Ethereum Shaken by 2.4M ETH Withdrawals as Validators Exit the Network

The Ethereum validator queue exceeds 10 billion dollars. A record volume that rekindles fears of selling pressure, but institutional giants seem to already counterbalance it.

In brief

- More than 10 billion ETH await withdrawal, raising fears of massive sales.

- Grayscale offsets this record withdrawal with 1.35 billion ETH injected into staking.

A record exit queue: should we fear selling pressure on ETH?

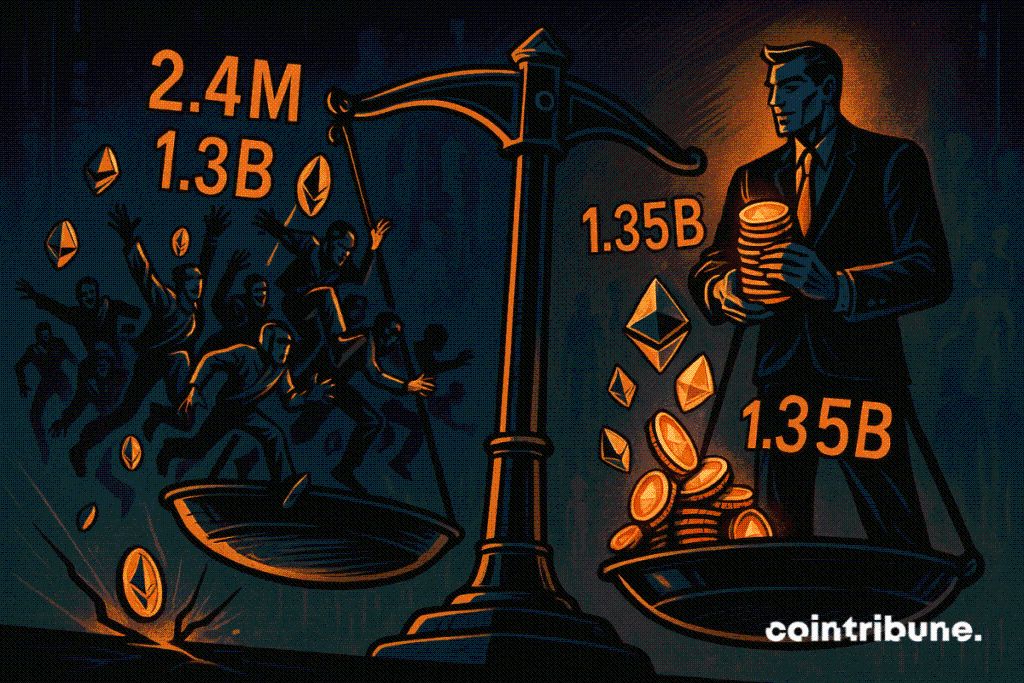

The Ethereum ecosystem is absorbing an unprecedented wave of withdrawals. More than 2.4 million ETH are currently waiting to exit staking. This represents nearly 10.1 billion dollars. This historic threshold extends the exit delay to more than 41 days, a record noted by Validator Queue .

This dynamic raises questions. After an 83% increase in the ETH price over one year, some validators seem to be looking to realize their gains. Such a mass of ETH on the way out could exert downward pressure on the market if the funds end up liquidated.

Another worrying signal: the entry queue remains five times shorter. Only 490,000 ETH are currently waiting to be staked , with a delay of 8.5 days. This imbalance between entries and exits can be interpreted as a pause in validators’ commitment, at least among individuals.

Despite everything, the security base of the Ethereum network remains robust. More than 1 million active validators still participate in block validation, with 35.6 million ETH staked. This amounts to about 30% of the total supply.

Institutions to the rescue: Grayscale and crypto treasuries stabilize the Ethereum network

Where historic validators fade, institutional players advance. Grayscale, a pioneer in crypto investment products, has injected 1.35 billion dollars worth of ETH into staking in just two days. This move follows the launch of an ETF offer incorporating staking as a source of passive income.

In a single day, Grayscale deposited 272,000 ETH into the entry queue. Alone, the asset manager thus represents the majority of deposits awaiting activation.

The dynamic goes beyond just Grayscale. According to Iliya Kalchev, analyst at Nexo, Ethereum ETF inflows exceed 620 million dollars in October. Company treasuries and funds now hold more than 10% of the total circulating supply.

This trend consolidates Ethereum’s status as a recognized yield asset. In this perspective, institutionalized staking strategies serve as a buffer against individual withdrawal movements.

Admittedly, short-term pressure is intriguing. Nevertheless, these massive institutional moves may herald a new era for Ethereum. Enough to imagine a new DeFi Summer!