Ethereum Staking Queues Hit Record Delays as Exits, Restaking, and ETFs Converge

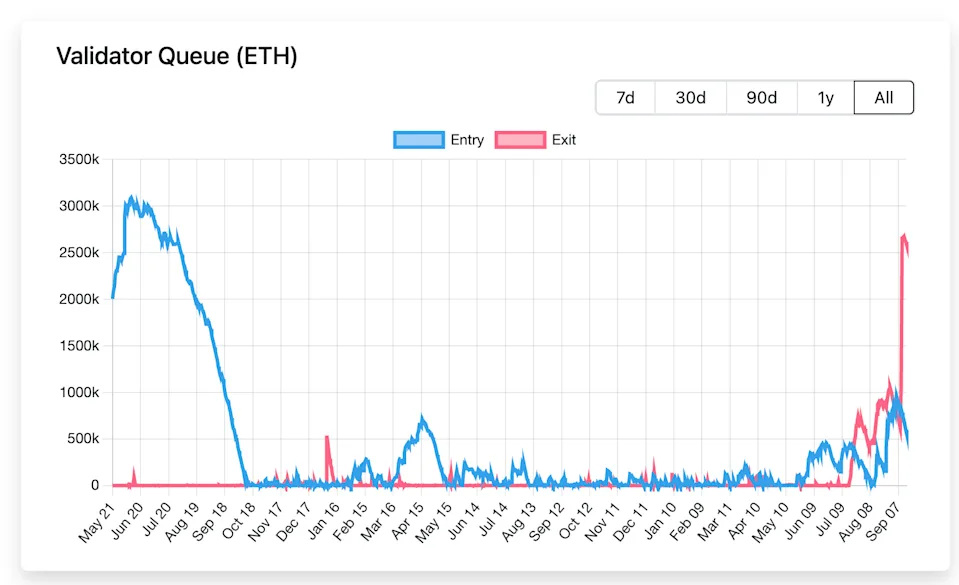

Ethereum network stakers are facing record-long exit times, with about 2.5 million ETH ($11.25 billion) pending withdrawal from the validator set, according to dashboard reports. Given this backlog of unsettled transactions, the waiting time for withdrawal has stretched to more than 46 days—the longest in the network’s history. For comparison, the last big withdrawal peak, which occurred in August, only had an 18-day wait time.

In brief

- About 2.5M ETH ($11.25B) is pending withdrawal, pushing validator exit times to a record 46 days.

- Kiln’s precautionary validator exit added 1.6M ETH to the queue, showing how industry events ripple through staking.

- Profit-taking, ETF demand, and SEC clarity fuel validator shifts, amplifying Ethereum’s staking congestion.

- Thalman says long queues reflect growth, not risk, as Ethereum adapts to profit cycles, infra limits, and regulation.

Industry Breaches Spark Fresh Delays in Ethereum’s Staking System

Ethereum’s staking system began experiencing this fresh delay a little over a week ago, after the NPM supply-chain attack and the SwissBorg breach. Following the hacks, staking infrastructure provider Kiln exited all its validators on September 9 as a precautionary move. This action resulted in 1.6 million ETH ($7 billion) entering the waiting line at once.

Although the network breach didn’t directly affect Ethereum’s proof-of-stake system, Kiln’s decision to hit a temporary break shows how broader industry events can trigger a strong ripple effect, enough to affect the Ethereum staking system.

SEC Clarity and ETF Optimism Add Fuel to Staking Surge

Benjamin Thalman, senior analyst at staking provider Figment, maintained that the current bottleneck for Ethereum validators stems from factors other than security. In a Monday blog post, Thalman explained that some stakers engaged in profit-taking activities following Ether’s over 160% surge since April.

At the time of writing, ETH is trading at $4,487 after moving relatively flat over the past intraday session.

He also noted that rising ETH exposure from digital asset treasuries and crypto ETFs has added to the growing withdrawal delays on the network.

Meanwhile, the SEC’s clarification that staking is not a security helped fuel fresh interest, as more validators entered the Ethereum staking ecosystem. Thalman also explained that suggestions of a potential greenlight on other Ether ETFs have also driven optimism, as industry participants prepare to capitalize on regulated staking exposure.

Ethereum’s Staking Bottleneck Reflects Growth, Not Security Risks, Says Thalman

The Ethereum churn limit caps the number of validators that can enter or exit the network within a set timeframe to ensure network stability. For now, the churn parameter is capped at 256 ETH per epoch (about 6.4 minutes), which is about 1,800 validators per day or roughly 57,600 ETH daily.

However, this limit isn’t fixed and changes with the number of active validators present on the network at a given time.

In essence:

- Validators must first wait in the exit queue, which currently takes around 45 days.

- While in the queue, they remain active on the network and continue earning rewards.

- Ethereum limits exits to 57,600 ETH per day, which slows the process further.

- After exiting, there is a fixed 256-epoch (~27.3 hours) delay before funds become withdrawable.

- Finally, withdrawals are processed by the sweep, which can add another 0 to 10 days of waiting.

Given the current number of ETH awaiting exits, validators on Wednesday could face about 44 days before possible withdrawal. Interestingly, Thalman is of the opinion that new validators will simply restake much of the existing Ether.

Assuming network participants re-stake 75% of the current queue, almost 2 million ETH would enter the activation queue. This would create delays for new staking and add backlog on both the entry and exit sides.

The activation queue is currently 13 days, to this add the ~2M ETH from those currently exiting (35 days) and 4.7M from ETFs (81 days), and the total is 129 days. This assumes that there are no other ETH holders that choose to stake and enter the queue, like corporate treasuries.

Benjamin Thalman

Thalman noted that the long queue shows just how central staking is to Ethereum. He maintained that while the system is working as intended, the surge of users exiting and re-entering reflects the growing challenges of a maturing network shaped by limited infrastructure, shifting profits, and new regulations .