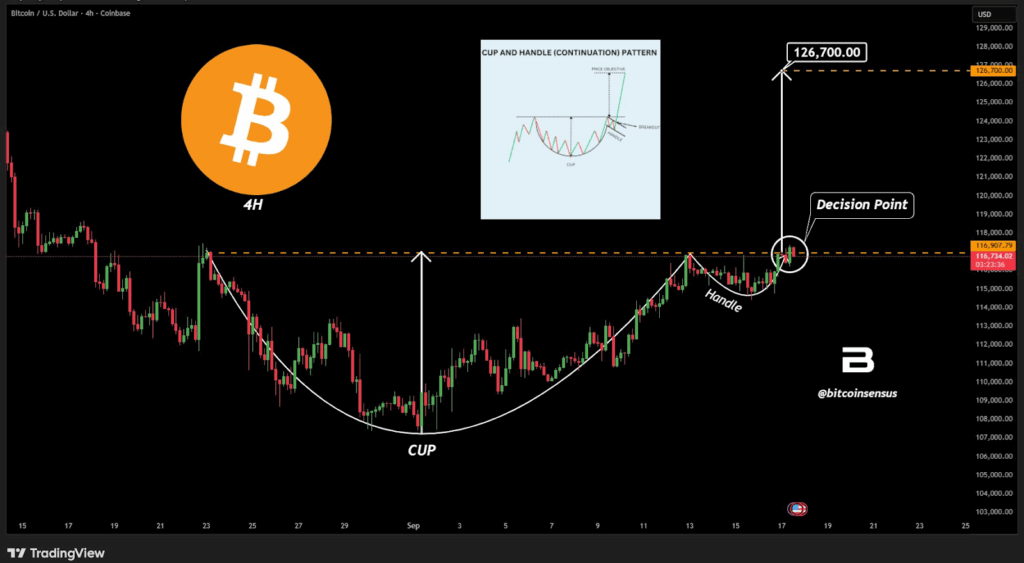

Bitcoin is testing a critical $117,000 resistance after forming a textbook cup-and-handle pattern; a confirmed breakout with heavy volume would target $126,700 (~8.5% upside). Monitor close above $117,000 and BTC dominance trends for confirmation.

-

Bitcoin near $117,000 resistance after forming a clean cup and handle.

-

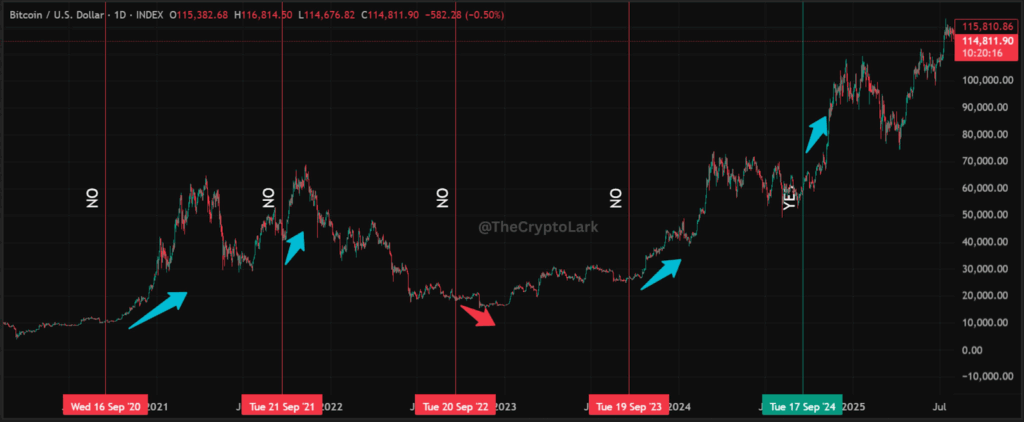

September Fed decisions have historically preceded notable BTC moves, regardless of the exact rate outcome.

-

BTC dominance is rising, indicating rotation from altcoins and setting Bitcoin up to lead the next recovery.

Bitcoin $117,000 cup and handle setup targets $126,700. Read quick analysis, price triggers, and trade guidance now.

What is the current Bitcoin setup and price target?

Bitcoin is testing a cup-and-handle formation with key resistance at $117,000. A decisive breakout above $117,000 on strong volume would project an initial target near $126,700, roughly an 8.5% move. Traders should watch closing levels and volume for confirmation.

How does the cup and handle pattern form and why does it matter?

The cup formed after a pullback to about $106,000 followed by a steady, rounded recovery. The handle is a short consolidation below the cup rim that flushes weak hands. This pattern signals distribution of risk before an impulsive move higher when price breaks the rim with volume.

BTC tests crucial $117,000 level as cup & handle setup eyes $126.7K target. The FOMC decision could trigger the next massive crypto pump.

- Bitcoin is near $117K resistance after forming a perfect cup and handle pattern .

- September Fed meetings usually spark Bitcoin rallies no matter what rate decision comes.

- BTC dominance climbs setting Bitcoin up to lead the next market recovery wave

The crypto king sits on a powder keg at $117,000. Bitcoin’s textbook cup and handle pattern is primed to explode, potentially delivering strong gains to $126,700 if price breaks with confirming volume. Risk management and close monitoring of intraday closes are critical.

Why could the Fed meeting spark a Bitcoin rally?

Historically, September Federal Reserve events have correlated with notable Bitcoin moves. Since 2020, many September policy windows preceded rallies, even when rate decisions were neutral. The market’s reaction often reflects positioning and liquidity shifts more than the headline decision.

Source: BitCoinsensus Via X

How is money flow and market structure supporting Bitcoin?

Capital is rotating back into Bitcoin from smaller-cap altcoins, increasing BTC dominance. This rotation typically precedes major Bitcoin advances and suggests a two-step cycle: Bitcoin highs first, altcoin revaluation later (alt season). Expect momentum to favor Bitcoin while dominance climbs.

The handle consolidation allows buyers to add exposure with defined stops. Confirmation requires a daily close above $117,000 with above-average volume. Failure to break could lead to a deeper retest of the cup base near $106,000.

Source: Lark Davis Via X

Frequently Asked Questions

What happens if Bitcoin breaks $117,000?

If Bitcoin breaks and closes above $117,000 with strong volume, the measured cup-and-handle target is approximately $126,700, implying ~8.5% upside. Traders should use stop-losses below the handle to manage risk.

How likely is a rally after the Fed decision?

Historically, September Fed windows have often preceded rallies, but outcomes vary. The market’s positioning and liquidity matter more than the specific rate call. Watch volatility and volume for trade signals.

Key Takeaways

- Cup-and-handle in play: A textbook formation sits below $117,000 and targets $126,700 on breakout.

- Fed timing: September Fed events have historically coincided with Bitcoin moves; monitor session liquidity.

- Market rotation: Rising BTC dominance indicates funds shifting from altcoins, favoring Bitcoin-led recovery.

Conclusion

Bitcoin’s cup-and-handle pattern at $117,000 sets a clear technical narrative: a confirmed breakout would target $126,700 while failed breakout risks a deeper retest. Traders should prioritize volume confirmation, manage position sizing, and follow BTC dominance as a leading indicator. COINOTAG will continue monitoring price action and market flows.