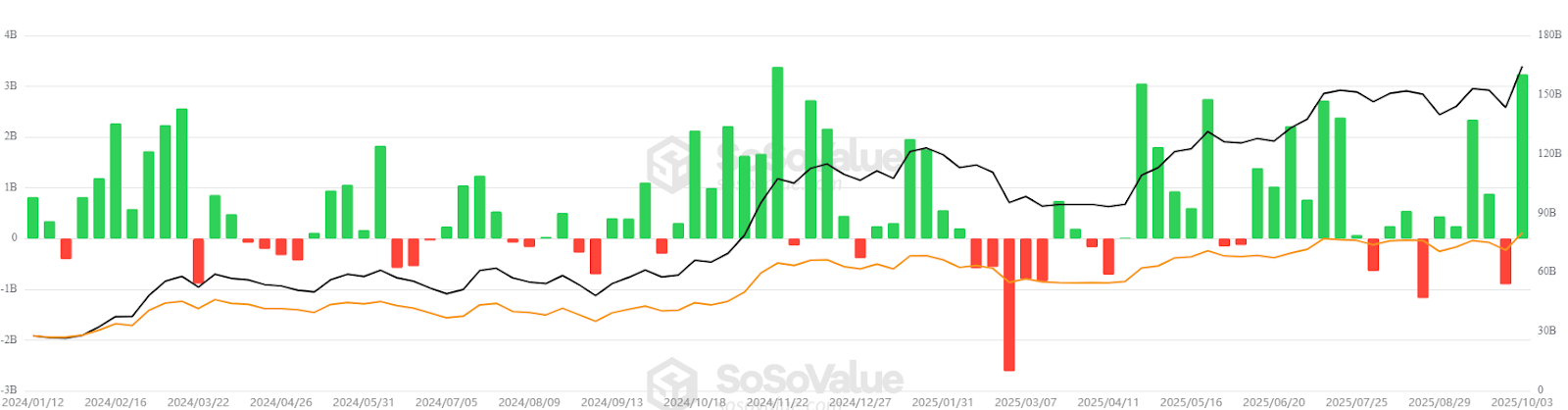

Bitcoin ETFs are signaling renewed investor optimism for “Uptober,” with US spot Bitcoin ETFs posting roughly $3.24 billion in net inflows last week — a near-record weekly total that suggests stronger demand and potential upside for BTC into Q4 2025.

-

Spot ETF inflows: $3.24B this week — near all-time weekly record.

-

Inflows reversed prior outflows and reflect rising expectations of a US interest rate cut.

-

Analysts estimate Q4 ETF demand could remove over 100,000 BTC from circulation, tightening supply.

Meta description: Bitcoin ETFs lead Uptober optimism as $3.24B in weekly inflows signal renewed BTC demand—read the analysis and what traders should watch next.

What are Bitcoin ETFs signaling for Uptober and Q4?

Bitcoin ETFs are acting as a clear market sentiment indicator: heavy spot ETF inflows this week (about $3.24 billion) point to renewed investor appetite and raise the probability of stronger BTC performance through October and into Q4, driven by dovish rate expectations and seasonal strength.

How large were this week’s ETF inflows and why do they matter?

US-listed spot Bitcoin ETFs recorded approximately $3.24 billion in cumulative net inflows over the past week, almost matching a record weekly total. These inflows matter because they represent sustained buying pressure from institutional and retail investors, reducing available BTC supply and supporting price momentum.

US spot Bitcoin ETFs, all-time chart, weekly. Source: Sosovalue

Why did sentiment shift toward Bitcoin ETFs this week?

Markets priced in a higher probability of US monetary easing, which lifted risk-asset demand. Analysts note a “shift in sentiment” as prospects for another rate cut improved, reversing the prior week’s $902 million outflow into a multi-billion dollar inflow episode.

What do analysts say about ETF absorption and BTC supply?

Industry analysts estimate that accelerating ETF absorption could materially retire BTC from liquid circulation. For example, one dispatch analyst projected that current Q4 run-rates might remove over 100,000 BTC — a figure that would exceed expected new issuance and tighten market supply.

This dynamic — rising ETF demand plus moderating long-term holder distribution — can help BTC build a stronger base near key technical supports.

BTC/USD, 1-day chart. Source: Cointelegraph/TradingView

When could this ETF-driven momentum affect price targets?

Short-term momentum pushed BTC briefly above $123,996 this week, a six-week high. Some market participants see a path to the prior all-time high and beyond if inflows continue and macro conditions remain supportive, though timing depends on upcoming data and Federal Reserve commentary.

Which macro and data events will influence BTC in the coming days?

Investors will monitor speeches from the US Federal Reserve chair, FOMC minutes, and US employment data. The timing and tone of these releases — and the resolution of a partial US government shutdown — could alter rate expectations and thereby ETF-driven demand for Bitcoin.

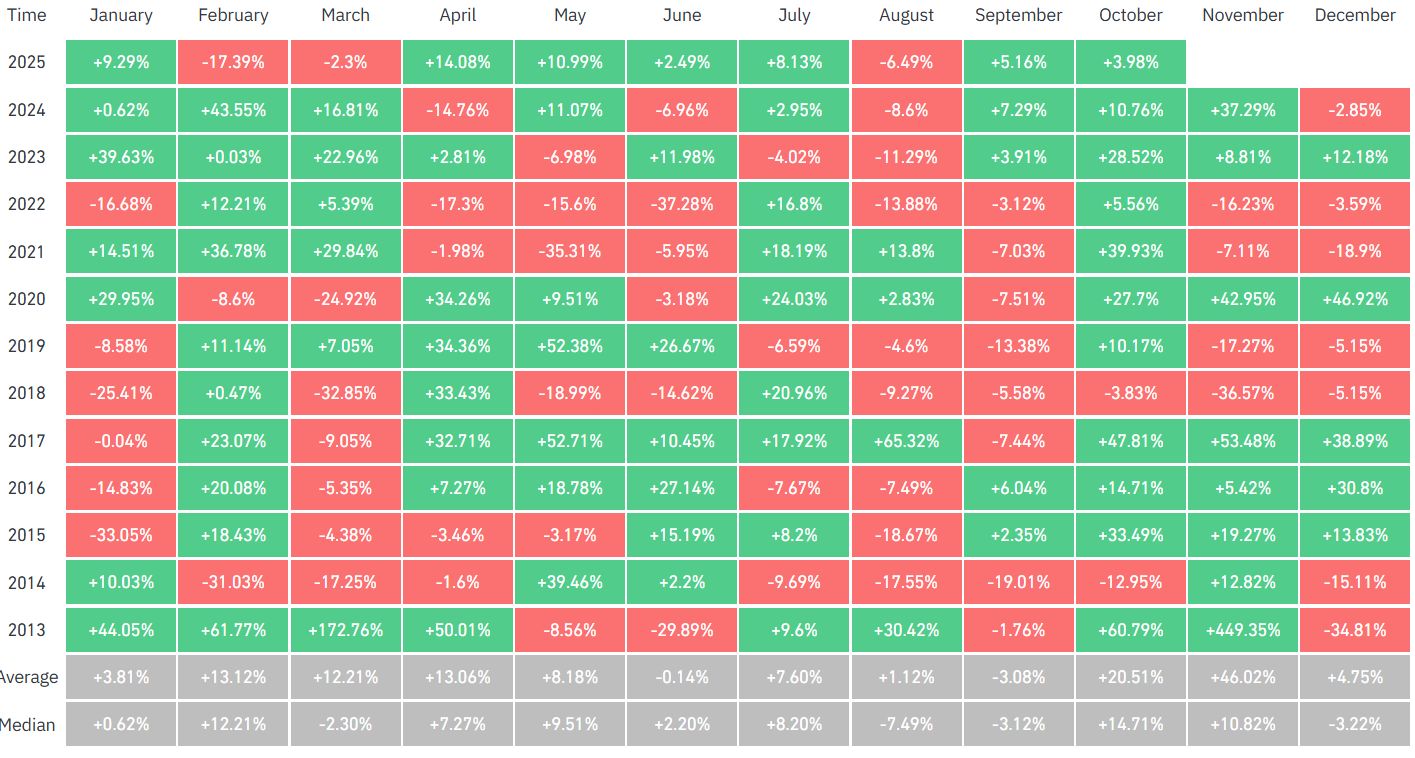

Bitcoin monthly returns. Source: CoinGlass

Historically, October ranks among Bitcoin’s strongest months. Data compiled by market analytics providers show average monthly returns near 20% for October, with November historically stronger — a seasonal pattern that traders call “Uptober.”

Frequently Asked Questions

How do spot Bitcoin ETF inflows affect BTC supply?

ETF inflows typically require the purchase of underlying BTC to back fund shares, which reduces circulating supply on exchanges. Sustained inflows can create structural demand that supports higher prices as available liquidity tightens.

Could ETF flows push BTC to a new all-time high before 2026?

ETF demand is a key bullish component, but reaching a new all-time high depends on continued inflows, macro policy shifts, and market liquidity. Analysts view ETF absorption as supportive but emphasize that Fed signals and economic data remain decisive.

What should investors watch this week for ETF-driven moves?

Monitor net weekly ETF inflows, Fed commentary, FOMC minutes, and employment releases. Sharp changes in rate expectations or a reversal in ETF flows can quickly change price direction.

Key Takeaways

- ETF inflows matter: $3.24B this week signals renewed institutional demand and supply tightening.

- Macro catalysts: Fed speeches, FOMC minutes, and US jobs data will influence near-term momentum.

- Seasonal strength: October historically favors BTC (“Uptober”); ETF demand could amplify seasonal gains.

Conclusion

Spot Bitcoin ETFs have emerged as a dominant sentiment gauge heading into Uptober, with recent multi-billion-dollar inflows suggesting renewed buying pressure and potential for stronger BTC performance into Q4. Traders should watch ETF flow reports and Fed-related events closely as the market digests evolving rate expectations.