incentive to reform their budgets. In the face of Europe’s zombification, the digital euro today represents the ECB’s last attempt to maintain control amid this crisis of confidence. This technological leap forward will not solve any structural problem and risks permanently compromising the euro’s credibility as a global reserve currency. Alternatives like bitcoin could then impose themselves to preserve savings from statewide generalized control.