Zcash Rockets to Three-Year High, But Overheating Risks Loom

Zcash (ZEC) has taken center stage in the crypto market after a parabolic rally sent it to a three-year high. The token has soared on the back of Grayscale’s new Zcash Trust, which has fueled a wave of fresh demand. But while ZEC now leads the market in performance, rising on both daily and weekly charts, on-chain signals warn that the rally may be overheating and vulnerable to a pullback.

In brief

- ZEC jumps 83% in 24 hours after Grayscale unveils its Zcash Trust, fueling demand and driving the token to multi-year highs.

- Social dominance spikes to a 5-year peak, signaling crowd-driven hype and potential risk of an unsustainable price rally.

- Funding rates show mixed signals as traders flip between long and short, highlighting uncertainty in ZEC’s momentum.

- ZEC trades at $146 with support at $134.48 and resistance at $161.35, leaving room for both correction and further gains.

Zcash Soars 83% in 24 Hours After Grayscale Trust Launch

ZEC, one of the market’s leading digital privacy tokens, extended its explosive run with an 83% jump in the past 24 hours, making it the day’s top performer. Over the past week, ZEC has gained 150%, outpacing other privacy-focused cryptocurrencies.

The latest surge followed the launch of Grayscale’s Zcash Trust, which is available to accredited investors. The trust provides accredited investors with exposure to ZEC without requiring direct ownership of the token. News of the product fueled strong demand, propelling ZEC to multi-year highs.

While momentum remains strong, on-chain data suggests that caution is warranted. Indicators point to euphoria in the market, raising concerns that ZEC’s rally may not be sustainable.

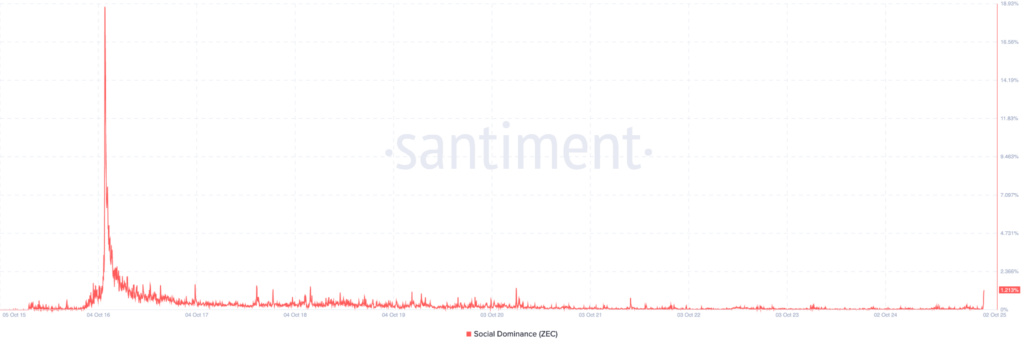

ZEC Social Dominance Hits 5-Year High as Market Signals Overheating Risks

One of the clearest signals for caution comes from ZEC’s social dominance. According to Santiment, this metric has climbed to a five-year high of 1.21% . Social dominance measures how much of the overall crypto conversation is focused on a single asset. When it spikes during rallies, it often signals overvaluation and crowd-driven sentiment.

Historically, similar surges in social dominance have preceded market corrections, as enthusiasm reaches unsustainable levels. This suggests that despite strong price action, Zcash may be entering overheated territory.

ZEC’s funding rates also reflect uncertainty. Data show that aggregated funding across major exchanges has fluctuated above and below neutral levels over the past week. This lack of directional conviction indicates that traders lack a clear bias, with long and short positions alternating in control. Such instability signals that speculative positioning may be driving much of the recent price action, leaving Zcash vulnerable if sentiment shifts.

ZEC Surges to $146 Amid Strong Momentum and Bullish Market Sentiment

At the time of writing, Zcash is trading at $146, following a strong four-week climb.

Here are other notable market trends:

- ZEC has surged 454% over the past year, marking one of the strongest rallies in the crypto market.

- It has outperformed all of the top 100 crypto assets during the same period.

- The token has also outpaced Bitcoin and Ethereum, cementing its position as a top-performing privacy coin.

- It is trading above the 200-day simple moving average, signaling strong technical momentum.

- Zcash has logged 18 green days in the last 30 sessions (60%), highlighting consistent upward pressure.

- Market sentiment remains bullish, with the Fear & Greed Index at 64, firmly in the “Greed” zone.

Looking ahead, ZEC’s trajectory depends on whether demand can sustain its current momentum. If hype fades, the token risks retracing gains. Immediate support sits near $134.48, with a deeper correction potentially dragging prices toward $112.72.

On the other hand, continued bullish momentum could push ZEC beyond resistance at $161.35, extending its rally further.

The coming days will be critical in determining whether Zcash consolidates its gains or faces a sharp correction. Traders and investors will be watching closely for signs of renewed buying—or fading enthusiasm.