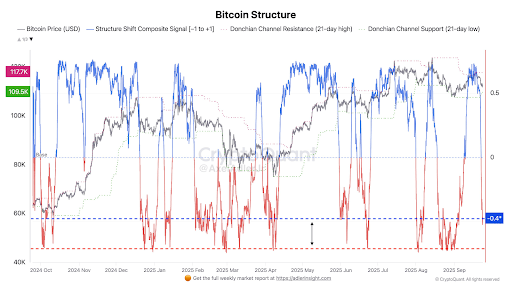

Bitcoin’s price outlook shows near-term bearish pressure as technical signals point to bear dominance; holding the $109.5K support is critical to avoid a deeper correction and to enable a possible retest of $117.7K.

-

Bear dominance signaled by composite index below −0.4.

-

Critical support: $109.5K — holding it may restore bullish momentum.

-

Volatility ranged from $62K to $130K; firms should monitor Donchian Channel bounds and composite signals.

Bitcoin price outlook: Bitcoin trades near $113K with $109.5K critical support — read technical analysis, key levels, and next steps to protect positions. Check levels now.

What is Bitcoin’s price outlook?

Bitcoin price outlook remains cautiously bearish as technical indicators show sellers in control. With price near $113K, the composite index below −0.4 and the lower Donchian Channel boundary in focus, $109.5K is the decisive support level that will shape the next directional move.

How does the $109.5K support level affect Bitcoin’s next move?

Holding $109.5K would likely stabilize the market and allow buyers to attempt a retest of $117.7K. Failure below this zone risks renewed selling pressure and a deeper correction. Analyst Axel Adler Jr. noted that the composite index turning negative aligns with pressure around the 21-day Donchian lower band.

Bitcoin struggles near $113K as technical signals warn of bear dominance, with $109.5K support critical for avoiding a deeper correction.

- Bitcoin faces intense selling pressure as the composite index turns negative and $109.5K support becomes the last strong defense.

- Price swings from $62K to $130K highlight extreme volatility while mixed signals reveal uncertainty in Bitcoin’s broader market structure.

- A retest of $117.7K remains possible if Bitcoin holds $109.5K support, but failure risks deeper losses and renewed bearish momentum.

Bitcoin now trades at a critical point as technical indicators flash warning signs of bearish dominance. According to analyst Axel Adler Jr., the composite index has fallen below −0.4, a level that signals sellers hold control.

He explained, “The market structure has shifted, with the composite index falling below the −0.4 threshold, indicating bear dominance.” This aligns with Bitcoin’s current struggle around the lower boundary of the 21-day Donchian Channel.

Besides, Adler pointed to $109.5K as a decisive support zone. Holding this level remains essential for restoring bullish strength. He noted that regaining structure above zero could allow a retest of $117.7K. Hence, market participants are closely monitoring whether Bitcoin can stabilize or extend losses.

Why do technical indicators show mixed phases?

Bitcoin’s multi-month price action shows repeated shifts in structure, driven by spikes in volatility and corrective phases. Between October 2024 and September 2025, price moved from roughly $62K up to $100K by December 2024, then continued to higher highs before corrective swings.

Source: Axel Adler Jr

The Structure Shift Composite Signal stayed mostly positive during run-ups, confirming favorable conditions at times. Donchian Channel resistance tracked the surge and widened during high-volatility rallies. Corrections, notably in January 2025, saw the composite index flip negative and volatility compress into tighter Donchian bounds during consolidation phases.

When could volatility and direction clarify?

Volatility eased at times, but the market lacked a clear long-term bias. A decisive close above recent structure thresholds (composite index > 0 and sustained trading above $117.7K) would favor buyers. Conversely, a confirmed breakdown below $109.5K on rising volume would indicate increased risk of deeper losses.

Frequently Asked Questions

What technical signal indicates bear dominance?

The composite index dropping below −0.4 signals bear dominance; traders should monitor this alongside Donchian Channel breaks and volume for confirmation.

How can traders protect positions near $109.5K?

Use tight risk management: set stop-loss levels below $109.5K, scale position sizes, and watch for confirmation (volume and composite index behavior) before adding exposure.

Can Bitcoin retest $117.7K soon?

If Bitcoin holds $109.5K and the composite index returns above zero, a retest of $117.7K becomes more likely. Short-term rallies would need supportive volume to sustain gains.

Key Takeaways

- Composite index below −0.4: Indicates sellers currently control momentum.

- $109.5K support: The decisive level for preventing deeper correction; monitor closely.

- Action item: Traders should apply disciplined risk management and watch Donchian Channel bounds and volume for confirmation.

Conclusion

Bitcoin’s short-term outlook is cautious as technical signals favor bears while $109.5K remains the pivotal support. Market participants should front-load decisions with clear stop rules and monitor composite index and Donchian Channel behavior. COINOTAG will continue to track developments and update levels as new data arrive.