Ethereum Faces the $5,000 Question as Altcoin Season Commences

Speculation is beginning to stir once again over whether leading altcoin Ethereum could finally test the long-awaited $5,000 milestone.

This renewed optimism comes as the on-chain data confirms that the crypto market has officially entered altcoin season, a phase during which altcoins have historically outperformed Bitcoin (BTC). While the broader market has struggled under bearish pressure in recent days, weighing on ETH’s current price action, underlying data points to resilience among coin holders.

This could open the door for an extended rally toward $5,000 in the near term. Here’s how.

80% of Top Altcoins Outperform Bitcoin—Is ETH Next to Rally?

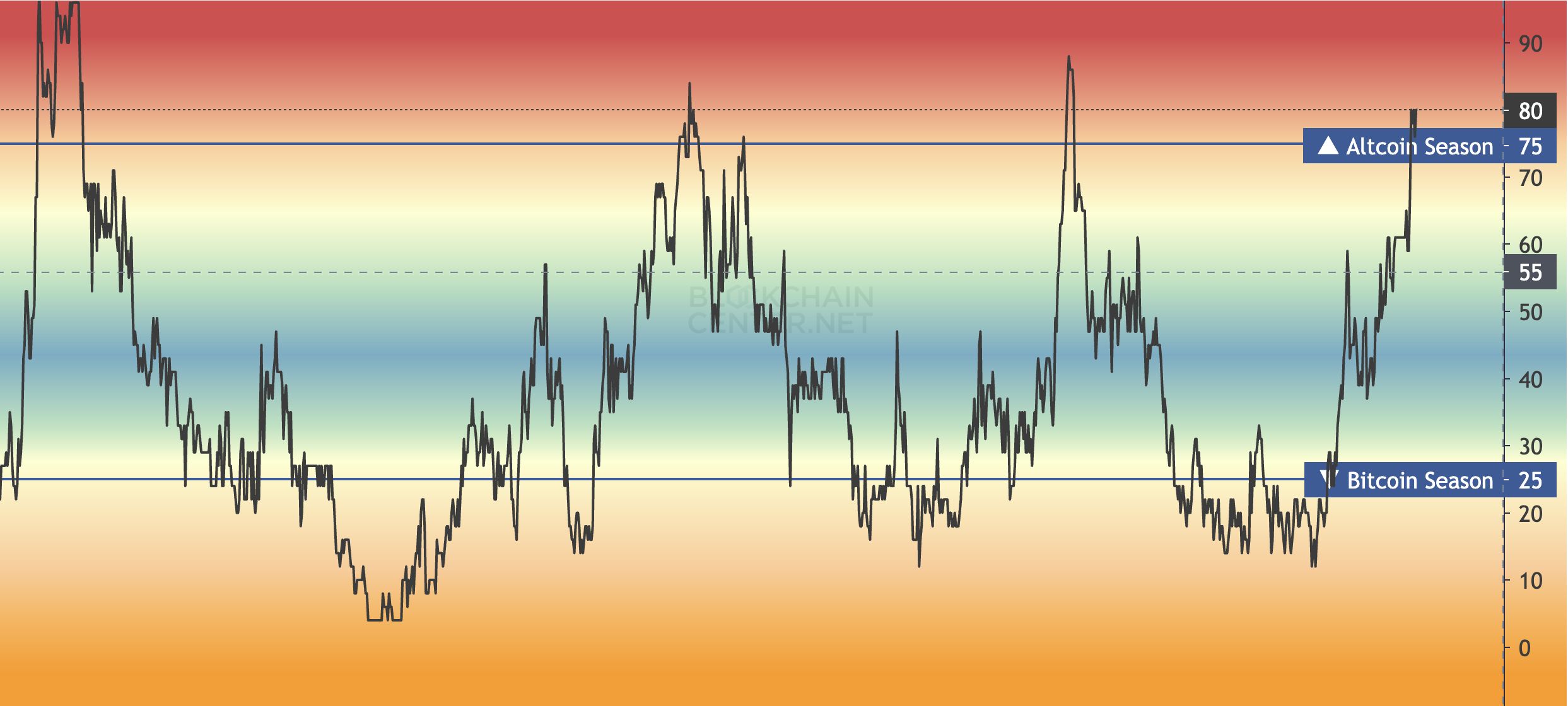

According to Blockchain Center, an altcoin season begins when at least 75% of the top 50 altcoins outperform BTC over a three-month period.

New data from the on-chain analytics platform shows that 80% of these tokens have beaten BTC’s performance in the past 90 days—well above the required threshold. This officially signals that the market has entered altcoin season.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Altcoin Season Index. Source: Blockchain Center

Altcoin Season Index. Source: Blockchain Center With market attention tilting away from Bitcoin and onto altcoins, ETH could benefit from this. This now begs the question of whether the shift could trigger a rally toward the highly anticipated $5,000 milestone for the altcoin.

ETH Holder Conviction and Institutional Demand Fuel $5,000 Buzz

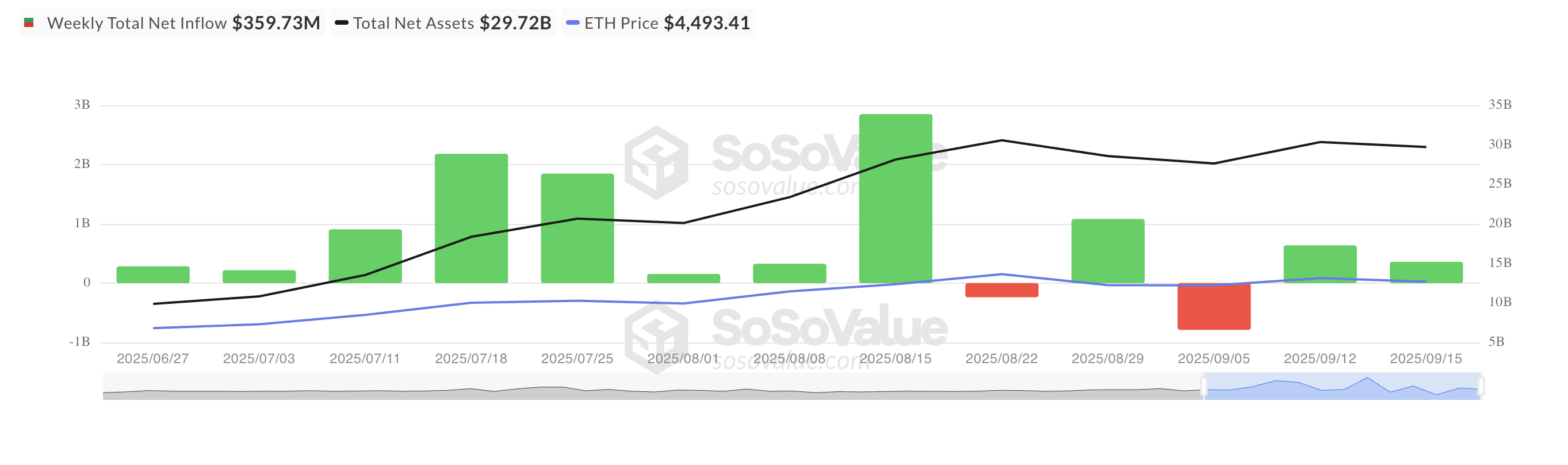

One of the strongest signals that this is possible comes from ETH’s climbing institutional flows. According to data from SosoValue, Ethereum ETFs recorded a net inflow of $639 million last week, a sharp reversal from the previous week when they posted their largest-ever weekly net outflow of $798 million.

Total Ethereum Spot ETF Net Inflow. Source: SosoValue

Total Ethereum Spot ETF Net Inflow. Source: SosoValue The turnaround signals renewed confidence among institutional investors, suggesting that appetite for ETH exposure is growing again.

Bullish momentum has extended into the current week, with inflows already totaling $360 million. This confirms key investors’ demand for the altcoin, a trend that could propel its price to new highs as the altcoin season kicks off.

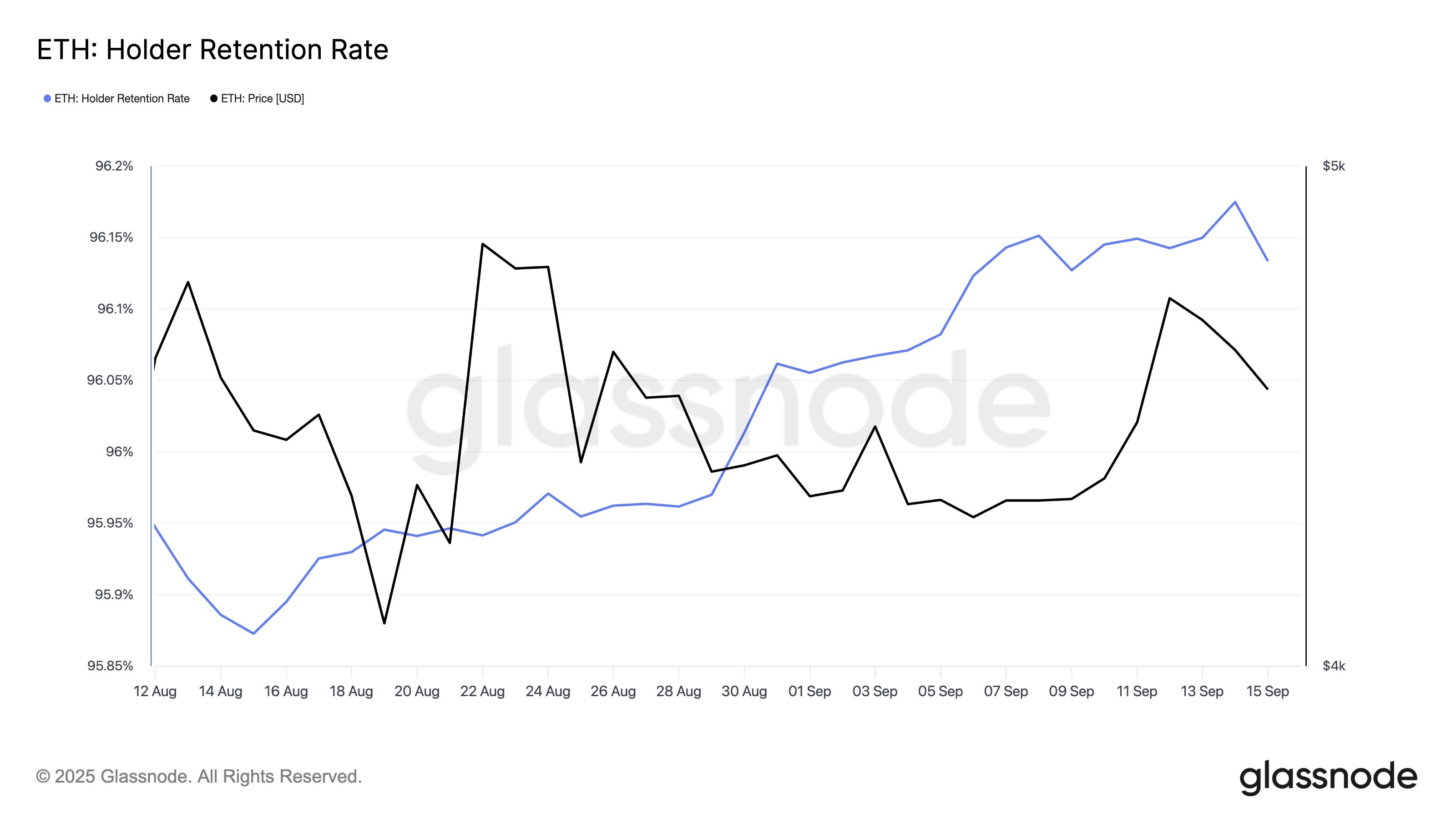

In addition, holders continue to display conviction despite ETH’s lackluster performance over the past few trading sessions. This is reflected by the coin’s Holder Retention Rate, which continues to climb. At press time, the metric stands at 96.13%.

ETH Holder Retention Rate. Source: Glassnode

ETH Holder Retention Rate. Source: Glassnode The Holder Retention Rate tracks the percentage of addresses that maintain a balance of ETH across consecutive 30-day periods. When it surges like this, investors are choosing to hold onto their positions rather than exit the market, even amid short-term volatility.

This behavior reflects growing confidence in ETH’s long-term potential and could aid a quicker rally toward $5,000 as the market settles into the new altcoin season.

$4,957 Breakout Could Ignite Rally to $5,000

A sustained rise in institutional inflows and stronger holding behavior among investors could help ETH reverse its current downward trend.

Such momentum may drive the price toward the $4,957 resistance level. A successful break above this barrier could pave the way for a rally to the $5,000 mark.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView Conversely, if market sentiment weakens further, ETH risks extending its decline, potentially dropping to $4,211.