BNB Meme Coins Tank 90%: Has the ‘BNB Meme Szn’ Bubble Finally Popped?

BNB Chain meme coins have crashed by as much as 90% in the past day, erasing millions in investor capital as the Chinese meme bubble bursts.

Rapid losses have left traders questioning whether these meme coins offer sustainable upside or are just speculative traps.

BNB Meme Coins Plunge As ‘BNB Meme Szn’ Collapses

In October, many BNB-based meme coins experienced explosive rallies. For instance, PALU pumped 1,693% after getting attention from Binance founder CZ and securing a listing on Binance Alpha.

Furthermore, 币安人生 (Binance Life) coin saw its market value peak at $500 million yesterday. Another coin, ‘4,’ also gained over 600x amid what the community called the ‘BNB meme szn.’

However, the momentum appears to have reversed now. The BNB meme coin market has endured a dramatic collapse, with most tokens dropping around 90% in just 24 hours. The sudden collapse has triggered widespread criticism from the community.

“Not only we were at the crypto top, stocks ath, you have BNB memes rugging the last bit of liquidity. Tell me why are going to dump,” an analyst wrote.

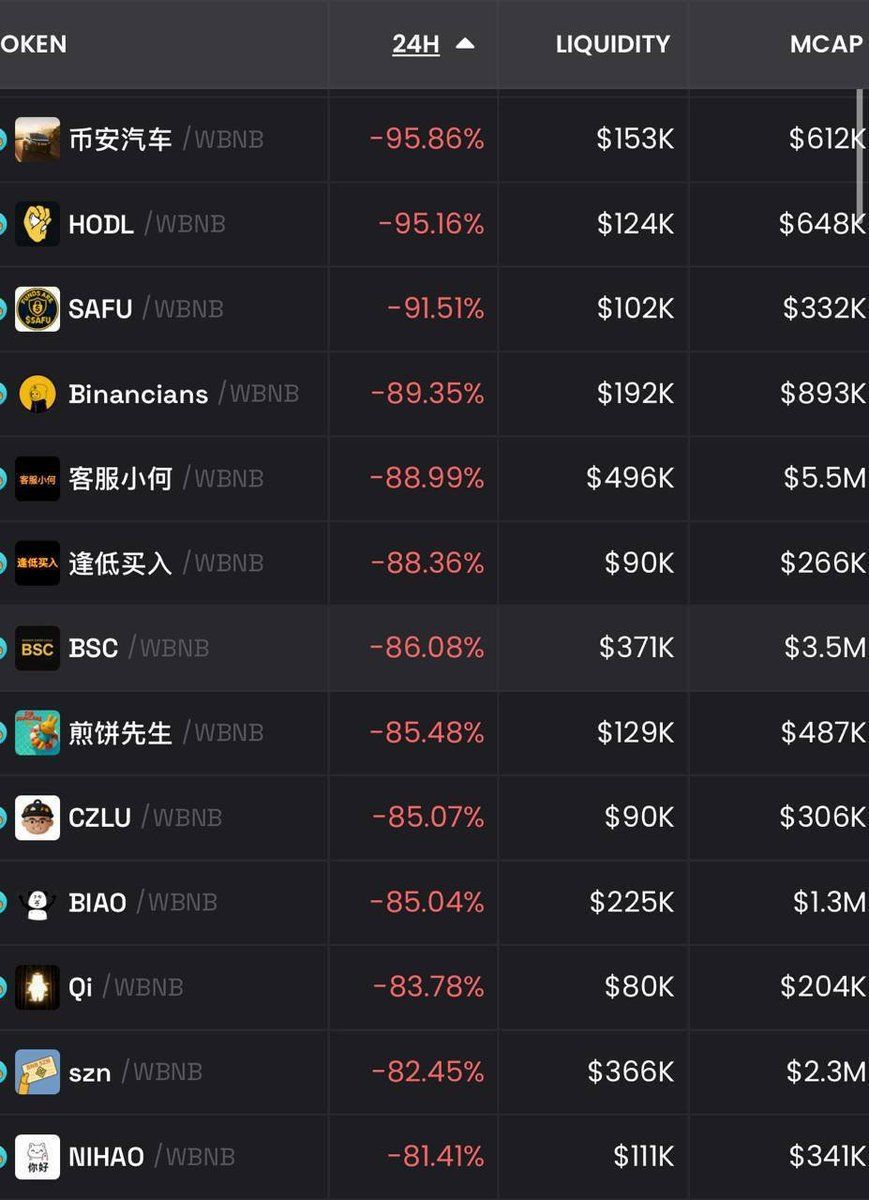

BNB Meme Coins Down 81%–96%. Source: X/Whale_Guru

BNB Meme Coins Down 81%–96%. Source: X/Whale_Guru Moreover, while the rapid rallies netted millions in profits for many traders, the steep declines have also led to similarly high losses. According to on-chain analytics from Lookonchain, a trader (0x2fcf) withdrew 5,090 BNB worth around $6.6 million from Binance to chase the meme rally.

“He spent 3,475 BNB($4.54 million) buying $币安人生, $客服小何, $PUP, and $哈基米 — all currently at a loss,” the post read.

Here’s a breakdown of the whale’s trades:

- 币安人生 (Binance Life): The whale bought 8.97 million tokens for 2,555 BNB ($3.3 million) — now sitting on a $439,000 loss.

- 客服小何: Acquired 16.31 million tokens for 760 BNB ($993,000), currently down by around $700,000.

- PUP: Purchased 5.19 million tokens for 105 BNB ($137,000), losing around $47,000.

- 哈基米: Invested 55 BNB ($67,000) for 4.84 million tokens, now down approximately $5,000.

In total, the wallet is sitting on an unrealized loss of roughly $1.2 million.

Rug Pulls, FOMO, and Lessons for Meme Coin Traders

Meanwhile, an analyst also claimed that many of these coins suffered a ‘rug pull’ along with HODL, a leading token in the recent BNB meme coin rally, as its price collapsed alongside other peers.

“I don’t need to convey the irony of that particular chart rugging with that particular ticker, but the lesson here – for all of us – is that if you aren’t early for 95% of anon memecoins, you are very likely being set-up as EL (Exit Liquidity),” the analyst stated.

He added that investors chasing hype risk becoming trapped in unsustainable cycles, urging participants to focus instead on established ‘blue-chip’ memes. According to Durden, early positioning remains the single most important factor for success in meme trading — a principle he summarized as,

“If in doubt, remember BEOBEL: Be Early Or Be Exit Liquidity.”

The collapse of Chinese-themed BNB meme tokens highlights the fragility of hype-driven markets and the risks inherent in short-lived meme coin bubbles. This sudden shift raised the question whether the BNB meme wave has truly come to an end — or if it’s merely a brief pause before the next speculative surge.