GENIUS Act could mark the end of the banking rip-off: Multicoin exec

The stablecoin-focused GENIUS Act, which was enacted in July, will trigger an exodus of deposits from traditional bank accounts into higher-yield stablecoins, according to the co-founder of Multicoin Capital.

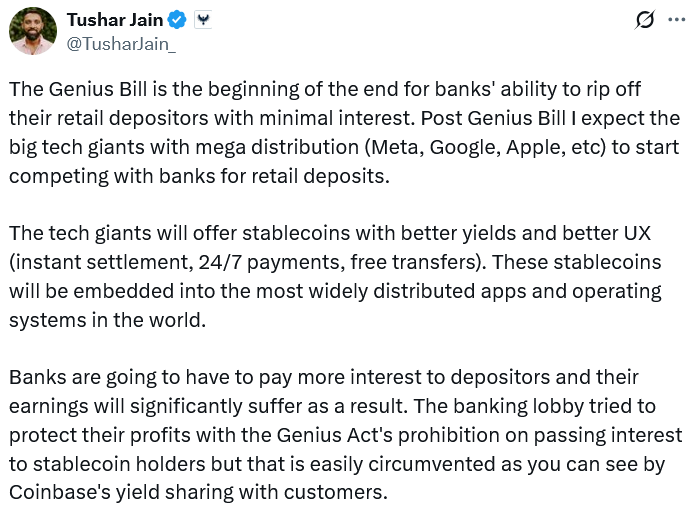

“The GENIUS Bill is the beginning of the end for banks’ ability to rip off their retail depositors with minimal interest,” Multicoin Capital’s co-founder and managing partner, Tushar Jain, posted to X on Saturday.

“Post Genius Bill, I expect the big tech giants with mega distribution (Meta, Google, Apple, etc) to start competing with banks for retail deposits,” Jain added, arguing that they would offer better stablecoin yields with a better user experience for instant settlement and 24/7 payments over traditional banking players.

He noted that banking groups tried to “protect their profits” in mid-August by calling on regulators to close a so-called loophole that may allow stablecoin issuers to pay interest or yields on stablecoins through their affiliates.

The GENIUS Act prohibits stablecoin issuers from offering interest or yield to holders of the token but doesn’t explicitly extend the ban to crypto exchanges or affiliated businesses, potentially enabling issuers to sidestep the law by offering yields through those partners.

US banking groups are concerned that the wide adoption of yield-bearing stablecoins could undermine the traditional banking system, which relies on banks attracting deposits to fund lending.

$6.6 trillion could leave the banking system

Mass stablecoin adoption could trigger around $6.6 trillion in deposit outflows from the traditional banking system, the US Department of the Treasury estimated in April.

“The result will be greater deposit flight risk, especially in times of stress, that will undermine credit creation throughout the economy. The corresponding reduction in credit supply means higher interest rates, fewer loans, and increased costs for Main Street businesses and households,” the Bank Policy Institute said in August.

To stay competitive, “banks are going to have to pay more interest to depositors,” Jain said, adding that “their earnings will significantly suffer as a result.”

Stablecoins offer users up to 10X more interest

The average interest rate for US savings accounts is 0.40%, and in Europe, the average rate on savings accounts is 0.25%, Patrick Collison, CEO of online payments platform Stripe, said last week.

Meanwhile, rates for Tether (USDT) and Circle’s USDC (USDC) on the borrowing and lending platform Aave currently stand at 4.02% and 3.69%, respectively.

Big Tech companies are reportedly exploring stablecoins

Jain’s bet on the Big Tech giants follows a Fortune report in June stating that Apple, Google, Airbnb, and X were among the top companies exploring issuing stablecoins to lower fees and improve cross-border payments. There haven’t been any further developments since.

Related: All currencies will be stablecoins by 2030: Tether co-founder

The stablecoin market currently sits at $308.3 billion, led by USDT and USDC at $177 billion and $75.2 billion, CoinGecko data shows.

The Treasury Department predicts the stablecoin market cap will boom another 566% to reach $2 trillion by 2028.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight