Corporate crypto treasuries are public companies allocating balance-sheet capital to digital assets to diversify reserves and seek returns; recent announcements include a $500M Solana-focused treasury and institutional funds that may accelerate altcoin inflows and market cycle expectations.

-

Public firms are raising large crypto treasuries to diversify corporate reserves.

-

Nasdaq-listed Helius plans a $500 million Solana (SOL) treasury; Standard Chartered’s SC Ventures targets $250 million for a digital asset fund in 2026.

-

Regulatory moves by the U.S. SEC and multi-asset approvals (GLDC) could speed institutional ETF reviews and broaden market access.

Corporate crypto treasuries surge as firms allocate capital to digital assets; read the latest on Solana, SEC standards, and DeFi trends—insights and actions for investors.

Public firms are raising hundreds of millions in capital for cryptocurrency strategies, reinforcing investor expectations of another historic altcoin market cycle.

Published: 2025-09-19

Updated: 2025-09-19

What are corporate crypto treasuries and why do they matter?

Corporate crypto treasuries are company-held digital asset reserves used to diversify liquidity, hedge inflation, or generate yield via staking and lending. Public announcements by Nasdaq-listed firms and banks signal institutional adoption that can increase capital flows into altcoins and reshape treasury management practices.

Source: Peter Mintzberg

How is Helius structuring its $500 million Solana treasury?

Helius Medical Technologies priced an oversubscribed PIPE offering to support a $500 million Solana-centric treasury. The company plans to use net proceeds to build SOL reserves and pursue staking and lending opportunities while keeping a conservative risk approach.

The financing includes equity at $6.88 per share and stapled warrants exercisable at $10.12 for three years, providing potential upside if warrants are exercised. Helius said it will scale holdings over 12–24 months using ATM sales and other capital-market tools.

What are the risk and revenue levers for a Solana-focused reserve?

Helius aims to generate revenue from staking and selective lending within the Solana ecosystem. Key levers include validator staking rewards, lending spreads, and active treasury management; countervailing risks are price volatility, network-specific operational risks, and regulatory uncertainty.

Why is Standard Chartered raising $250 million for a digital asset fund?

Standard Chartered’s SC Ventures plans to raise $250 million for a digital asset investment fund slated for 2026. The fund—backed by Middle East investors—focuses on financial-services digital assets and signals continued institutional interest from established banks.

SC Ventures highlighted prior digital-asset initiatives (Libeara, Zodia Markets, Zodia Custody) as proof points for ongoing conviction in the sector, aiming for global investment opportunities and strategic joint ventures.

What regulatory changes could affect institutional crypto products?

The U.S. Securities and Exchange Commission issued generic listing standards to accelerate reviews for spot crypto ETFs across major exchanges. The SEC’s approval of Grayscale’s Digital Large Cap Fund (GLDC) also represents the first U.S. multi-asset crypto ETP approval, widening product categories for investors.

These regulatory shifts may shorten timelines for exchange approvals and enable diversified crypto ETPs, affecting capital allocation decisions by institutional treasuries and asset managers.

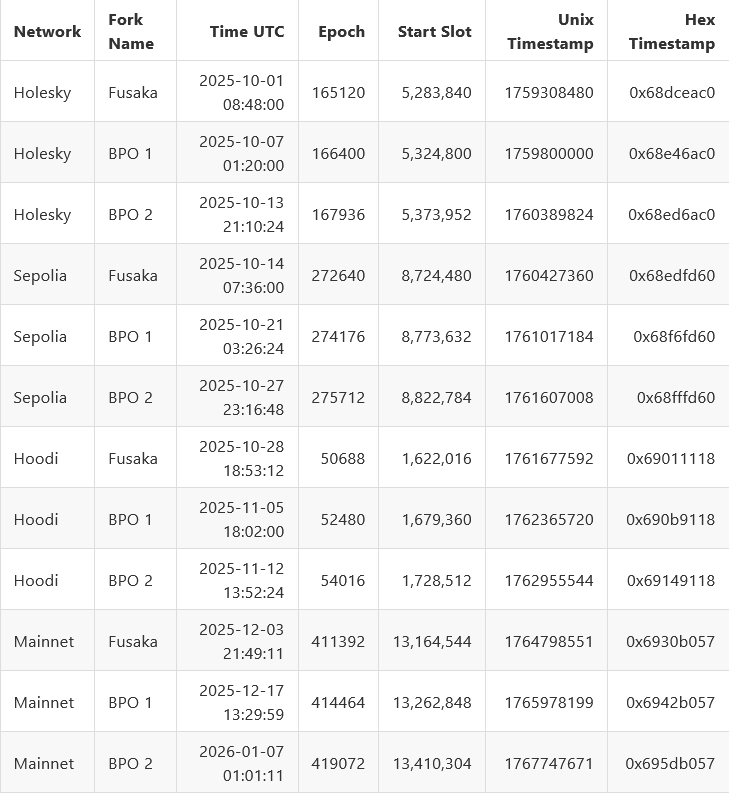

The slated timeline for Fusaka’s deployment. Source: Barnabas Busa

When will Ethereum’s Fusaka upgrade and blob capacity increases take place?

Developers tentatively scheduled the Fusaka hard fork for early December, with increased blob capacity following around Dec. 17 and an additional capacity hard fork targeted for Jan. 7, 2026. Public testnets are planned between October and mid-November.

Ethereum researchers report that the upcoming blob-parameter forks will more than double blob capacity, improving L2 efficiency by storing large datasets off-chain and reducing transaction costs.

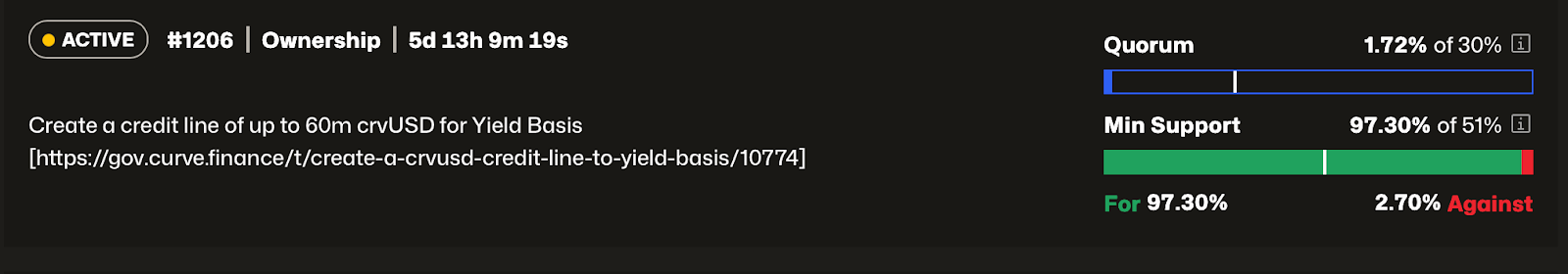

How could Curve Finance’s $60 million proposal change CRV economics?

Curve Finance’s DAO is voting on a $60 million crvUSD credit line to create the Yield Basis mechanism. If approved, stakers could receive veCRV in return, and Yield Basis is expected to return 35–65% of value to veCRV holders while allocating 25% to ecosystem incentives.

Current voting for the $60 million credit line proposal. Source: Curve Finance

What do U.S. consumer polls indicate about DeFi adoption?

A recent Ipsos survey for the DeFi Education Fund found that 42% of U.S. adults said they would likely try DeFi if proposed legislation were enacted. Respondents cited low trust in traditional finance and interest in security, personalized control, and flexibility.

The survey (1,321 respondents) showed many would use DeFi for online purchases, suggesting potential consumer demand under clearer regulatory frameworks.

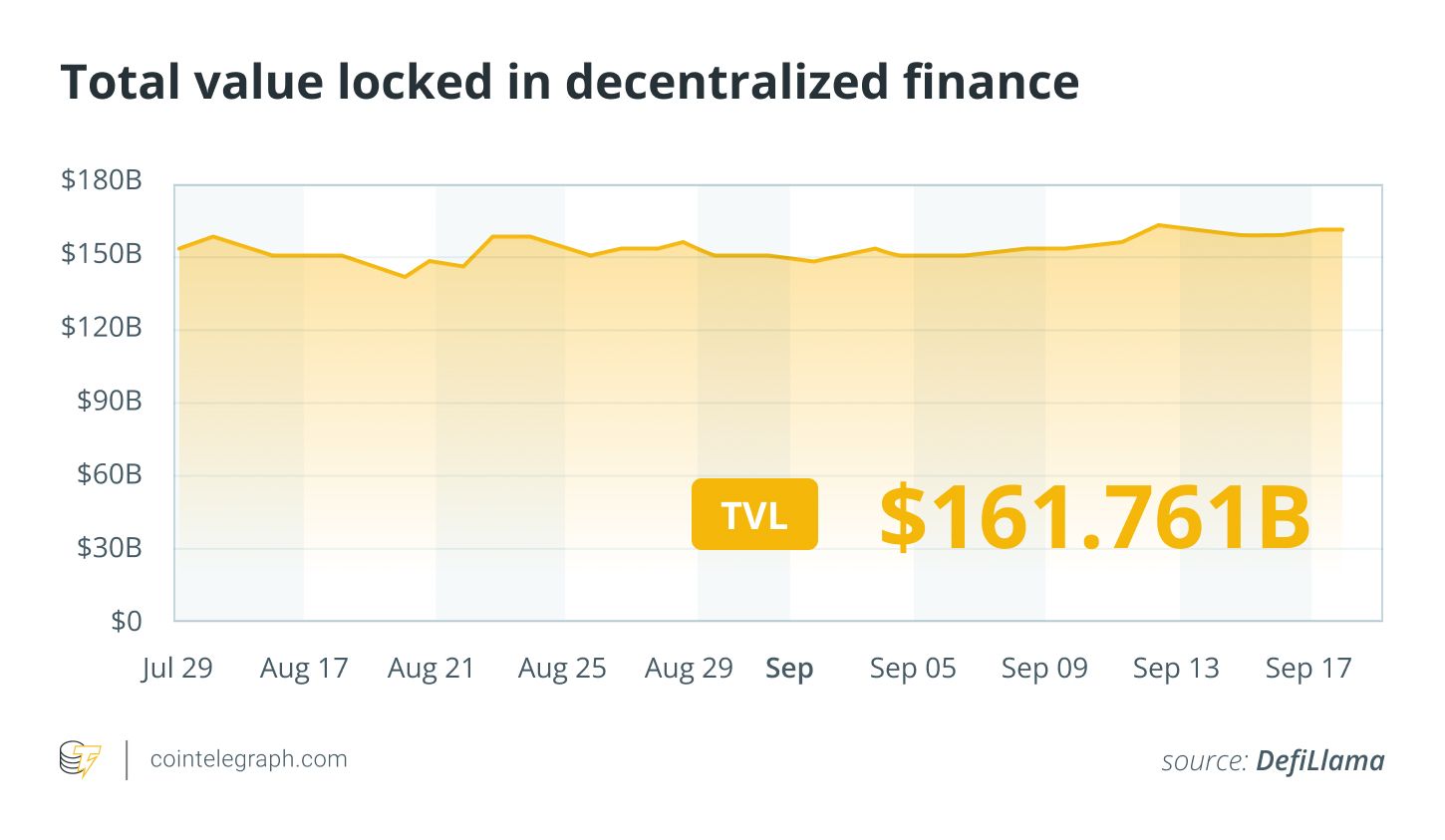

DeFi market overview

Market data from Cointelegraph Markets Pro and TradingView showed most top-100 tokens ended the week higher. Aster (ASTER) posted the largest weekly gain of over 600%, followed by Immutable (IMX) with ~50% growth.

Total value locked in DeFi. Source: DefiLlama

Frequently Asked Questions

How should companies evaluate building a crypto treasury?

Companies should assess treasury objectives, liquidity needs, counterparty risk, custody solutions, regulatory compliance, and stress-test allocations under multiple price scenarios. Use conservative allocations and clear governance to manage volatility and operational risk.

Will SEC listing standards speed ETF approvals?

New SEC generic listing standards aim to streamline exchange reviews for spot crypto ETFs. Faster, standardized review processes could shorten approval timelines, but final timing depends on exchange filings and regulator assessments.

Key Takeaways

- Institutional momentum: Public companies and banks are mobilizing large pools of capital for crypto treasuries and funds.

- Regulatory catalyst: SEC listing standards and GLDC approval may broaden institutional product options.

- Network upgrades matter: Ethereum’s Fusaka and blob increases will influence L2 scaling and cost dynamics.

Conclusion

Public announcements—from Helius’s $500M Solana reserve to SC Ventures’ $250M fund plans—underscore accelerating institutional engagement with crypto. With parallel regulatory developments and protocol upgrades, corporate crypto treasuries are positioned to shape the next altcoin cycle. Monitor governance, liquidity, and regulatory signals as firms scale allocations.