MicroStrategy Adds 850 BTC as Fed Cuts Interest Rates

Contents

Toggle- Quick Breakdown

- Fed Rate cut sparks fresh purchase

- MicroStrategy’s growing Bitcoin treasury

- Saylor on institutional demand and market “Boredom”

Quick Breakdown

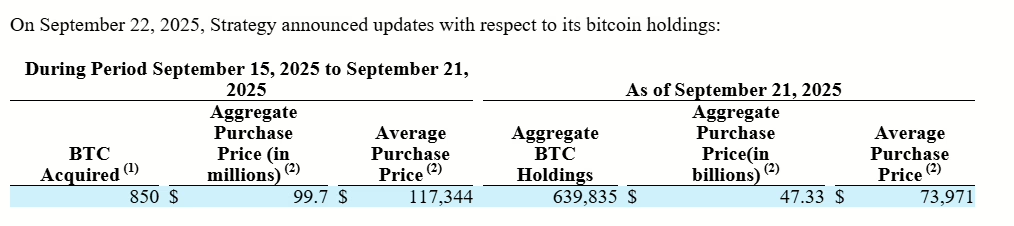

- MicroStrategy bought 850 BTC worth $99.7M after the Fed’s interest rate cut.

- The firm now holds 639,835 BTC, acquired for about $47.3B.

- Purchases have slowed sharply compared to earlier in 2025.

MicroStrategy, the world’s largest corporate Bitcoin holder, has expanded its holdings once again, securing 850 BTC worth $99.7 million following the U.S. Federal Reserve’s first rate cut of the year.

Fed Rate cut sparks fresh purchase

According to a filing with the U.S. Securities and Exchange Commission (SEC) on Monday, MicroStrategy acquired 850 Bitcoin during the week ending Sunday. The purchase was executed at an average price of $117,344 per BTC, shortly after the Federal Reserve lowered interest rates by 25 basis points.

Source : SEC

Source : SEC Standard Chartered now expects the Fed to slash rates by 50 basis points in September, doubling its previous 25 bps forecast. Bitcoin briefly rallied above $117,000 following the Fed’s decision, data from CoinGecko shows.

MicroStrategy’s growing Bitcoin treasury

The latest addition brings the company’s total Bitcoin stash to 639,835 BTC, bought for approximately $47.3 billion at an average cost of $73,971 per coin.

Despite the new acquisition, MicroStrategy’s recent pace has slowed. In September so far, the firm has purchased 3,330 BTC, a significant drop from 7,714 BTC in August and well below July’s 31,466 BTC haul.

Saylor on institutional demand and market “Boredom”

Executive Chairman Michael Saylor remains steadfast in his Bitcoin accumulation strategy, even at higher price levels. He noted in a recent interview that reduced volatility, driven by institutional adoption, could make the market appear less exciting.

“The conundrum is, well, if the mega institutions are going to enter, if the volatility decreases, it is going to be boring for a while, and because it’s boring for a while, people’s adrenaline rush is going to drop,”

Saylor remarked.

Additionally, Saylor has urged U.S. regulators to establish a formal taxonomy for digital assets , warning that ongoing regulatory ambiguity threatens to stall innovation and hinder the nation’s competitiveness in the global crypto market.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”