XRP price is consolidating near $2.91 after rebounding from a $2.80 double bottom; holding above $2.85 is key to retesting $3.00–$3.10 as trading volume jumps to $9.33B and derivatives activity remains elevated.

-

Double bottom at $2.80 supports a potential retest of $3.00 if $2.85 holds.

-

Trading volume rose 28% to $9.33B; market cap ~ $163.23B with ~475K active wallets.

-

Derivatives volume reached $11.19B; $20.21M liquidations largely from long positions.

XRP price consolidating near $2.91 after a rebound; hold above $2.85 to test $3.00. Read expert analysis and market data. (XRP price report — COINOTAG)

What is XRP consolidation at $2.91 indicating?

XRP consolidation near $2.91 indicates a pause after a rebound from a $2.80 double bottom, showing buyers and sellers balancing before the next directional move. Short-term momentum hinges on holding $2.85 for a retest of $3.00–$3.10 while volume and derivatives flows inform conviction.

How did the double bottom at $2.80 form and why does it matter?

The double bottom formed in early September and provided structural support that catalyzed the rebound. Technical analysts cite the pattern as bullish when confirmed by rising volume. Trading volume increased 28.06% to $9.33B, reinforcing the pattern’s significance and suggesting sustained participant interest.

XRP consolidates near $2.91 after rebounding from $2.80 support, with $2.85 key for retesting $3.00–$3.10 as volume hits $9.33B.

- XRP forms double bottom at $2.80, with $2.85 support key for retest of $3.00–$3.10 levels.

- Trading volume rose 28% to $9.33B, while market cap holds $163.23B with 475K active wallets.

- Derivatives volume hit $11.19B, but $20.21M liquidations were dominated by long positions.

XRP recently rebounded from the $2.80 support after forming a double bottom, pushing back toward the $3.00 resistance zone. The cryptocurrency is now attempting a pullback, with price consolidating around $2.91. Analysts noted that holding above $2.85 could strengthen bullish momentum for another retest of $3.00.

Why did market structure favor the rebound?

Late August to late September price action created a double bottom that provided a reliable support zone. Analysis prepared by BitGuru highlighted that this structure limited downside and allowed buyers to re-enter. The market exceeded $3.10 before a measured retracement, then found support again near $2.80.

$XRP recently rebounded from the $2.80 support after forming a double bottom, pushing back toward the $3.00 resistance zone. Now attempting a pullback, with price consolidating around $2.91.

— BitGuru 🔶 (Twitter) September 25, 2025

Holding above $2.85 could strengthen bullish momentum for another retest of $3.00. pic.twitter.com/Y0fODb2MSt

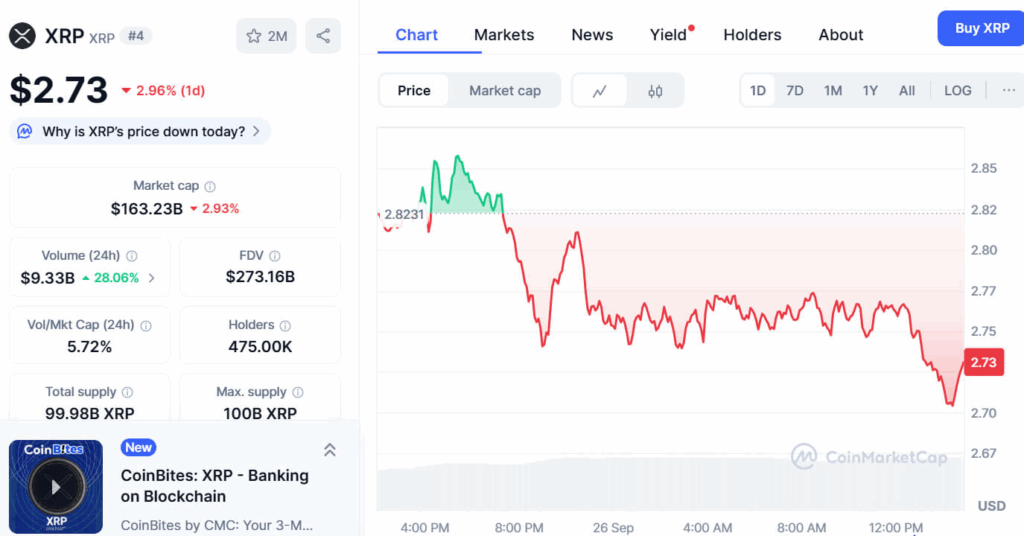

The rebound from this level guided the market back toward the $3.00 zone. At present, XRP trades near $2.73 after intraday volatility. CoinMarketCap data shows a daily decline of 2.96%, with market capitalization at $163.23 billion.

Source: CoinMarketCap

Source: CoinMarketCap Trading volume grew by 28.06% to $9.33 billion, which pushed the 24-hour volume-to-market-cap ratio to 5.72%. The circulating supply remains at 99.98 billion tokens, close to the capped supply of 100 billion. Holder numbers reached 475,000 wallets, reflecting sustained participation.

How active are derivatives markets and what do they signal?

Derivatives data from Coinglass shows mixed movements. XRP derivatives volume increased 10.64% to $11.19B, while open interest declined 3.26% to $7.24B. These mixed signals indicate heightened trading activity but reduced longer-term levered exposure.

Source: KamranAsghar (X)

Source: KamranAsghar (X) Options trading contracted sharply, with options volume falling 76.76% to $1.91K and open interest down 85.05% at $179.64K. Liquidation data showed $20.21 million cleared over 24 hours, dominated by $18.18 million in long positions. An observation by Kamran Asghar noted XRP coiling above the $2.60–$2.70 zone.

He added that “the spring is compressed” and projected an aggressive move toward $4.03 once consolidation completes. Analysts agree that if XRP maintains stability above $2.85, a retest of $3.00 remains possible. A break beyond this resistance could open the path toward $3.10 and higher targets.

Frequently Asked Questions

What triggers an XRP move above $3.00?

Short-term triggers include maintaining support above $2.85 with rising on-chain activity and sustained trading volume. A clear break and close above $3.00 on higher volume would confirm bullish momentum.

How much did XRP derivatives volume change recently?

Derivatives volume rose approximately 10.64% to $11.19B, while open interest eased 3.26% to $7.24B, indicating more trading activity but slightly reduced net leveraged positions.

Key Takeaways

- Support structure: Double bottom at $2.80 is the immediate structural base for bulls.

- Volume confirmation: 28% increase to $9.33B supports the rebound and potential retest of $3.00.

- Derivatives watch: $11.19B derivatives volume and $20.21M liquidations suggest short-term volatility; monitor open interest and long-liquidation flows.

Conclusion

XRP price consolidation near $2.91, backed by a $2.80 double bottom and rising on-chain volume, sets the market for a potential retest of $3.00 if $2.85 remains intact. Monitor trading volume, derivatives flows, and wallet activity for confirmation; COINOTAG will continue to report updates as conditions evolve.

Published by COINOTAG — Updated: 2025-09-27